Frontier Communications 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

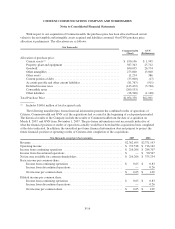

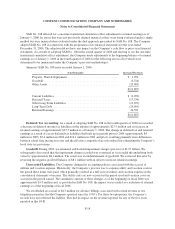

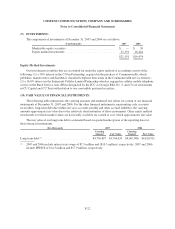

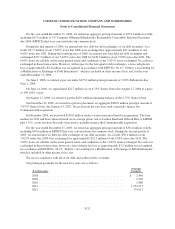

(9) INVESTMENTS:

The components of investments at December 31, 2007 and 2006 are as follows:

($ in thousands) 2007 2006

Marketable equity securities ................................. $ — $ 30

Equity method investments .................................. 21,191 16,444

$21,191 $16,474

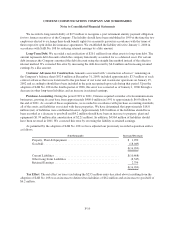

Equity Method Investments

Our investments in entities that are accounted for under the equity method of accounting consist of the

following: (1) a 50% interest in the C-Don Partnership, acquired in the purchase of Commonwealth, which

publishes, manufactures and distributes classified telephone directories in the Commonwealth service territory;

(2) a 16.8% interest in the Fairmount Cellular Limited Partnership which is engaged in cellular mobile telephone

service in the Rural Service Area (RSA) designated by the FCC as Georgia RSA No. 3; and (3) our investments

in CU Capital and CU Trust with relation to our convertible preferred securities.

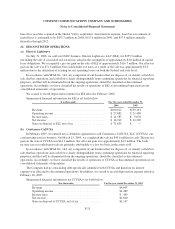

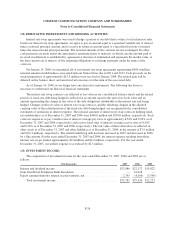

(10) FAIR VALUE OF FINANCIAL INSTRUMENTS:

The following table summarizes the carrying amounts and estimated fair values for certain of our financial

instruments at December 31, 2007 and 2006. For the other financial instruments, representing cash, accounts

receivables, long-term debt due within one year, accounts payable and other accrued liabilities, the carrying

amounts approximate fair value due to the relatively short maturities of those instruments. Other equity method

investments for which market values are not readily available are carried at cost, which approximates fair value.

The fair value of our long-term debt is estimated based on quoted market prices at the reporting date for

those financial instruments.

($ in thousands) 2007 2006

Carrying

Amount Fair Value Carrying

Amount Fair Value

Long-term debt (1) ................................ $4,736,897 $4,760,639 $4,467,086 $4,620,921

(1) 2007 and 2006 include interest rate swaps of $7.9 million and ($10.3 million), respectively. 2007 and 2006

include EPPICS of $14.5 million and $17.9 million, respectively.

F-22