Frontier Communications 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

SAB No. 108 allowed for a one-time transitional cumulative effect adjustment to retained earnings as of

January 1, 2006 for errors that were not previously deemed material as they were being evaluated under a single

method but were material when evaluated under the dual approach prescribed by SAB No. 108. The Company

adopted SAB No. 108 in connection with the preparation of its financial statements for the year ended

December 31, 2006. The adoption did not have any impact on the Company’s cash flow or prior year financial

statements. As a result of adopting SAB No. 108 in the fourth quarter of 2006 and electing to use the one-time

transitional cumulative effect adjustment, the Company made adjustments to the beginning balance of retained

earnings as of January 1, 2006 in the fourth quarter of 2006 for the following errors (all of which were

determined to be immaterial under the Company’s previous methodology):

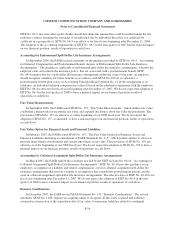

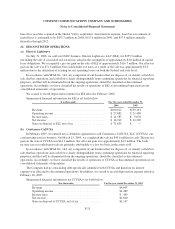

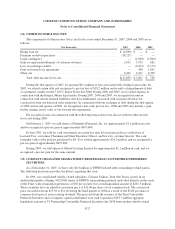

Summary SAB No. 108 entry recorded January 1, 2006:

($ in thousands) Increase/(Decrease)

Property, Plant & Equipment ................................... $ 1,990

Goodwill ................................................... (3,716)

Other Assets ................................................ (20,081)

$(21,807)

Current Liabilities ............................................ $ (2,922)

Deferred Taxes .............................................. (17,339)

Other Long-Term Liabilities ................................... (13,037)

Long-Term Debt ............................................. (24,901)

Retained Earnings ............................................ 36,392

$(21,807)

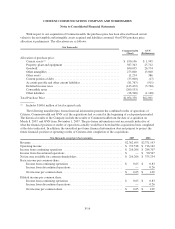

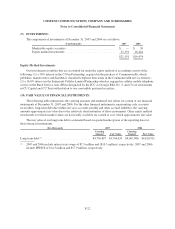

Deferred Tax Accounting. As a result of adopting SAB No. 108 in the fourth quarter of 2006 we recorded

a decrease in deferred income tax liabilities in the amount of approximately $23.5 million and an increase in

retained earnings of approximately $23.5 million as of January 1, 2006. The change in deferred tax and retained

earnings is a result of excess deferred tax liabilities that built up in periods prior to 2004 (approximately $4

million in 2003, $5.4 million in 2002 and $14.1 million in 2001 and prior), resulting primarily from differences

between actual state income tax rates and the effective composite state rate utilized for estimating the Company’s

book state tax provisions.

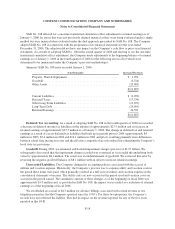

Goodwill. During 2002, we estimated and booked impairment charges (pre-tax) of $1.07 billion. We

subsequently discovered that the impairment charge recorded was overstated as it exceeded the underlying book

value by approximately $8.1 million. The result was an understatement of goodwill. We corrected this error by

reversing the negative goodwill balance of $8.1 million with an offset to increase retained earnings.

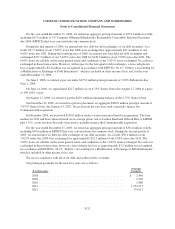

Unrecorded Liabilities. The Company changed its accounting policies associated with the accrual of

utilities and vacation expense. Historically, the Company’s practice was to expense utility and vacation costs in

the period these items were paid, which generally resulted in a full year of utilities and vacation expense in the

consolidated statements of income. The utility costs are now accrued in the period used and vacation costs are

accrued in the period earned. The cumulative amount of these changes as of the beginning of fiscal 2006 was

approximately $3.0 million and, as provided in SAB No. 108, the impact was recorded as a reduction of retained

earnings as of the beginning of fiscal 2006.

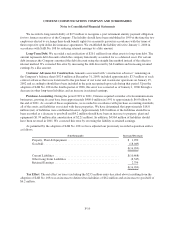

We established an accrual of $4.5 million for advance billings associated with certain revenue at two

telephone properties that the Company operated since the 1930’s. For these two properties, the Company’s

records have not reflected the liability. This had no impact on the revenue reported for any of the five years

reported in this 10-K.

F-18