Frontier Communications 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

consideration at fair value in each subsequent reporting period and to expense all acquisition related costs. The

effective date of SFAS No. 141R is for business combinations for which the acquisition date is on or after the

beginning of the first annual reporting period beginning on or after December 15, 2008. This standard does not

impact our currently reported results. The Company is currently evaluating the impact that the adoption of the

standard will have on the Company’s future results of operations or financial condition.

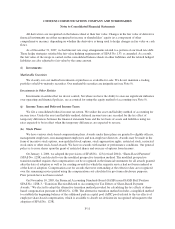

(3) ACQUISITION OF COMMONWEALTH TELEPHONE AND GLOBAL VALLEY NETWORKS:

On March 8, 2007, we acquired Commonwealth Telephone Enterprises, Inc. (“Commonwealth” or “CTE”)

in a cash-and-stock taxable transaction, for a total consideration of approximately $1.1 billion. We paid $804.1

million in cash ($663.7 million net, after cash acquired) and issued common stock with a value of $247.4 million.

In connection with the acquisition of Commonwealth, we assumed $35.0 million of debt under a revolving

credit facility and $191.8 million face amount of Commonwealth convertible notes (fair value of $209.6 million).

During March 2007, we paid down the $35.0 million credit facility. We have retired all but $8.5 million of the

$191.8 million face amount of Commonwealth convertible notes as of December 31, 2007. The notes were

retired by the payment of $165.4 million in cash and the issuance of our common stock valued at $36.7 million.

The premium paid of $18.9 million was recorded as $17.8 million to goodwill and $1.1 million to other income

(loss), net.

We entered into an agreement on July 5, 2007 with Country Road Communications LLC (“Country Road”)

to acquire Global Valley Networks, Inc. (“GVN”) and GVN Services (“GVS”) through the purchase from

Country Road of 100% of the outstanding common stock of Evans Telephone Holdings, Inc., the parent company

of GVN and GVS. We closed on this acquisition on October 31, 2007. The purchase price of $62.0 million was

paid with cash on hand.

We have accounted for the acquisitions of Commonwealth and GVN as purchases under U.S. generally

accepted accounting principles. Under the purchase method of accounting, the assets and liabilities of

Commonwealth and GVN are recorded as of the acquisition date, at their respective fair values, and consolidated

with those of Citizens. The reported consolidated financial condition of Citizens as of December 31, 2007,

reflects the final allocation of these fair values. The final allocation reflects a decrease of $236.5 million in the

value of the Commonwealth customer base, as compared to our preliminary estimate.

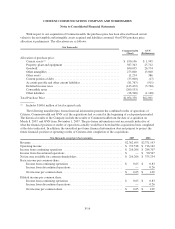

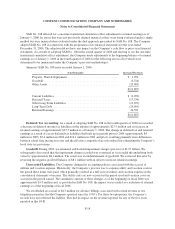

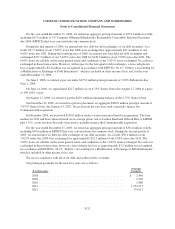

The following schedule provides a summary of the purchase price paid by Citizens in the acquisitions of

Commonwealth and GVN as of December 31, 2007:

($ in thousands)

Commonwealth GVN

Cash paid ................................................... $ 804,085 $62,001

Value of Citizens common stock issued ............................ 247,435 —

Accrued closing costs .......................................... 2,838 —

Total Purchase Price ........................................... $1,054,358 $62,001

F-15