Frontier Communications 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

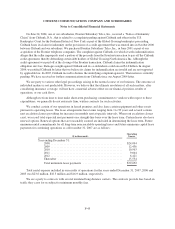

available on long-term, high quality corporate bonds that approximate the benefit obligation. In making this

determination we consider, among other things, the yields on the Citigroup Pension Discount Curve and Bloomberg

Finance and the changes in those rates from one period to the next. This rate can change from year-to-year based on

market conditions that impact corporate bond yields. Our discount rate increased from 6.00% at year-end 2006 to

6.50% at year-end 2007.

The expected long-term rate of return on plan assets is applied in the determination of periodic pension and

postretirement benefit cost as a reduction in the computation of the expense. In developing the expected long-term rate

of return assumption, we considered published surveys of expected market returns, 10 and 20 year actual returns of

various major indices, and our own historical 5-year and 10-year investment returns. The expected long-term rate of

return on plan assets is based on an asset allocation assumption of 35% to 55% in fixed income securities, 35% to 55%

in equity securities and 5% to 15% in alternative investments. We review our asset allocation at least annually and

make changes when considered appropriate. In 2007, we did not change our expected long-term rate of return from the

8.25% used in 2006. Our pension plan assets are valued at actual market value as of the measurement date. The

measurement date used to determine pension and other postretirement benefit measures for the pension plan and the

postretirement benefit plan is December 31.

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans” (SFAS No. 158). We adopted SFAS No. 158 prospectively on December 31, 2006. SFAS

No. 158 requires that we recognize all obligations related to defined benefit pensions and other postretirement benefits.

This statement requires that we quantify the plans’ funded status as an asset or a liability on our consolidated balance

sheets. In accordance with SFAS No. 158, our 2005 accounting and related disclosures were not affected by the

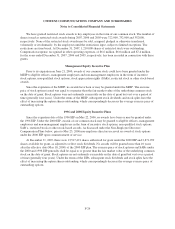

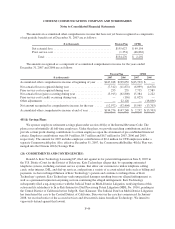

adoption of the new standard. The table below summarizes the incremental effects of SFAS No. 158 adoption on the

individual line items in our consolidated balance sheet at December 31, 2006:

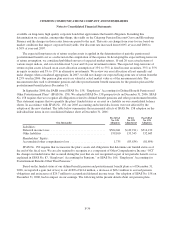

($ in thousands)

Pre SFAS

No. 158

Adoption

SFAS

No. 158

Adjustment

Post SFAS

No. 158

Adoption

Liabilities:

Deferred income taxes ..................................... $564,041 $ (49,911) $514,130

Other liabilities ........................................... 199,100 133,545 332,645

Shareholders’ Equity:

Accumulated other comprehensive loss ........................ 1,735 (83,634) (81,899)

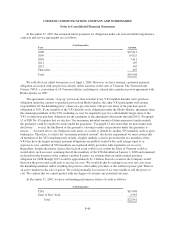

SFAS No. 158 requires that we measure the plan’s assets and obligations that determine our funded status as of

the end of the fiscal year. We are also required to recognize as a component of Other Comprehensive Income “OCI”

the changes in funded status that occurred during the year that are not recognized as part of net periodic benefit cost as

explained in SFAS No. 87, “Employers’ Accounting for Pensions,” or SFAS No. 106, “Employers’ Accounting for

Postretirement Benefits Other Than Pensions.”

Based on the funded status of our defined benefit pension and postretirement benefit plans as of December 31,

2006, we reported a gain (net of tax) to our AOCI of $41.4 million, a decrease of $66.1 million to accrued pension

obligations and an increase of $24.7 million to accumulated deferred income taxes. Our adoption of SFAS No. 158 on

December 31, 2006, had no impact on our earnings. The following tables present details about our pension plans.

F-39