GE 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

ge 2008 annual report 47

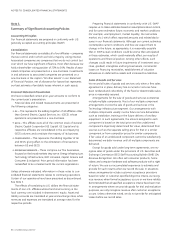

In evaluating whether a particular relationship qualifies for

hedge accounting, we test effectiveness at inception and each

reporting period thereafter by determining whether changes in

the fair value of the derivative offset, within a specified range,

changes in the fair value of the hedged item. If fair value

changes fail this test, we discontinue applying hedge accounting

to that relationship prospectively. Fair values of both the deriva-

tive instrument and the hedged item are calculated using inter-

nal valuation models incorporating market-based assumptions,

subject to third-party confirmation.

At December 31, 2008, derivative assets and liabilities were

$12.6 billion and $5.2 billion, respectively. Further information

about our use of derivatives is provided in Notes 18, 23 and 29.

INVESTMENTS MEASURED AT FAIR VALUE IN EARNINGS include

retained interests in securitizations accounted for under SFAS 155,

Accounting for Certain Hybrid Financial Instruments, and equity

investments of $2.6 billion at year-end 2008. The earnings effects

of changes in fair value on these assets, favorable and unfavorable,

will be reflected in the period in which those changes occur. As

discussed in Note 17, we have businesses that are held for sale

valued at $2.7 billion at year-end 2008, which represents the

estimated fair value less costs to sell. Those sales are expected

to close in the first quarter of 2009. As discussed in Note 16, we

also have assets that are classified as held for sale in the ordinary

course of business, primarily credit card receivables, loans and

real estate properties, carried at $5.0 billion at year-end 2008,

which represents the lower of carrying amount or estimated fair

value less costs to sell. To the extent that the estimated fair value

less costs to sell is lower than carrying value, any favorable or

unfavorable changes in fair value will be reflected in earnings in

the period in which such changes occur.

OTHER LOSS CONTINGENCIES are recorded as liabilities when it is

probable that a liability has been incurred and the amount of the

loss is reasonably estimable. Disclosure is required when there is

a reasonable possibility that the ultimate loss will materially

exceed the recorded provision. Contingent liabilities are often

resolved over long time periods. Estimating probable losses

requires analysis of multiple forecasts that often depend on

judgments about potential actions by third parties such as

regulators.

Further information is provided in Notes 20 and 31.

INCOME TAXES. Our annual tax rate is based on our income,

statutory tax rates and tax planning opportunities available to us

in the various jurisdictions in which we operate. Tax laws are

complex and subject to different interpretations by the taxpayer

and respective governmental taxing authorities. Significant judg-

ment is required in determining our tax expense and in evaluating

our tax positions, including evaluating uncertainties under FIN 48,

Accounting for Uncertainty in Income Taxes. We review our tax

positions quarterly and adjust the balances as new information

becomes available. Our income tax rate is significantly affected

by the tax rate on our global operations. In addition to local

country tax laws and regulations, this rate depends on the extent

earnings are indefinitely reinvested outside the United States.

Indefinite reinvestment is determined by management’s judgment

about and intentions concerning the future operations of the

company. Deferred income tax assets represent amounts available

to reduce income taxes payable on taxable income in future years.

Such assets arise because of temporary differences between the

financial reporting and tax bases of assets and liabilities, as well

as from net operating loss and tax credit carryforwards. We eval-

uate the recoverability of these future tax deductions and credits

by assessing the adequacy of future expected taxable income from

all sources, including reversal of taxable temporary differences,

forecasted operating earnings and available tax planning strategies.

These sources of income inherently rely heavily on estimates.

We use our historical experience and our short and long-range

business forecasts to provide insight. Further, our global and

diversified business portfolio gives us the opportunity to employ

various prudent and feasible tax planning strategies to facilitate

the recoverability of future deductions. Amounts recorded for

deferred tax assets related to non-U.S. net operating losses, net

of valuation allowances, were $1.8 billion and $1.7 billion at

December 31, 2008 and 2007, respectively. Such year-end 2008

amounts are expected to be fully recoverable within the applicable

statutory expiration periods. To the extent we do not consider it

more likely than not that a deferred tax asset will be recovered,

a valuation allowance is established.

Further information on income taxes is provided in the

Operations —Overview section and in Notes 7 and 21.

DERIVATIVES AND HEDGING. We use derivatives to manage a vari-

ety of risks, including risks related to interest rates, foreign

exchange and commodity prices. Accounting for derivatives as

hedges requires that, at inception and over the term of the

arrangement, the hedged item and related derivative meet the

requirements for hedge accounting. The rules and interpreta-

tions related to derivatives accounting are complex. Failure to

apply this complex guidance correctly will result in all changes in

the fair value of the derivative being reported in earnings, with-

out regard to the offsetting changes in the fair value of the

hedged item.