Frontier Communications 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

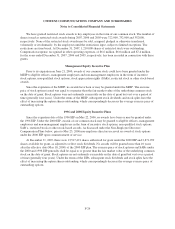

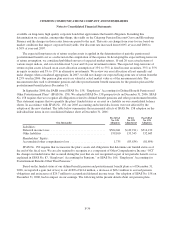

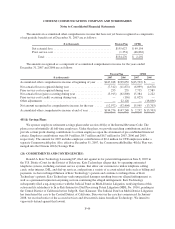

(22) QUARTERLY FINANCIAL DATA (UNAUDITED):

($ in thousands, except per share amounts) First

quarter Second

quarter Third

quarter Fourth

quarter Year ended

December 31,

2007

Revenue .................................. $556,147 $578,826 $575,814 $577,228 $2,288,015

Operating income ........................... 193,302 171,298 165,925 174,891 705,416

Net income ................................ 67,667 40,559 47,415 59,013 214,654

Net income available for common shareholders per

basic share ............................... $ 0.21 $ 0.12 $ 0.14 $ 0.18 $ 0.65

Net income available for common shareholders per

diluted share ............................. $ 0.21 $ 0.12 $ 0.14 $ 0.18 $ 0.65

2006

Revenue .................................. $506,861 $506,912 $507,198 $504,396 $2,025,367

Operating income ........................... 157,338 169,458 160,721 156,973 644,490

Net income ................................ 50,483 101,702 128,459 63,911 344,555

Net income available for common shareholders per

basic share ............................... $ 0.15 $ 0.32 $ 0.40 $ 0.20 $ 1.07

Net income available for common shareholders per

diluted share ............................. $ 0.15 $ 0.31 $ 0.40 $ 0.20 $ 1.06

The quarterly net income per common share amounts are rounded to the nearest cent. Annual net income per

common share may vary depending on the effect of such rounding. Our quarterly results include the results of

operations of Commonwealth from the date of its acquisition on March 8, 2007 and of GVN from the date of its

acquisition on October 31, 2007. During the second quarter of 2006, we recorded a gain in investment income of

$61.4 million resulting from the dissolution and liquidation of the Rural Telephone Bank. In the third quarter of

2006 we sold ELI (see Note 8). See Notes 13 and 14 for a description of other miscellaneous transactions

impacting our quarterly results.

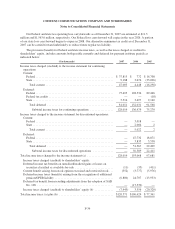

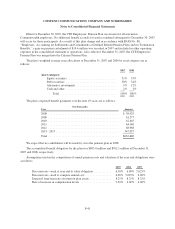

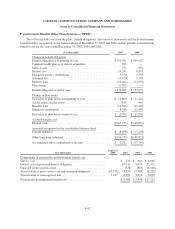

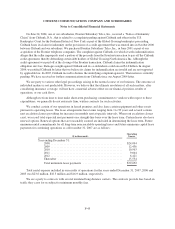

(23) RETIREMENT PLANS:

We sponsor a noncontributory defined benefit pension plan covering a significant number of our former and

current employees and other postretirement benefit plans that provide medical, dental, life insurance and other

benefits for covered retired employees and their beneficiaries and covered dependents. The benefits are based on

years of service and final average pay or career average pay. Contributions are made in amounts sufficient to

meet ERISA funding requirements while considering tax deductibility. Plan assets are invested in a diversified

portfolio of equity and fixed-income securities and alternative investments.

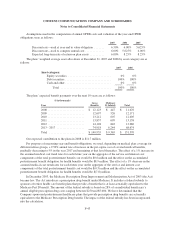

The accounting results for pension and postretirement benefit costs and obligations are dependent upon

various actuarial assumptions applied in the determination of such amounts. These actuarial assumptions include

the following: discount rates, expected long-term rate of return on plan assets, future compensation increases,

employee turnover, healthcare cost trend rates, expected retirement age, optional form of benefit and mortality.

We review these assumptions for changes annually with our independent actuaries. We consider our discount rate

and expected long-term rate of return on plan assets to be our most critical assumptions.

The discount rate is used to value, on a present value basis, our pension and postretirement benefit

obligations as of the balance sheet date. The same rate is also used in the interest cost component of the pension

and postretirement benefit cost determination for the following year. The measurement date used in the selection

of our discount rate is the balance sheet date. Our discount rate assumption is determined annually with

assistance from our actuaries based on the pattern of expected future benefit payments and the prevailing rates

F-38