Frontier Communications 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

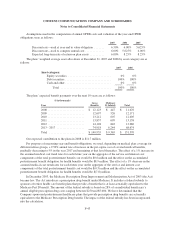

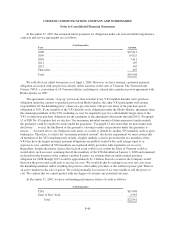

In addition, for the years ended December 31, 2007, 2006 and 2005, restricted stock awards of 1,209,000,

1,174,000 and 1,456,000 shares, respectively, are excluded from our basic weighted average shares outstanding

and included in our dilutive shares until the shares are no longer subject to restriction after the satisfaction of all

specified conditions.

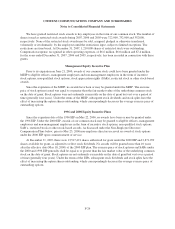

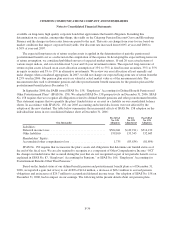

EPPICS

At December 31, 2007 and 2006, we had 80,307 and 147,079 shares, respectively, of potentially dilutive

EPPICS, which were convertible into our common stock at a 4.3615 to 1 ratio at an exercise price of $11.46 per

share. If all EPPICS that remain outstanding as of December 31, 2007 are converted, we would issue

approximately 350,259 shares of our common stock. As a result of the September 2004 special, non-recurring

dividend, the EPPICS exercise price for conversion into common stock was reduced from $13.30 to $11.46.

These securities have been included in the diluted income per common share calculation for the periods ended

December 31, 2007, 2006 and 2005.

Stock Units

At December 31, 2007, 2006 and 2005, we had 225,427, 319,423, and 206,630 stock units, respectively,

issued under the Director Plans and the Non-Employee Directors’ Retirement Plan. These securities have not

been included in the diluted income per share of common stock calculation because their inclusion would have

had an antidilutive effect.

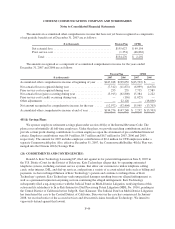

Share Repurchase Programs

In February 2007, our Board of Directors authorized us to repurchase up to $250.0 million of our common

stock in public or private transactions over the following twelve-month period. This share repurchase program

commenced on March 19, 2007. During 2007, we repurchased approximately 17.3 million shares of our common

stock at an aggregate cost of approximately $250.0 million. The repurchase program was completed on

October 15, 2007.

In February 2006, our Board of Directors authorized us to repurchase up to $300.0 million of our common

stock in public or private transactions over the following twelve-month period. This share repurchase program

commenced on March 6, 2006. During 2006, we repurchased approximately 10.2 million shares of our common

stock at an aggregate cost of approximately $135.2 million.

F-36