Frontier Communications 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(2) RECENT ACCOUNTING LITERATURE AND CHANGES IN ACCOUNTING PRINCIPLES:

New Accounting Pronouncements

Accounting for Uncertainty in Income Taxes

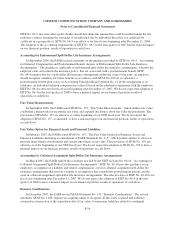

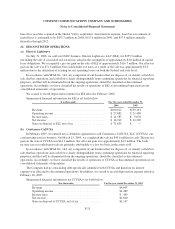

In July 2006, the FASB issued FASB Interpretation No. (FIN) 48, “Accounting for Uncertainty in Income

Taxes.” Among other things, FIN No. 48 requires applying a “more likely than not” threshold to the recognition

and derecognition of uncertain tax positions either taken or expected to be taken in the Company’s income tax

returns. We adopted the provisions of FIN No. 48 in the first quarter of 2007. The total amount of our gross FIN

No. 48 tax liability for tax positions that may not be sustained under a “more likely than not” threshold as of the

date of adoption was $44.7 million (including $10.4 million acquired from CTE) and amounts to $66.0 million as

of December 31, 2007. This amount includes an accrual for interest from the date the tax positions were taken in

the amount of $6.2 million as of December 31, 2007. These balances include amounts of $9.0 million and $1.4

million for total FIN No. 48 tax liabilities and accrued interest, respectively, resulting from positions taken by

Commonwealth Telephone Enterprises, Inc., which we acquired in March 2007. An increase of $14.8 million in

the balance since the date of adoption is attributable to a change made to the estimated useful life of an intangible

asset for income tax purposes. This tax position is temporary in nature and, therefore, will not impact the

Company’s results of operations when ultimately settled in the future. The amount of our total FIN No. 48 tax

liabilities reflected above that would positively impact the calculation of our effective income tax rate, if our tax

positions are sustained, is $21.1 million as of December 31, 2007.

The Company’s policy regarding the classification of interest and penalties is to include these amounts as a

component of income tax expense. This treatment of interest and penalties is consistent with prior periods. We

have recognized in our consolidated statement of operations for the year ended December 31, 2007, additional

interest in the amount of $1.2 million. We are subject to income tax examinations generally for the years 2003

forward for both our Federal and state filing jurisdictions. We maintain uncertain tax positions in various state

jurisdictions. It is reasonably possible that amounts related to previous asset dispositions and tax credits will

change within the next 12 months, due to the expiration of the relevant statutes of limitations. This could

favorably impact our results of operations by up to $7.0 million and reduce acquired goodwill balances by up to

$3.0 million. Amounts related to all other positions that may change within the next twelve months are not

material.

How Taxes Collected from Customers and Remitted to Governmental Authorities Should be Presented in

the Income Statement

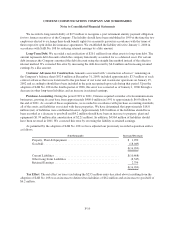

In June 2006, the FASB issued EITF Issue No. 06-3, “How Taxes Collected from Customers and Remitted

to Governmental Authorities Should be Presented in the Income Statement,” which requires disclosure of the

accounting policy for any tax assessed by a governmental authority that is directly imposed on a revenue-

producing transaction, that is Gross versus Net presentation. EITF No. 06-3 is effective for periods beginning

after December 15, 2006. We adopted the disclosure requirements of EITF No. 06-3 commencing January 1,

2007. See Note 1(d).

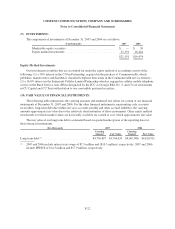

Accounting for Purchases of Life Insurance

In September 2006, the FASB reached consensus on the guidance provided by EITF No. 06-5, “Accounting

for Purchases of Life Insurance-Determining the Amount That Could Be Realized in Accordance with FASB

Technical Bulletin No. 85-4, Accounting for Purchases of Life Insurance.” EITF No. 06-5 states that a

policyholder should consider any additional amounts included in the contractual terms of the insurance policy

other than the cash surrender value in determining the amount that could be realized under the insurance contract.

F-13