Frontier Communications 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

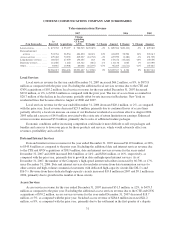

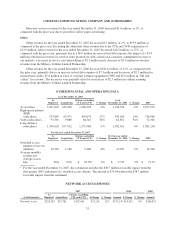

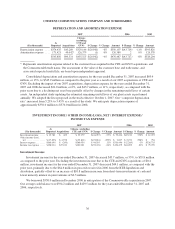

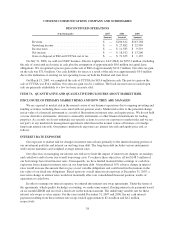

DEPRECIATION AND AMORTIZATION EXPENSE

2007 2006 2005

($ in thousands) As

Reported Acquisitions

Citizens

(excluding

CTE and

GVN) $ Change % Change Amount $ Change % Change Amount

Depreciation expense .... $374,435 $45,289 $329,146 $(20,961) -6% $350,107 $(43,719) -11% $393,826

Amortization expense .... 171,421 45,042* 126,379 (1) 0% 126,380 2 0% 126,378

$545,856 $90,331 $455,525 $(20,962) -4% $476,487 $(43,717) -8% $520,204

* Represents amortization expense related to the customer base acquired in the CTE and GVN acquisitions, and

the Commonwealth trade name. Our assessment of the value of the customer base and trade name, and

associated expected useful life, are based upon independent appraisal.

Consolidated depreciation and amortization expense for the year ended December 31, 2007 increased $69.4

million, or 15%, to $545.9 million as compared to the prior year as a result of our 2007 acquisitions of CTE and

GVN. Excluding the impact of our 2007 acquisitions, depreciation expense for the years ended December 31,

2007 and 2006 decreased $21.0 million, or 6%, and $43.7 million, or 11%, respectively, as compared with the

prior years due to a declining net asset base partially offset by changes in the remaining useful lives of certain

assets. An independent study updating the estimated remaining useful lives of our plant assets is performed

annually. We adopted the lives proposed in the study effective October 1, 2007. Our “composite depreciation

rate” increased from 5.25% to 5.45% as a result of the study. We anticipate depreciation expense of

approximately $350.0 million to $370.0 million for 2008.

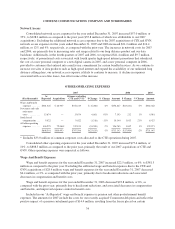

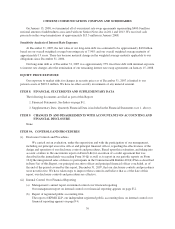

INVESTMENT INCOME / OTHER INCOME (LOSS), NET / INTEREST EXPENSE /

INCOME TAX EXPENSE

2007 2006 2005

($ in thousands) As

Reported Acquisitions Citizens (excluding

CTE and GVN) $ Change % Change Amount $ Change % Change Amount

Investment income ..... $ 35,781 $ 402 $ 35,379 $(44,057) -55% $ 79,436 $67,213 550% $ 12,223

Other income (loss),

net ................ $(17,833) $ 4,978 $ (22,811) $(25,818) -859% $ 3,007 $ 2,251 298% $ 756

Interest expense ........ $380,696 $ (260) $380,956 $ 44,510 13% $336,446 $ (2,289) -1% $338,735

Income tax expense ..... $128,014 $27,013 $101,001 $(35,478) -26% $136,479 $61,209 81% $ 75,270

Investment Income

Investment income for the year ended December 31, 2007 decreased $43.7 million, or 55%, to $35.8 million

as compared to the prior year. Excluding the investment income due to the CTE and GVN acquisitions of $0.4

million, investment income for the year ended December 31, 2007 decreased $44.1 million, as compared with the

prior year, primarily due to the $64.6 million in proceeds received in 2006 from the RTB liquidation and

dissolution, partially offset by an increase of $10.8 million in income from short-term investments of cash and

lower minority interest in joint ventures of $2.3 million.

We borrowed $550.0 million in December 2006 in anticipation of the Commonwealth acquisition in 2007.

Our average cash balance was $594.2 million and $429.5 million for the years ended December 31, 2007 and

2006, respectively.

36