Frontier Communications 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

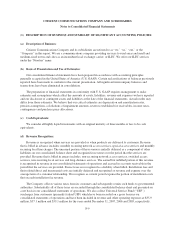

Notes to Consolidated Financial Statements

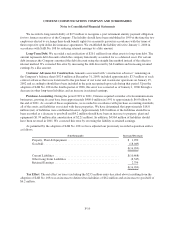

EITF No. 06-5 also states that a policyholder should determine the amount that could be realized under the life

insurance contract assuming the surrender of an individual-life by individual-life policy (or certificate by

certificate in a group policy). EITF No. 06-5 was effective for fiscal years beginning after December 15, 2006.

The adoption of the accounting requirements of EITF No. 06-5 in the first quarter of 2007 had no material impact

on our financial position, results of operation or cash flows.

Accounting for Endorsement Split-Dollar Life Insurance Arrangements

In September 2006, the FASB reached consensus on the guidance provided by EITF No. 06-4, “Accounting

for Deferred Compensation and Postretirement Benefit Aspects of Endorsement Split-Dollar Life Insurance

Arrangements.” The guidance is applicable to endorsement split-dollar life insurance arrangements, whereby the

employer owns and controls the insurance policy, that are associated with a postretirement benefit. EITF

No. 06-4 requires that for a split-dollar life insurance arrangement within the scope of the issue, an employer

should recognize a liability for future benefits in accordance with SFAS No. 106 (if, in substance, a

postretirement benefit plan exists) or Accounting Principles Board Opinion No. 12 (if the arrangement is, in

substance, an individual deferred compensation contract) based on the substantive agreement with the employee.

EITF No. 06-4 is effective for fiscal years beginning after December 15, 2007. We do not expect the adoption of

EITF No. 06-4 in the first quarter of 2008 to have a material impact on our financial position, results of

operations or cash flows.

Fair Value Measurements

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” which defines fair value,

establishes a framework for measuring fair value, and expands disclosures about fair value measurements. The

provisions of SFAS No. 157 are effective as of the beginning of our 2008 fiscal year. We do not expect the

adoption of SFAS No. 157, as amended, to have a material impact on our financial position, results of operations

or cash flows.

Fair Value Option for Financial Assets and Financial Liabilities

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities Including an amendment of FASB Statement No. 115,” which permits entities to choose to

measure many financial instruments and certain other items at fair value. The provisions of SFAS No. 159 are

effective as of the beginning of our 2008 fiscal year. We do not expect the adoption of SFAS No. 159 to have a

material impact on our financial position, results of operations or cash flows.

Accounting for Collateral Assignment Split-Dollar Life Insurance Arrangements

In March 2007, the FASB ratified the consensus reached by the EITF on Issue No. 06-10, “Accounting for

Collateral Assignment Split-Dollar Life Insurance Arrangements.” EITF No. 06-10 provides guidance on an

employers’ recognition of a liability and related compensation costs for collateral assignment split-dollar life

insurance arrangements that provide a benefit to an employee that extends into postretirement periods and the

asset in collateral assignment split-dollar life insurance arrangements. The effective date of EITF No. 06-10 is for

fiscal years beginning after December 15, 2007. We do not expect the adoption of EITF No. 06-4 in the first

quarter of 2008 to have a material impact on our financial position, results of operations or cash flows.

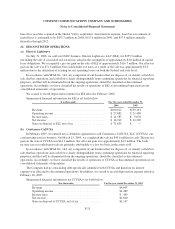

Business Combinations

In December 2007, the FASB revised SFAS Statement No. 141, “Business Combinations”. The revised

statement, SFAS No. 141R, requires an acquiring entity to recognize all the assets acquired and liabilities

assumed in a transaction at the acquisition date at fair value, to remeasure liabilities related to contingent

F-14