Frontier Communications 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

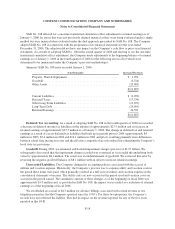

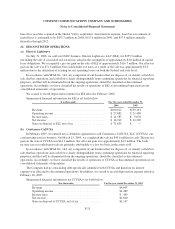

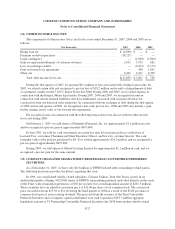

During 2007, we retired an aggregate principal amount of $967.2 million of debt, including $3.3 million of

5% Company Obligated Mandatorily Redeemable Convertible Preferred Securities due 2036 (EPPICS) and $17.8

million of 3.25% Commonwealth convertible notes that were converted into our common stock. As further

described below, we temporarily borrowed and repaid $200.0 million during the month of March 2007, utilized

to temporarily fund our acquisition of Commonwealth. Although this borrowing does not appear in our

December 31, 2006 or 2007 balance sheet, the borrowing and repayment are shown gross in the above table.

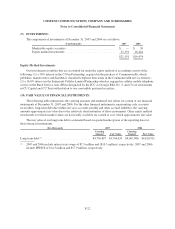

In connection with the acquisition of Commonwealth, we assumed $35.0 million of debt under a revolving

credit facility and approximately $191.8 million face amount of Commonwealth convertible notes (fair value of

approximately $209.6 million). During March 2007, we paid down the $35.0 million credit facility, and through

December 31, 2007, we have retired approximately $183.3 million face amount (for which we paid $165.4

million in cash and $36.7 million in common stock) of the convertible notes (premium paid of $18.9 million was

recorded as $17.8 million to goodwill and $1.1 million to other income (loss), net), resulting in a remaining

outstanding balance of $8.5 million as of December 31, 2007.

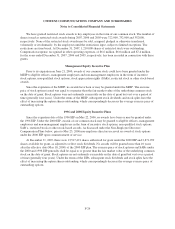

On March 23, 2007, we issued in a private placement an aggregate $300.0 million principal amount of

6.625% Senior Notes due 2015 and $450.0 million principal amount of 7.125% Senior Notes due 2019. Proceeds

from the sale were used to pay down $200.0 million principal amount of indebtedness borrowed on March 8,

2007 under a bridge loan facility in connection with the acquisition of Commonwealth, and redeem, on April 26,

2007, $495.2 million principal amount of our 7.625% Senior Notes due 2008.

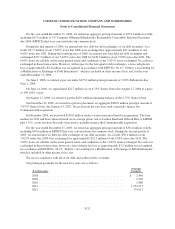

During the first quarter of 2007, we incurred and expensed approximately $4.1 million of fees associated

with the bridge loan facility. In the second quarter of 2007, we completed an exchange offer (to publicly register

the debt) on the $750.0 million in total of private placement notes described above, in addition to the $400.0

million principal amount of 7.875% Senior Notes issued in a private placement on December 22, 2006, for

registered Senior Notes due 2027. On April 26, 2007, we redeemed $495.2 million principal amount of our

7.625% Senior Notes due 2008 at a price of 103.041% plus accrued and unpaid interest. The debt retirement

generated a pre-tax loss on the early extinguishment of debt at a premium of approximately $16.3 million in the

second quarter of 2007 and is included in other income (loss), net. As a result of this debt redemption, we also

terminated three interest rate swap agreements hedging an aggregate $150.0 million notional amount of

indebtedness. Payments on the swap terminations of approximately $1.0 million were made in the second quarter

of 2007.

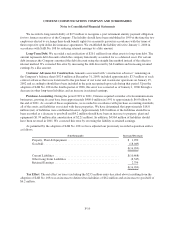

On January 15, 2008, we terminated all of our interest rate swap agreements representing $400.0 million

notional amount of indebtedness associated with our Senior Notes due in 2011 and 2013. Cash proceeds on the

swap terminations of approximately $15.5 million were received in January 2008. The related gain will be

deferred on the balance sheet, and amortized into income over the term of the associated debt.

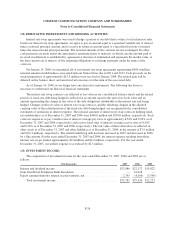

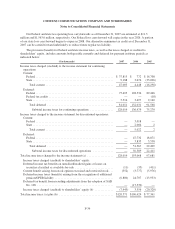

As of December 31, 2007, EPPICS representing a total principal amount of $197.3 million have been

converted into 15,918,182 shares of our common stock. Approximately $4.0 million of EPPICS, which are

convertible into 350,259 shares of our common stock, were outstanding at December 31, 2007. Our long-term

debt footnote indicates $14.5 million of EPPICS outstanding at December 31, 2007, of which $10.5 million is

debt of related parties for which the Company has an offsetting receivable.

As of December 31, 2007, we had available lines of credit with financial institutions in the aggregate

amount of $250.0 million and there were no outstanding standby letters of credit issued under the facility.

Associated facility fees vary, depending on our debt leverage ratio, and were 0.225% per annum as of

December 31, 2007. The expiration date for this $250.0 million five year revolving credit agreement is May 18,

2012. During the term of the credit facility we may borrow, repay and reborrow funds. The credit facility is

available for general corporate purposes but may not be used to fund dividend payments.

F-24