Frontier Communications 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

RISKS RELATED TO LIQUIDITY, FINANCIAL RESOURCES, AND CAPITALIZATION

Substantial debt and debt service obligations may adversely affect us.

We have a significant amount of indebtedness. We may also obtain additional long-term debt and working

capital lines of credit to meet future financing needs, subject to certain restrictions under our existing

indebtedness, which would increase our total debt.

The significant negative consequences on our financial condition and results of operations that could result

from our substantial debt include:

• limitations on our ability to obtain additional debt or equity financing, partially due to the effects of the

current credit environment;

• instances in which we are unable to meet the financial covenants contained in our debt agreements or to

generate cash sufficient to make required debt payments, which circumstances have the potential of

accelerating the maturity of some or all of our outstanding indebtedness;

• the allocation of a substantial portion of our cash flow from operations to service our debt, thus

reducing the amount of our cash flow available for other purposes, including operating costs, capital

expenditures and dividends that could improve our competitive position or results of operations;

• requiring us to sell debt or equity securities or to sell some of our core assets, possibly on unfavorable

terms, to meet payment obligations;

• compromising our flexibility to plan for, or react to, competitive challenges in our business and the

communications industry; and

• the possibility of our being put at a competitive disadvantage with competitors who do not have as

much debt as us, and competitors who may be in a more favorable position to access additional capital

resources.

We will require substantial capital to upgrade and enhance our operations.

Replacing or upgrading our infrastructure will result in significant capital expenditures. If this capital is not

available when needed, our business will be adversely affected. Increasing competition, offering new services,

improving the capabilities or reducing the maintenance costs of our plant may cause our capital expenditures to

increase in the future. In addition, our ongoing annual dividend of $1.00 per share under our current policy

utilizes a significant portion of our cash generated by operations and therefore limits our operating and financial

flexibility and our ability to significantly increase capital expenditures. While we believe that the amount of our

dividend will allow for adequate amounts of cash flow for capital spending and other purposes, any material

reduction in cash generated by operations and any increases in capital expenditures, interest expense or cash

taxes would reduce the amount of cash generated by operations and available for payment of dividends. Losses

of access lines, the effects of increased competition, lower subsidy and access revenues and the other factors

described above may reduce our cash generated by operations and may require us to increase capital

expenditures. In addition, we expect our cash paid for taxes to increase significantly in 2008 and 2009.

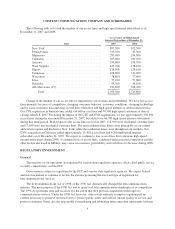

RISKS RELATED TO REGULATION

The access charge revenues we receive may be reduced at any time.

A significant portion of our revenues ($349.4 million, or 15% in 2007) is derived from access charges paid

by IXCs for services we provide in originating and terminating intrastate and interstate traffic. The amount of

access charge revenues we receive for these services is regulated by the FCC and state regulatory agencies.

Recent rulings regarding access charges have lowered the amount of revenue we receive from this source. The

10