Frontier Communications 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

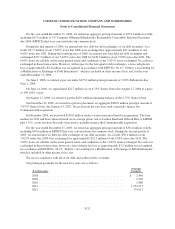

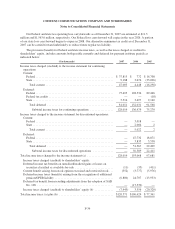

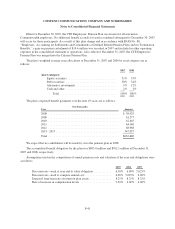

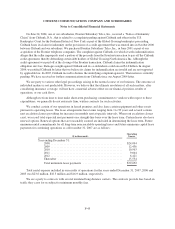

The following table sets forth the changes in the Company’s balance of unrecognized tax benefits for the

year in accordance with FIN No. 48:

($ in thousands) 2007

Unrecognized tax benefits - beginning of year ............................ $30,332

Gross increases - unrecognized tax benefits acquired via acquisitions .......... 8,977

Gross increases - current year tax positions ............................... 20,408

Unrecognized tax benefits - end of year ................................. $59,717

The amounts above exclude $6.2 million of accrued interest that we have recorded and would be payable

should the Company’s tax positions not be sustained.

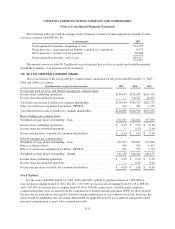

(19) NET INCOME PER COMMON SHARE:

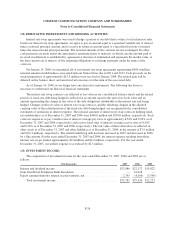

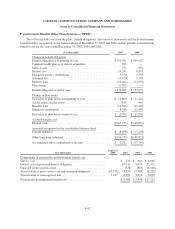

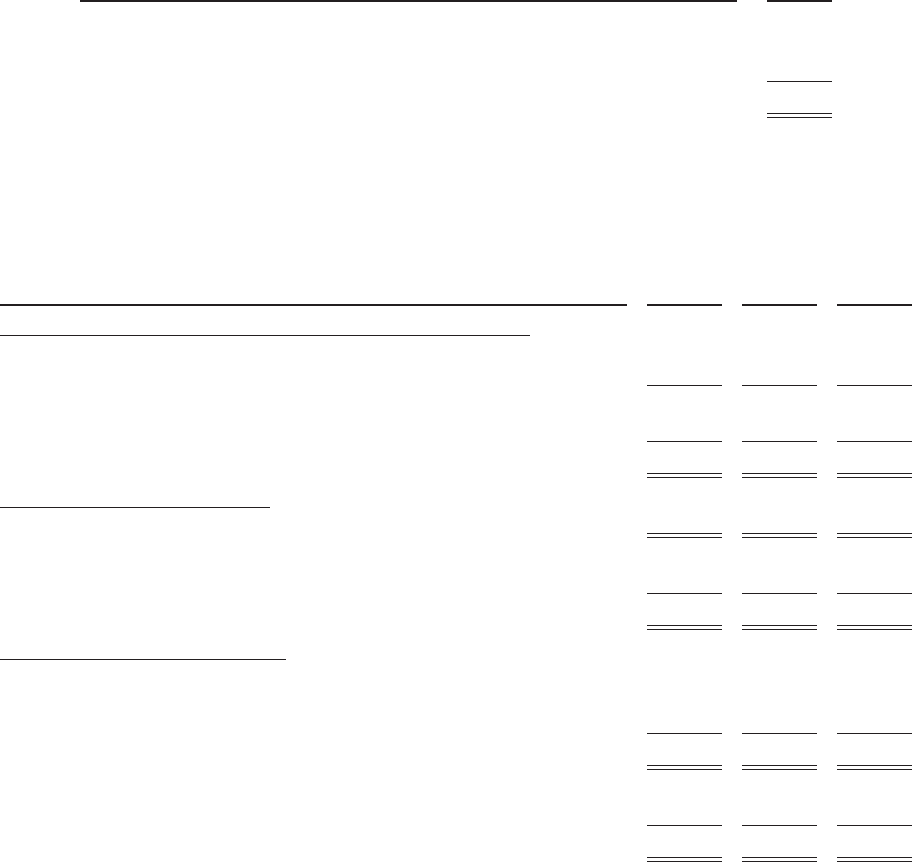

The reconciliation of the net income per common share calculation for the years ended December 31, 2007,

2006 and 2005 is as follows:

($ in thousands, except per-share amounts) 2007 2006 2005

Net income used for basic and diluted earnings per common share:

Income from continuing operations .................................. $214,654 $254,008 $187,942

Income from discontinued operations ................................ — 90,547 14,433

Total basic net income available for common shareholders ............... $214,654 $344,555 $202,375

Effect of conversion of preferred securities - EPPICS .................... 152 401 1,255

Total diluted net income available for common shareholders .............. $214,806 $344,956 $203,630

Basic earnings per common share:

Weighted-average shares outstanding - basic .......................... 331,037 322,641 337,065

Income from continuing operations .................................. $ 0.65 $ 0.79 $ 0.56

Income from discontinued operations ................................ — 0.28 0.04

Net income per share available for common shareholders ................ $ 0.65 $ 1.07 $ 0.60

Diluted earnings per common share:

Weighted-average shares outstanding - basic .......................... 331,037 322,641 337,065

Effect of dilutive shares ........................................... 940 931 1,417

Effect of conversion of preferred securities - EPPICS .................... 401 973 3,193

Weighted-average shares outstanding - diluted ......................... 332,378 324,545 341,675

Income from continuing operations .................................. $ 0.65 $ 0.78 $ 0.56

Income from discontinued operations ................................ — 0.28 0.04

Net income per share available for common shareholders ................ $ 0.65 $ 1.06 $ 0.60

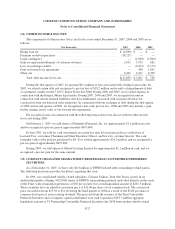

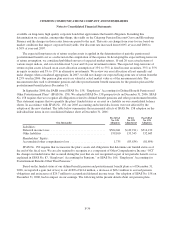

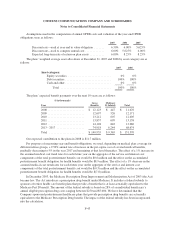

Stock Options

For the years ended December 31, 2007, 2006 and 2005, options to purchase shares of 1,804,000 (at

exercise prices ranging from $15.02 to $18.46), 1,917,000 (at exercise prices ranging from $13.45 to $18.46),

and 1,930,000 (at exercise prices ranging from $13.09 to $18.46), respectively, issuable under employee

compensation plans were excluded from the computation of diluted earnings per share (EPS) for those periods

because the exercise prices were greater than the average market price of our common stock and, therefore, the

effect would be antidilutive. In calculating diluted EPS we apply the treasury stock method and include future

unearned compensation as part of the assumed proceeds.

F-35