Frontier Communications 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

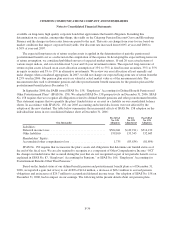

Effective December 30, 2007, the CTE Employees’ Pension Plan was frozen for all non-union

Commonwealth employees. No additional benefit accruals for service rendered subsequent to December 30, 2007

will occur for those participants. As a result of this plan change and in accordance with SFAS No. 88,

“Employers’ Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and for Termination

Benefits,” a gain on pension curtailment of $14.4 million was recorded in 2007 and included in other operating

expenses in the consolidated statement of operations. Also, effective December 31, 2007, the CTE Employees’

Pension Plan was merged into the Citizens Pension Plan.

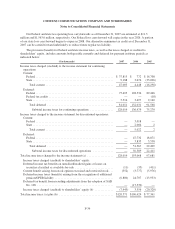

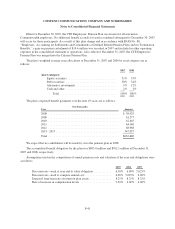

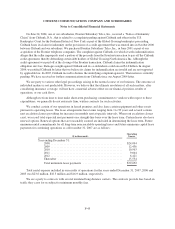

The plan’s weighted average asset allocations at December 31, 2007 and 2006 by asset category are as

follows:

2007 2006

Asset category:

Equity securities ................................. 51% 53%

Debt securities .................................. 38% 34%

Alternative investments ........................... 9% 12%

Cash and other .................................. 2% 1%

Total ...................................... 100% 100%

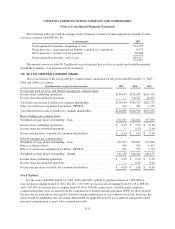

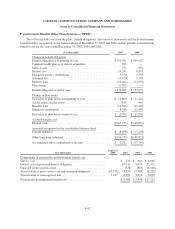

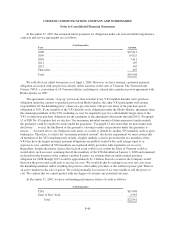

The plan’s expected benefit payments over the next 10 years are as follows:

($ in thousands)

Year Amount

2008 ................................................ $ 58,423

2009 ................................................ 61,277

2010 ................................................ 62,645

2011 ................................................ 64,540

2012 ................................................ 68,968

2013 - 2017 ........................................... 347,027

Total ................................................ $662,880

We expect that no contribution will be made by us to the pension plan in 2008.

The accumulated benefit obligation for the plan was $805.0 million and $762.1 million at December 31,

2007 and 2006, respectively.

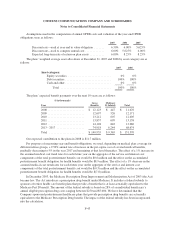

Assumptions used in the computation of annual pension costs and valuation of the year-end obligations were

as follows:

2007 2006 2005

Discount rate—used at year end to value obligation ............ 6.50% 6.00% 5.625%

Discount rate—used to compute annual cost .................. 6.00% 5.625% 6.00%

Expected long-term rate of return on plan assets ............... 8.25% 8.25% 8.25%

Rate of increase in compensation levels ..................... 3.50% 4.00% 4.00%

F-41