GE 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ge 2008 annual report 73

notes to consolidated financial statements

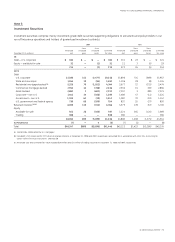

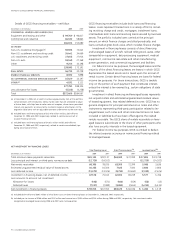

GE receivables balances at December 31, 2008 and 2007, before

allowance for losses, included $11,274 million and $11,008 million,

respectively, from sales of goods and services to customers, and

$293 million and $381 million at December 31, 2008 and 2007,

respectively, from transactions with associated companies.

GE current receivables of $231 million and $252 million at

December 31, 2008 and 2007, respectively, arose from sales, prin-

cipally of Aviation goods and services on open account to various

agencies of the U.S. government, our largest single customer.

About 5% of GE sales of goods and services were to the U.S.

government in 2008, compared with 4% in both 2007 and 2006.

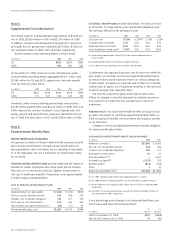

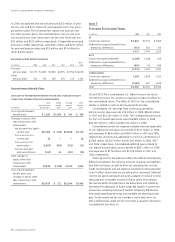

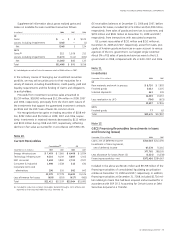

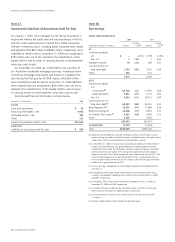

Note 11.

Inventories

December 31 (In millions) 2008 2007

GE

Raw materials and work in process $ 8,710 $ 7,893

Finished goods 5,032 5,025

Unbilled shipments 561 539

14,303 13,457

Less revaluation to LIFO (706) (623)

13,597 12,834

GECS

Finished goods 77 63

Total $13,674 $12,897

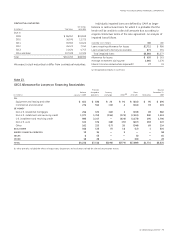

Note 12.

GECS Financing Receivables (investments in loans

and financing leases)

December 31 (In millions) 2008 2007

Loans, net of deferred income $310,203 $313,290

Investment in financing leases,

net of deferred income 67,578 75,015

377,781 388,305

Less allowance for losses (Note 13) (5,325) (4,238)

Financing receivables— net $372,456 $384,067

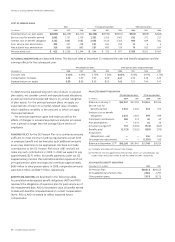

Included in the above are $6,461 million and $9,708 million of the

financing receivables of consolidated, liquidating securitization

entities at December 31, 2008 and 2007, respectively. In addition,

financing receivables at December 31, 2008, included $2,736 mil-

lion relating to loans that had been acquired and accounted for in

accordance with SOP 03-3, Accounting for Certain Loans or Debt

Securities Acquired in a Transfer.

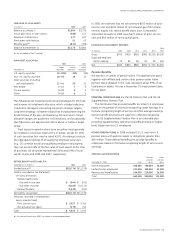

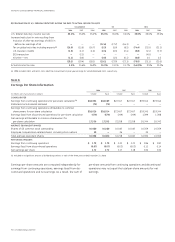

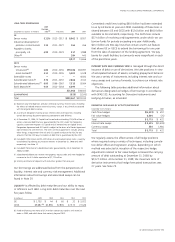

Supplemental information about gross realized gains and

losses on available-for-sale investment securities follows.

(In millions) 2008 2007 2006

GE

Gains $—$ 5 $ 125

Losses, including impairments (148) — (1)

Net (148) 5 124

GECS

Gains (a) 212 1,026 313

Losses, including impairments (1,472) (141) (181)

Net (1,260) 885 132

Total $(1,408) $ 890 $ 256

(a) Included gain on sale of Swiss Re common stock of $566 million in 2007.

In the ordinary course of managing our investment securities

portfolio, we may sell securities prior to their maturities for a

variety of reasons, including diversification, credit quality, yield and

liquidity requirements and the funding of claims and obligations

to policyholders.

Proceeds from investment securities sales amounted to

$5,239 million, $18,993 million and $12,394 million in 2008, 2007

and 2006, respectively, principally from the short-term nature of

the investments that support the guaranteed investment contracts

portfolio and the 2007 sale of Swiss Re common stock.

We recognized pre-tax gains on trading securities of $108 mil-

lion, $292 million and $5 million in 2008, 2007 and 2006, respec-

tively. Investments in retained interests decreased by $113 million

and $102 million during 2008 and 2007, respectively, reflecting

declines in fair value accounted for in accordance with SFAS 155.

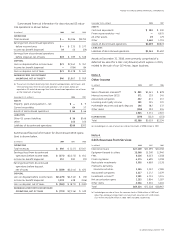

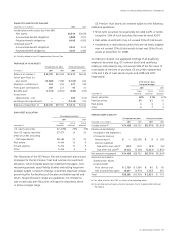

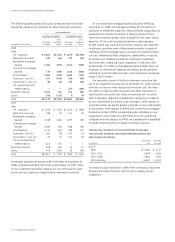

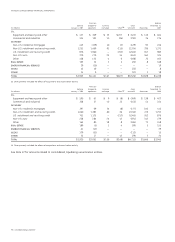

Note 10.

Current Receivables

Consolidated (a) GE

December 31 (In millions) 2008 2007 2008 2007

Energy Infrastructure $ 7,403 $ 7,065 $ 6,409 $ 5,934

Technology Infrastructure 9,214 9,149 5,687 5,443

NBC Universal 3,659 3,800 2,701 2,927

Consumer & Industrial 1,498 2,238 513 630

Corporate items and

eliminations 296 526 381 642

22,070 22,778 15,691 15,576

Less allowance for losses (659) (519) (627) (483)

Total $21,411 $22,259 $15,064 $15,093

(a) Included GE industrial customer receivables factored through a GECS affiliate and

reported as financing receivables by GECS. See Note 26.