Frontier Communications 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

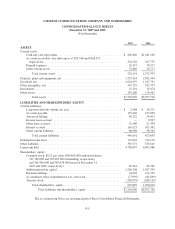

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

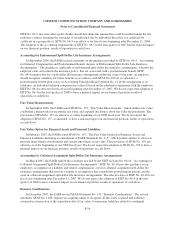

In accordance with the adoption of SFAS No. 123R, we recorded stock-based compensation expense for the

cost of stock options, restricted shares and stock units issued under our stock plans (together, Stock-Based

Awards). Stock-based compensation expense for the years ended December 31, 2007 and 2006 was $9.0 million

and $10.3 million, respectively, ($5.6 million and $6.7 million after tax, respectively).

The compensation cost recognized is based on awards ultimately expected to vest. SFAS No. 123R requires

forfeitures to be estimated and revised, if necessary, in subsequent periods if actual forfeitures differ from those

estimates.

Prior to the adoption of SFAS No. 123R, we applied Accounting Principles Board Opinion (APB) No. 25

and related interpretations to account for our stock plans resulting in the use of the intrinsic-value based method

to value the stock. Under APB No. 25, we were not required to recognize compensation expense for the cost of

stock options issued under our stock plans.

Prior to 2006, we provided pro forma net income and pro forma net income per common share disclosures

for employee and non-employee director stock option grants based on the fair value of the options at the date of

grant (see Note 17). For purposes of presenting pro forma information, the fair value of options granted is

computed using the Black Scholes option-pricing model.

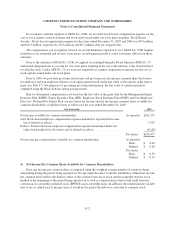

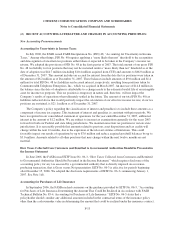

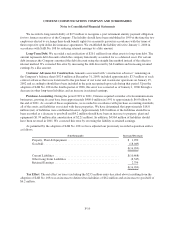

Had we determined compensation cost based on the fair value at the grant date for the Management Equity

Incentive Plan (MEIP), Equity Incentive Plan (EIP), Employee Stock Purchase Plan (ESPP) and Non-Employee

Directors’ Deferred Fee Equity Plan, our pro forma net income and net income per common share available for

common shareholders would have been as follows for the year ended December 31, 2005:

($ in thousands) 2005

Net income available for common shareholders ............................... Asreported $202,375

Add: Stock-based employee compensation expense included in reported net income,

net of related tax effects ................................................ 5,267

Deduct: Total stock-based employee compensation expense determined under fair

value based method for all awards, net of related tax effects ................... (8,165)

Pro forma $199,477

Net income per common share available for common shareholders As reported:

Basic $ 0.60

Diluted $ 0.60

Pro forma:

Basic $ 0.59

Diluted $ 0.59

(l) Net Income Per Common Share Available for Common Shareholders:

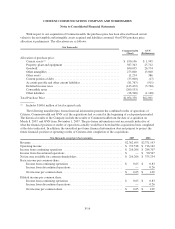

Basic net income per common share is computed using the weighted average number of common shares

outstanding during the period being reported on. Except when the effect would be antidilutive, diluted net income

per common share reflects the dilutive effect of the assumed exercise of stock options using the treasury stock

method at the beginning of the period being reported on as well as common shares that would result from the

conversion of convertible preferred stock (EPPICS) and convertible notes. In addition, the related interest on debt

(net of tax) is added back to income since it would not be paid if the debt was converted to common stock.

F-12