Frontier Communications 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

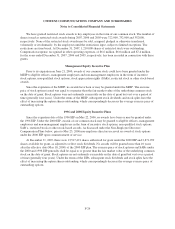

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

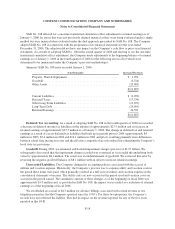

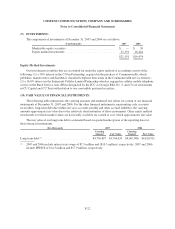

For the year ended December 31, 2006, we retired an aggregate principal amount of $251.0 million of debt,

including $15.9 million of 5% Company Obligated Mandatorily Redeemable Convertible Preferred Securities

due 2006 (EPPICS) that were converted into our common stock.

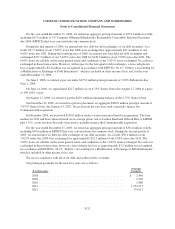

During the first quarter of 2006, we entered into two debt-for-debt exchanges of our debt securities. As a

result, $47.5 million of our 7.625% notes due 2008 were exchanged for approximately $47.4 million of our

9.00% notes due 2031. During the fourth quarter of 2006, we entered into four debt-for-debt exchanges and

exchanged $157.3 million of our 7.625% notes due 2008 for $149.9 million of our 9.00% notes due 2031. The

9.00% notes are callable on the same general terms and conditions as the 7.625% notes exchanged. No cash was

exchanged in these transactions. However, with respect to the first quarter debt exchanges, a non-cash pre-tax

loss of approximately $2.4 million was recognized in accordance with EITF No. 96-19, “Debtor’s Accounting for

a Modification or Exchange of Debt Instruments,” which is included in other income (loss), net, for the year

ended December 31, 2006.

On June 1, 2006, we retired at par our entire $175.0 million principal amount of 7.60% Debentures due

June 1, 2006.

On June 14, 2006, we repurchased $22.7 million of our 6.75% Senior Notes due August 17, 2006 at a price

of 100.181% of par.

On August 17, 2006, we retired at par the $29.1 million remaining balance of the 6.75% Senior Notes.

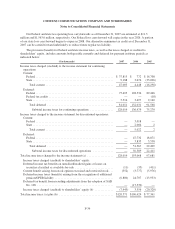

On December 22, 2006, we issued in a private placement, an aggregate $400.0 million principal amount of

7.875% Senior Notes due January 15, 2027. Proceeds from the sale were used to partially finance the

Commonwealth acquisition.

In December 2006, we borrowed $150.0 million under a senior unsecured term loan agreement. The loan

matures in 2012 and bears interest based on an average prime rate or London Interbank Offered Rate or LIBOR

plus 1

3

⁄

8

%, at our election. Proceeds were used to partially finance the Commonwealth acquisition.

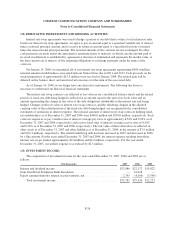

For the year ended December 31, 2005, we retired an aggregate principal amount of $36.4 million of debt,

including $30.0 million of EPPICS that were converted into our common stock. During the second quarter of

2005, we entered into two debt-for-debt exchanges of our debt securities. As a result, $50.0 million of our

7.625% notes due 2008 were exchanged for approximately $52.2 million of our 9.00% notes due 2031. The

9.00% notes are callable on the same general terms and conditions as the 7.625% notes exchanged. No cash was

exchanged in these transactions, however a non-cash pre-tax loss of approximately $3.2 million was recognized

in accordance with EITF No. 96-19, “Debtor’s Accounting for a Modification or Exchange of Debt Instruments,”

which is included in other income (loss), net.

We are in compliance with all of our debt and credit facility covenants.

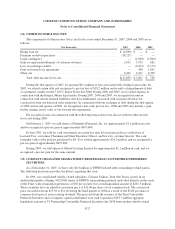

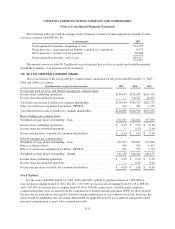

Our principal payments for the next five years are as follows:

Principal

Payments($ in thousands)

2008 ........................................................... $ 2,448

2009 ........................................................... 2,507

2010 ........................................................... 5,886

2011 ........................................................... 1,252,517

2012 ........................................................... 179,017

F-25