Frontier Communications 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

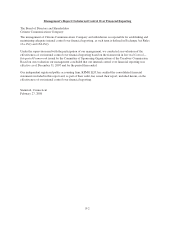

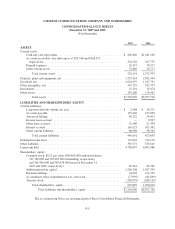

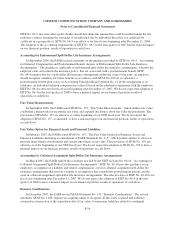

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

December 31, 2007 and 2006

($ in thousands)

2007 2006

ASSETS

Current assets:

Cash and cash equivalents ........................................... $ 226,466 $1,041,106

Accounts receivable, less allowances of $32,748 and $108,537,

respectively .................................................... 234,762 187,737

Prepaid expenses .................................................. 29,437 30,377

Other current assets ................................................ 33,489 13,773

Total current assets ............................................ 524,154 1,272,993

Property, plant and equipment, net ........................................ 3,335,244 2,983,504

Goodwill, net ......................................................... 2,634,559 1,917,751

Other intangibles, net .................................................. 547,735 432,353

Investments .......................................................... 21,191 16,474

Other assets .......................................................... 193,186 174,461

Total assets .................................................. $7,256,069 $6,797,536

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Long-term debt due within one year ................................... $ 2,448 $ 39,271

Accounts payable ................................................. 179,402 153,890

Advanced billings ................................................. 44,722 39,417

Income taxes accrued .............................................. — 9,897

Other taxes accrued ................................................ 21,400 21,434

Interest accrued ................................................... 116,923 103,342

Other current liabilities ............................................. 80,996 58,392

Total current liabilities ......................................... 445,891 425,643

Deferred income taxes .................................................. 711,645 514,130

Other liabilities ....................................................... 363,737 332,645

Long-term debt ....................................................... 4,736,897 4,467,086

Shareholders’ equity:

Common stock, $0.25 par value (600,000,000 authorized shares;

327,749,000 and 322,265,000 outstanding, respectively,

and 349,456,000 and 343,956,000 issued at December 31,

2007 and 2006, respectively) ...................................... 87,364 85,989

Additional paid-in capital ........................................... 1,280,508 1,207,399

Retained earnings ................................................. 14,001 134,705

Accumulated other comprehensive loss, net of tax ........................ (77,995) (81,899)

Treasury stock .................................................... (305,979) (288,162)

Total shareholders’ equity ....................................... 997,899 1,058,032

Total liabilities and shareholders’ equity ....................... $7,256,069 $6,797,536

The accompanying Notes are an integral part of these Consolidated Financial Statements.

F-5