Frontier Communications 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

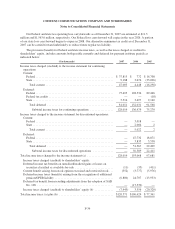

(14) OTHER INCOME(LOSS) NET:

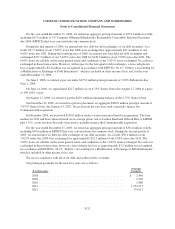

The components of other income (loss), net for the years ended December 31, 2007, 2006 and 2005 are as

follows:

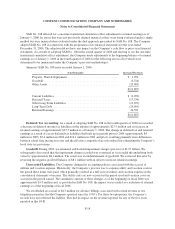

($ in thousands) 2007 2006 2005

Bridge loan fee ..................................................... $ (4,069) $ — $ —

Premium on debt repurchases ......................................... (18,217) — —

Legal contingency .................................................. — (1,000) (7,000)

Gain on expiration/settlement of customer advances ........................ 2,031 3,539 681

Loss on exchange of debt ............................................. — (2,433) (3,175)

Gain on forward rate agreements ....................................... — 430 1,851

Other, net ......................................................... 2,422 2,471 8,399

Total other income (loss), net ...................................... $(17,833) $ 3,007 $ 756

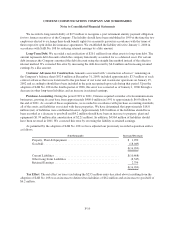

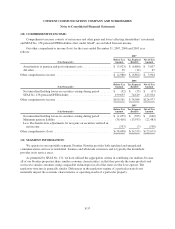

During the first quarter of 2007, we incurred $4.1 million of fees associated with a bridge loan facility. In

2007, we retired certain debt and recognized a pre-tax loss of $18.2 million on the early extinguishment of debt

at a premium, mainly for the 7.625% Senior Notes due 2008. During 2006 and 2005, we recorded expense in

connection with the Bangor, Maine legal matter. During 2007, 2006 and 2005, we recognized income in

connection with certain retained liabilities, that have terminated, associated with customer advances for

construction from our disposed water properties. In connection with our exchange of debt during the first quarter

of 2006 and second quarter of 2005, we recognized a non-cash, pre-tax loss. 2006 and 2005 also include a gain

for the changes in fair value of our forward rate agreements.

Pre-tax gains (losses) in connection with the following transactions were also recorded in other income

(loss), net during 2005:

On February 1, 2005, we sold shares of Prudential Financial, Inc. for approximately $1.1 million in cash,

and we recognized a pre-tax gain of approximately $493,000.

In June 2005, we sold for cash our interests in certain key man life insurance policies on the lives of

Leonard Tow, our former Chairman and Chief Executive Officer, and his wife, a former director. The cash

surrender value of the policies purchased by Dr. Tow totaled approximately $24.2 million, and we recognized a

pre-tax gain of approximately $457,000.

During 2005, we sold shares of Global Crossing Limited for approximately $1.1 million in cash, and we

recognized a pre-tax gain for the same amount.

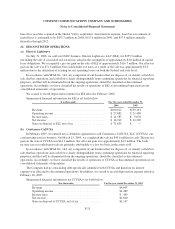

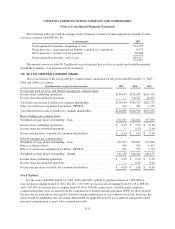

(15) COMPANY OBLIGATED MANDATORILY REDEEMABLE CONVERTIBLE PREFERRED

SECURITIES:

As of December 31, 2007, we have only $4.0 million of EPPICS related debt outstanding to third parties.

The following disclosure provides the history regarding this issue.

In 1996, our consolidated wholly-owned subsidiary, Citizens Utilities Trust (the Trust), issued, in an

underwritten public offering, 4,025,000 shares of EPPICS, representing preferred undivided interests in the assets

of the Trust, with a liquidation preference of $50 per security (for a total liquidation amount of $201.3 million).

These securities have an adjusted conversion price of $11.46 per share of our common stock. The conversion

price was reduced from $13.30 to $11.46 during the third quarter of 2004 as a result of the $2.00 per share of

common stock special, non-recurring dividend. The proceeds from the issuance of the Trust Convertible

Preferred Securities and a Company capital contribution were used to purchase $207.5 million aggregate

liquidation amount of 5% Partnership Convertible Preferred Securities due 2036 from another wholly-owned

F-27