Frontier Communications 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

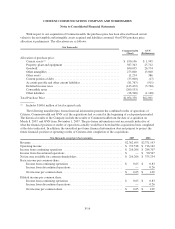

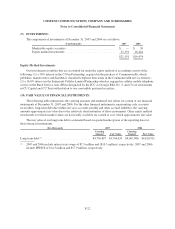

(6) ACCOUNTS RECEIVABLE:

The components of accounts receivable at December 31, 2007 and 2006 are as follows:

($ in thousands) 2007 2006

End user ...................................................... $244,592 $ 273,828

Other ........................................................ 22,918 22,446

Less: Allowance for doubtful accounts .............................. (32,748) (108,537)

Accounts receivable, net ..................................... $234,762 $ 187,737

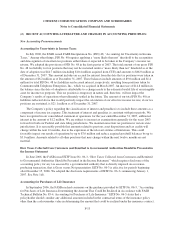

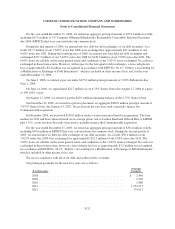

An analysis of the activity in the allowance for doubtful accounts for the years ended December 31, 2007,

2006, and 2005 is as follows:

Additions

Allowance for doubtful accounts

Balance at

beginning of

Period

Balance of

acquired

properties

Charged to

bad debt

expense*

Charged to other

accounts -

Revenue Deductions

Balance at

end of

Period

2005 ..................... $ 35,080 $ — $12,797 $ 1,080 $17,572 $ 31,385

2006 ..................... 31,385 — 20,257 80,003 23,108 108,537

2007 ..................... 108,537 1,499 31,131 (77,898) 30,521 32,748

* Such amounts are included in bad debt expense and for financial reporting purposes are classified as contra-

revenue.

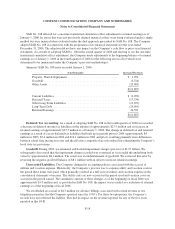

We maintain an allowance for estimated bad debts based on our estimate of collectability of our accounts

receivable. Bad debt expense is recorded as a reduction to revenue.

Our allowance for doubtful accounts increased by approximately $78.3 million in 2006 as a result of carrier

activity that was in dispute. Our allowance for doubtful accounts (and “end user” receivables) declined from

December 31, 2006, primarily as a result of the resolution of our principal carrier dispute. On March 12, 2007,

we entered into a settlement agreement with a carrier pursuant to which we were paid $37.5 million, resulting in

a favorable impact on our revenue in the first quarter of 2007 of $38.7 million.

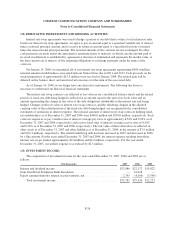

(7) OTHER INTANGIBLES:

Other intangibles at December 31, 2007 and 2006 are as follows:

($ in thousands) 2007 2006

Customer base ............................................... $1,271,085 $ 994,605

Trade name ................................................. 132,381 122,058

Other intangibles ......................................... 1,403,466 1,116,663

Less: Accumulated amortization ................................. (855,731) (684,310)

Total other intangibles, net ................................. $ 547,735 $ 432,353

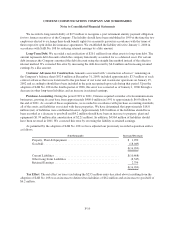

Amortization expense was $171.4 million, $126.4 million and $126.4 million for the years ended

December 31, 2007, 2006 and 2005, respectively. Amortization expense for 2007 is comprised of $126.4 million

for amortization associated with our “legacy” properties and $45.0 million for intangible assets (customer base

and trade name) acquired in the Commonwealth and Global Valley acquisitions. As of December 31, 2007,

$263.5 million has been allocated to the customer base (five year life) and $10.3 million to the trade name (five

year life) acquired in the Commonwealth acquisition, and $13.0 million on a preliminary basis to the customer

F-20