GE 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ge 2008 annual report 85

notes to consolidated financial statements

All grants of GE options under all plans must be approved by

the Management Development and Compensation Committee,

which consists entirely of independent directors.

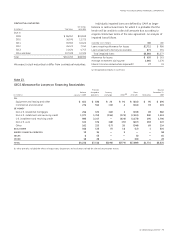

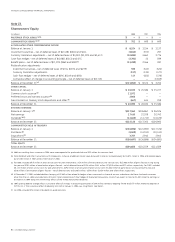

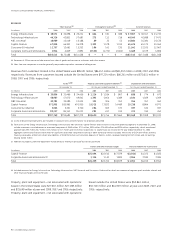

STOCK COMPENSATION PLANS

Securities

Securities Weighted available

to be issued average for future

December 31, 2008 (Shares in thousands) upon exercise exercise price issuance

APPROVED BY SHAREOWNERS

Options 214,824 $36.30 (a)

RSUs 36,392 (b) (a)

PSUs 1,050 (b) (a)

NOT APPROVED BY SHAREOWNERS

(CONSULTANTS’ PLAN)

Options 683 35.85 (c)

RSUs 91 (b) (c)

Total 253,040 $36.30 462,787

(a) In 2007, the Board of Directors approved the 2007 Long-Term Incentive Plan (the

Plan). The Plan replaced the 1990 Long-Term Incentive Plan. The maximum number

of shares that may be granted under the Plan is 500 million shares, of which no

more than 250 million may be available for awards granted in any form provided

under the Plan other than options or stock appreciation rights. The approximate

105.9 million shares available for grant under the 1990 Plan were retired upon

approval of the 2007 Plan. Total shares available for future issuance under the 2007

Plan amounted to 439.0 million shares at December 31, 2008.

(b) Not applicable.

(c) Total shares available for future issuance under the consultants’ plan amount to

23.8 million shares.

Outstanding options expire on various dates through

December 11, 2018.

The following table summarizes information about stock

options outstanding at December 31, 2008.

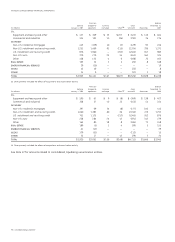

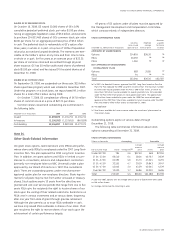

STOCK OPTIONS OUTSTANDING

(Shares in thousands) Outstanding Exercisable

Average Average

exercise exercise

Exercise price range Shares Average life (a) price Shares price

Under $27.00 784 4.6 $22.50 568 $23.94

27.01–32.00 66,510 6.1 28.36 40,767 28.39

32.01–37.00 61,593 4.6 34.73 47,045 34.91

37.01–42.00 32,555 4.7 39.19 19,843 39.47

42.01–47.00 42,045 2.0 43.29 42,045 43.29

Over $47.00 12,020 1.7 56.86 12,020 56.86

Total 215,507 4.4 $36.30 162,288 $37.59

At year-end 2007, options with an average exercise price of $36.98 were exercisable

on 168 million shares.

(a) Average contractual life remaining in years.

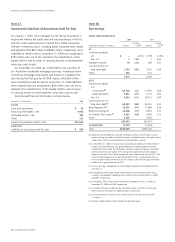

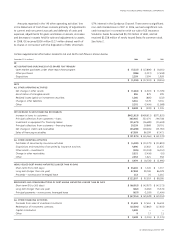

SHARES OF GE PREFERRED STOCK

On October 16, 2008, GE issued 30,000 shares of GE’s 10%

cumulative perpetual preferred stock, par value $1.00 per share,

having an aggregate liquidation value of $3.0 billion, and warrants

to purchase 134,831,460 shares of GE’s common stock, par value

$0.06 per share, for an aggregate purchase price of $3.0 billion

in cash. The preferred stock is redeemable at GE’s option after

three years, in whole or in part, at a price of 110% of liquidation

value plus accrued and unpaid dividends. The warrants are exer-

cisable at the holder’s option at any time and from time to time,

in whole or in part, for five years at an exercise price of $22.25

per share of common stock and are settled through physical

share issuance. GE has 50 million authorized shares of preferred

stock ($1.00 par value), and has issued 30 thousand shares as of

December 31, 2008.

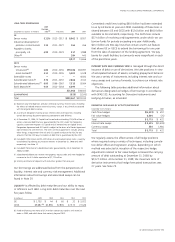

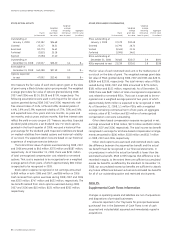

SHARES OF GE COMMON STOCK

On September 25, 2008, we suspended our three-year, $15 billion

share repurchase program, which was initiated in December 2007.

Under this program, on a book basis, we repurchased 99.1 million

shares for a total of $3.1 billion during 2008.

On October 7, 2008, GE completed an offering of 547.8 million

shares of common stock at a price of $22.25 per share.

Common shares issued and outstanding are summarized in

the following table.

December 31 (In thousands) 2008 2007 2006

Issued 11,693,829 11,145,252 11,145,212

In treasury (1,156,932) (1,157,653) (867,839)

Outstanding 10,536,897 9,987,599 10,277,373

Note 24.

Other Stock-Related Information

We grant stock options, restricted stock units (RSUs) and perfor-

mance share units (PSUs) to employees under the 2007 Long-Term

Incentive Plan. This plan replaced the 1990 Long-Term Incentive

Plan. In addition, we grant options and RSUs in limited circum-

stances to consultants, advisors and independent contractors

(primarily non-employee talent at NBC Universal) under a plan

approved by our Board of Directors in 1997 (the consultants’

plan). There are outstanding grants under one shareowner-

approved option plan for non-employee directors. Share require-

ments for all plans may be met from either unissued or treasury

shares. Stock options expire 10 years from the date they are

granted and vest over service periods that range from one to five

years. RSUs give the recipients the right to receive shares of our

stock upon the vesting of their related restrictions. Restrictions on

RSUs vest in various increments and at various dates, beginning

after one year from date of grant through grantee retirement.

Although the plan permits us to issue RSUs settleable in cash,

we have only issued RSUs settleable in shares of our stock. PSUs

give recipients the right to receive shares of our stock upon the

achievement of certain performance targets.