GE 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ge 2008 annual report 65

notes to consolidated financial statements

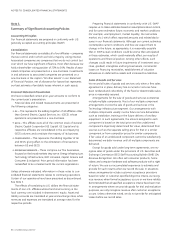

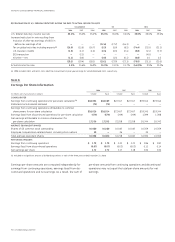

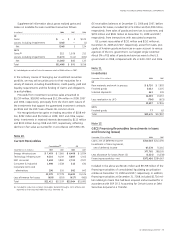

In 2009, we estimate that we will amortize $675 million of prior

service cost and $105 million of net actuarial gain from share-

owners’ equity into retiree benefit plans cost. Comparable

amortized amounts in 2008 were $673 million of prior service

cost and $49 million of net actuarial gains.

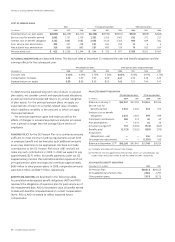

ESTIMATED FUTURE BENEFIT PAYMENTS

2014 –

(In millions) 2009 2010 2011 2012 2013 2018

Gross $910 $930 $965 $980 $1,000 $5,200

Expected Medicare

Part D subsidy 75 80 85 90 95 550

Net $835 $850 $880 $890 $ 905 $4,650

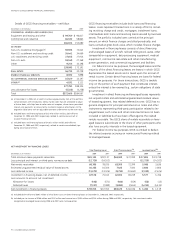

Pension Benefits

We sponsor a number of pension plans. Principal pension plans,

together with affiliate and certain other pension plans (other

pension plans) detailed in this note, represent about 99% of our

total pension assets. We use a December 31 measurement date

for our plans.

PRINCIPAL PENSION PLANS are the GE Pension Plan and the GE

Supplementary Pension Plan.

The GE Pension Plan provides benefits to certain U.S. employees

based on the greater of a formula recognizing career earnings or a

formula recognizing length of service and final average earnings.

Certain benefit provisions are subject to collective bargaining.

The GE Supplementary Pension Plan is an unfunded plan

providing supplementary retirement benefits primarily to higher-

level, longer-service U.S. employees.

OTHER PENSION PLANS in 2008 included 31 U.S. and non-U.S.

pension plans with pension assets or obligations greater than

$50 million. These defined benefit plans provide benefits to

employees based on formulas recognizing length of service and

earnings.

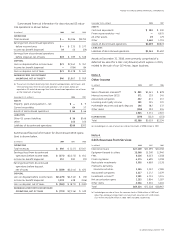

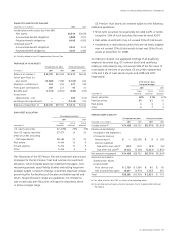

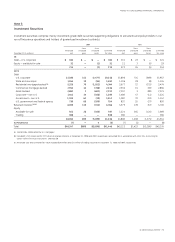

PENSION PLAN PARTICIPANTS

Principal Other

pension pension

December 31, 2008 Total plans plans

Active employees 188,000 140,000 48,000

Vested former employees 231,000 190,000 41,000

Retirees and beneficiaries 246,000 220,000 26,000

Total 665,000 550,000 115,000

FAIR VALUE OF PLAN ASSETS

(In millions) 2008 2007

Balance at January 1 $1,804 $1,710

Actual gain (loss) on plan assets (486) 221

Employer contributions 617 622

Participant contributions 51 47

Benefits paid (a) (811) (796)

Balance at December 31 $1,175 $1,804

(a) Net of Medicare Part D subsidy.

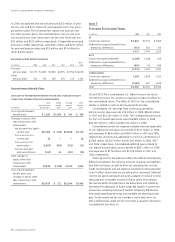

PLAN ASSET ALLOCATION

2008 2007

Target Actual Actual

December 31 allocation allocation allocation

U.S. equity securities 19 – 39% 25% 33%

Non-U.S. equity securities 18 – 38 15 20

Debt securities (including

cash equivalents) 11–41 39 31

Real estate 2–12 7 6

Private equities 3–13 8 5

Other 0–10 6 5

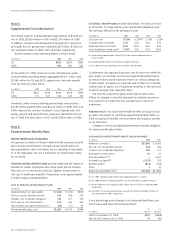

Plan fiduciaries set investment policies and strategies for the trust

and oversee its investment allocation, which includes selecting

investment managers and setting long-term strategic targets.

Long-term strategic investment objectives include preserving the

funded status of the plan and balancing risk and return. Target

allocation ranges are guidelines, not limitations, and occasionally

plan fiduciaries will approve allocations above or below a target

range.

Trust assets invested in short-term securities must generally

be invested in securities rated A1/P1 or better, except for 15%

of such securities that may be rated A2/P2. According to statute,

the aggregate holdings of all qualifying employer securities

(e.g., GE common stock) and qualifying employer real property

may not exceed 10% of the fair value of trust assets at the time

of purchase. GE securities represented 3.6% and 5.9% of trust

assets at year-end 2008 and 2007, respectively.

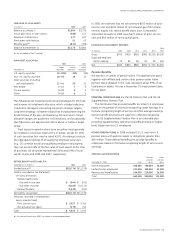

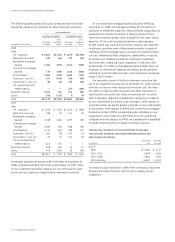

RETIREE BENEFIT ASSET (LIABILITY)

December 31 (In millions) 2008 2007

Funded status (a) $(10,774) $(11,179)

Liability recorded in the Statement

of Financial Position

Retiree health plans

Due within one year $ (644) $ (675)

Due after one year (9,105) (10,172)

Retiree life plans (1,025) (332)

Net liability recognized $(10,774) $(11,179)

Amounts recorded in shareowners’

equity (unamortized)

Prior service cost $ 5,027 $ 5,700

Net actuarial loss (gain) (475) 210

Total $ 4,552 $ 5,910

(a) Fair value of assets less APBO, as shown in the preceding tables.