Frontier Communications 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

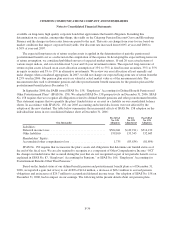

Our Federal and state tax operating loss carryforwards as of December 31, 2007 are estimated at $11.3

million and $1,563.0 million, respectively. Our Federal loss carryforward will expire in the year 2026. A portion

of our state loss carryforward begins to expire in 2008. Our alternative minimum tax credit as of December 31,

2007 can be carried forward indefinitely to reduce future regular tax liability.

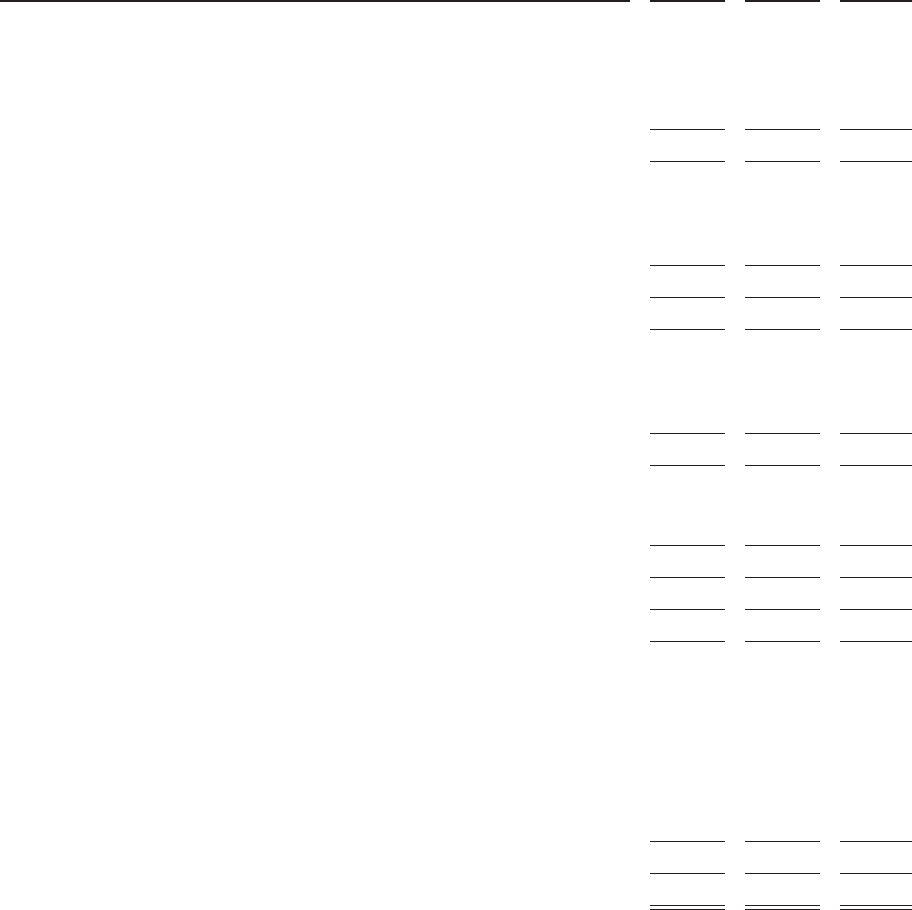

The provision (benefit) for Federal and state income taxes, as well as the taxes charged or credited to

shareholders’ equity, includes amounts both payable currently and deferred for payment in future periods as

indicated below:

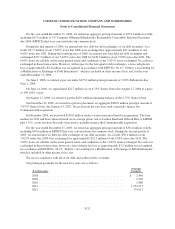

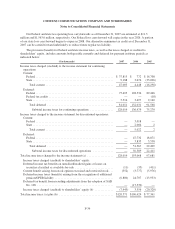

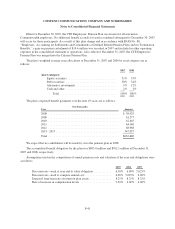

($ in thousands) 2007 2006 2005

Income taxes charged (credited) to the income statement for continuing

operations:

Current:

Federal ..................................................... $ 37,815 $ 772 $ 16,708

State ....................................................... 9,188 3,676 (33,006)

Total current .............................................. 47,003 4,448 (16,298)

Deferred:

Federal ..................................................... 75,495 128,534 89,446

Federal tax credits ............................................ — — (18)

State ....................................................... 5,516 3,497 2,140

Total deferred ............................................. 81,011 132,031 91,568

Subtotal income taxes for continuing operations ................ 128,014 136,479 75,270

Income taxes charged to the income statement for discontinued operations:

Current:

Federal ..................................................... — 3,018 —

State ....................................................... — 2,004 2

Total current .............................................. — 5,022 2

Deferred:

Federal ..................................................... — 47,732 18,871

State ....................................................... — 3,835 3,538

Total deferred ............................................. — 51,567 22,409

Subtotal income taxes for discontinued operations .............. — 56,589 22,411

Total income taxes charged to the income statement (a) .................. 128,014 193,068 97,681

Income taxes charged (credited) to shareholders’ equity:

Deferred income tax benefits on unrealized/realized gains or losses on

securities classified as available-for-sale .......................... (11) (35) (411)

Current benefit arising from stock options exercised and restricted stock . . . (552) (3,777) (5,976)

Deferred income taxes (benefits) arising from the recognition of additional

pension/OPEB liability ........................................ (6,880) 24,707 (13,933)

Deferred tax benefit from recording adjustments from the adoption of SAB

No.108 .................................................... — (17,339) —

Income taxes charged (credited) to shareholders’ equity (b) ............. (7,443) 3,556 (20,320)

Total income taxes: (a) plus (b) ..................................... $120,571 $196,624 $ 77,361

F-34