GE 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s discussion and analsis

ge 2008 annual report 41

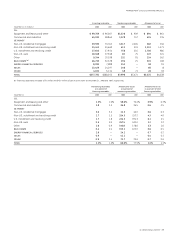

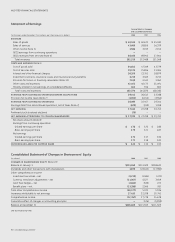

GECS Cash Flow

GECS cash and equivalents aggregated $37.5 billion at

December 31, 2008, compared with $9.4 billion at December 31,

2007. GECS CFOA totaled $31.2 billion in 2008, compared with

$25.0 billion in 2007. The increase is primarily the result of

increased collections of interest from loans and finance leases

and rental income from operating leases, resulting primarily

from core growth and currency exchange; and increases in cash

collateral received from counterparties on derivative contracts.

These increases were partially offset by increases in interest

payments resulting from increased borrowings and taxes paid.

GECS principal use of cash has been investing in assets to

grow its businesses. Of the $28.6 billion that GECS invested

during 2008, $17.4 billion was used for additions to financing

receivables; $13.3 billion was used to invest in new equipment,

principally for lease to others; and $25.0 billion was used for

acquisitions of new businesses, the largest of which were

Merrill Lynch Capital, CitiCapital and Bank BPH in 2008. This use

of cash was partially offset by proceeds from dispositions of

property, plant and equipment of $11.0 billion and proceeds

from sales of discontinued operations and principal businesses

of $10.1 billion.

GECS paid dividends to GE through a distribution of its

retained earnings, including special dividends from proceeds of

certain business sales. Dividends paid to GE totaled $2.4 billion in

2008, compared with $7.3 billion in 2007. There were no special

dividends paid to GE in 2008, compared with $2.4 billion in 2007.

During 2008, GECS borrowings with maturities of 90 days or less

decreased by $31.3 billion. New borrowings of $122.5 billion

having maturities longer than 90 days were added during 2008,

while $67.1 billion of such long-term borrowings were retired.

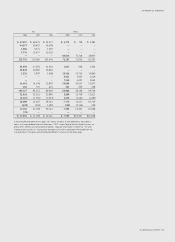

Intercompany Eliminations

Effects of transactions between related companies are eliminated

and consist primarily of GECS dividends to GE; GE customer

receivables sold to GECS; GECS services for trade receivables

management and material procurement; buildings and equipment

(including automobiles) leased by GE from GECS; information

technology (IT) and other services sold to GECS by GE; aircraft

engines manufactured by GE that are installed on aircraft pur-

chased by GECS from third-party producers for lease to others;

medical equipment manufactured by GE that is leased by GECS

to others; and various investments, loans and allocations of GE

corporate overhead costs. See Note 26 for further information

related to intercompany eliminations.

The lack of a current-year counterpart to last year’s $2.4 billion

GECS special dividend and a $2.5 billion decrease in GECS ordinary

dividend are the primary reasons for the decrease in the amount

of intercompany eliminations referred to above.

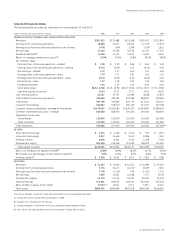

December 31 (In billions) 2008 2007 2006

Operating cash collections $115.5 $102.8 $ 90.6

Operating cash payments (98.8) (86.8) (76.6)

Cash dividends from GECS 2.4 7.3 9.8

GE cash from operating

activities (GE CFOA) $ 19.1 $ 23.3 $ 23.8

The most significant source of cash in CFOA is customer-related

activities, the largest of which is collecting cash following a product

or services sale. GE operating cash collections increased by

$12.7 billion in 2008 and $12.2 billion in 2007. These increases

are consistent with the changes in comparable GE operating

segment revenues, comprising Energy Infrastructure, Technology

Infrastructure, NBC Universal and Consumer & Industrial. Analyses

of operating segment revenues discussed in the preceding

Segment Operations section is the best way of understanding

their customer-related CFOA.

The most significant operating use of cash is to pay our sup-

pliers, employees, tax authorities and others for the wide range of

materials and services necessary in a diversified global organiza-

tion. GE operating cash payments increased by $12.0 billion in

2008 and by $10.2 billion in 2007, comparable to the increases in

GE total costs and expenses.

Dividends from GECS represented distribution of a portion of

GECS retained earnings, including special dividends from proceeds

from certain business sales, and are distinct from cash from

continuing operating activities within the financial services busi-

nesses, which increased in 2008 by $6.2 billion to $31.2 billion,

following an increase of $3.4 billion in 2007. The amounts we show

in GE CFOA are the total dividends, including normal dividends

as well as any special dividends from excess capital, primarily

resulting from GECS business sales. Beginning in the third quarter

of 2008, we reduced our dividend from GECS from 40% to 10%

of GECS earnings.

GE sells customer receivables to GECS in part to fund the

growth of our industrial businesses. These transactions can result

in cash generation or cash use in any given period. The incremental

cash generated or used from the sale of customer receivables

(net effect) is the amount of cash received for receivables sold

in a period less the amount of cash collected on receivables

previously sold. This net effect represents the cash generated or

used in the period related to this activity. The incremental cash

generated in GE CFOA from selling these receivables to GECS

decreased GE CFOA by $0.1 billion in 2008, and increased GE CFOA

by $0.3 billion and $2.0 billion in 2007 and 2006, respectively.

See Note 26 for additional information about the elimination of

intercompany transactions between GE and GECS.