Frontier Communications 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Dividends

We expect to pay regular quarterly dividends. Our ability to fund a regular quarterly dividend will be

impacted by our ability to generate cash from operations. The declarations and payment of future dividends will

be at the discretion of our Board of Directors, and will depend upon many factors, including our financial

condition, results of operations, growth prospects, funding requirements, applicable law and other factors our

Board of Directors deems relevant.

Off-Balance Sheet Arrangements

We do not maintain any off-balance sheet arrangements, transactions, obligations or other relationships with

unconsolidated entities that would be expected to have a material current or future effect upon our financial

statements.

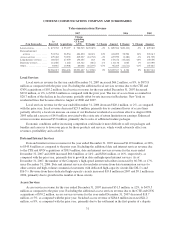

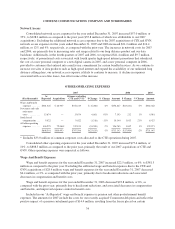

Future Commitments

A summary of our future contractual obligations and commercial commitments as of December 31, 2007 is

as follows:

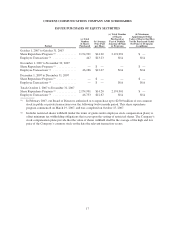

Contractual Obligations: Payment due by period

($ in thousands) Total 2008 2009-2010 2011-2012 Thereafter

Long-term debt obligations, excluding interest

(see Note 11) (1) ........................ $4,760,639 $ 2,448 $ 8,393 $1,431,534 $3,318,264

Interest on long-term debt .................. 4,887,086 370,721 740,879 579,081 3,196,405

Operating lease obligations (see Note 24) ..... 79,052 24,094 23,399 16,025 15,534

Purchase obligations (see Note 24) ........... 55,904 27,813 27,236 360 495

FIN No. 48 liability (see Note 2) ............. 65,959 15,500 26,170 18,175 6,114

Total .............................. $9,848,640 $440,576 $826,077 $2,045,175 $6,536,812

(1) Includes interest rate swaps for $7.9 million.

At December 31, 2007, we have outstanding performance letters of credit totaling $22.9 million.

Divestitures

On August 24, 1999, our Board of Directors approved a plan of divestiture for our public utilities services

businesses, which included gas, electric and water and wastewater businesses. We have sold all of these

properties. All of the agreements relating to the sales provide that we will indemnify the buyer against certain

liabilities (typically liabilities relating to events that occurred prior to sale), including environmental liabilities,

for claims made by specified dates and that exceed threshold amounts specified in each agreement (see Note 24).

Discontinued Operations

On July 31, 2006, we sold our CLEC business Electric Lightwave, LLC (ELI) for $255.3 million (including

a later sale of associated real estate) in cash plus the assumption of approximately $4.0 million in capital lease

obligations. We recognized a pre-tax gain on the sale of ELI of approximately $116.7 million. Our after-tax gain

on the sale was $71.6 million. Our cash liability for taxes as a result of the sale was approximately $5.0 million

due to the utilization of existing tax net operating losses on both the Federal and state level.

On March 15, 2005, we completed the sale of Conference Call USA, LLC (CCUSA) for $43.6 million in

cash. The pre-tax gain on the sale of CCUSA was $14.1 million. Our after-tax gain was $1.2 million. The book

income taxes recorded upon sale are primarily attributable to a low tax basis in the assets sold.

26