Frontier Communications 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

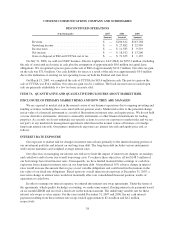

On January 15, 2008, we terminated all of our interest rate swap agreements representing $400.0 million

notional amount of indebtedness associated with our Senior Notes due in 2011 and 2013. We received cash

proceeds on the swap terminations of approximately $15.5 million in January 2008.

Sensitivity Analysis of Interest Rate Exposure

At December 31, 2007, the fair value of our long-term debt was estimated to be approximately $4.8 billion,

based on our overall weighted average borrowing rate of 7.94% and our overall weighted average maturity of

approximately 13 years. There has been no material change in the weighted average maturity applicable to our

obligations since December 31, 2006.

Our long-term debt as of December 31, 2007 was approximately 97% fixed rate debt with minimal exposure

to interest rate changes after the termination of our remaining interest rate swap agreements on January 15, 2008.

EQUITY PRICE EXPOSURE

Our exposure to market risks for changes in security prices as of December 31, 2007 is limited to our

pension assets of $822.2 million. We have no other security investments of any material amount.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The following documents are filed as part of this Report:

1. Financial Statements, See Index on page F-1.

2. Supplementary Data, Quarterly Financial Data is included in the Financial Statements (see 1. above).

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

(i) Disclosure Controls and Procedures

We carried out an evaluation, under the supervision and with the participation of our management,

including our principal executive officer and principal financial officer, regarding the effectiveness of the

design and operation of our disclosure controls and procedures. Based upon this evaluation, and taking into

account a failure to file one interim report on Form 8-K (for execution of a credit agreement that was

described in the immediately succeeding Form 10-Q) as well as to report in our periodic reports on Form

10-Q the unregistered sales of shares to participants in the Commonwealth Builder 401(k) Plan as described

in Item 5(a) of this Report, our principal executive officer and principal financial officer concluded, as of

the end of the period covered by this report, December 31, 2007, that our disclosure controls and procedures

were not effective. We have taken steps to improve these controls and believe that as of the date of this

report, our disclosure controls and procedures are effective.

(ii) Internal Control Over Financial Reporting

(a) Management’s annual report on internal control over financial reporting

Our management report on internal control over financial reporting appears on page F-2.

(b) Report of registered public accounting firm

The report of KPMG LLP, our independent registered public accounting firm, on internal control over

financial reporting appears on page F-4.

39