Frontier Communications 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

the Trust Convertible Preferred Securities and a Company capital contribution were used to purchase $207.5

million aggregate liquidation amount of 5% Partnership Convertible Preferred Securities due 2036 from another

wholly owned consolidated subsidiary, Citizens Utilities Capital L.P. (the Partnership). The proceeds from the

issuance of the Partnership Convertible Preferred Securities and a Company capital contribution were used to

purchase from us $211.8 million aggregate principal amount of 5% Convertible Subordinated Debentures due

2036. The sole assets of the Trust are the Partnership Convertible Preferred Securities, and our Convertible

Subordinated Debentures are substantially all the assets of the Partnership. Our obligations under the agreements

relating to the issuances of such securities, taken together, constitute a full and unconditional guarantee by us of

the Trust’s obligations relating to the Trust Convertible Preferred Securities and the Partnership’s obligations

relating to the Partnership Convertible Preferred Securities.

In accordance with the terms of the issuances, we paid the annual 5% interest in quarterly installments on

the Convertible Subordinated Debentures in 2007, 2006 and 2005. Cash was paid (net of investment returns) to

the Partnership in payment of the interest on the Convertible Subordinated Debentures. The cash was then

distributed by the Partnership to the Trust and then by the Trust to the holders of the EPPICS.

As of December 31, 2007, EPPICS representing a total principal amount of $197.3 million had been

converted into 15,918,182 shares of our common stock, and a total of $4.0 million remains outstanding to third

parties. Our long-term debt footnote indicates $14.5 million of EPPICS outstanding at December 31, 2007, of

which $10.5 million is debt of related parties for which we have an offsetting receivable.

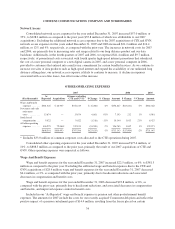

Interest Rate Management

In order to manage our interest expense, we had entered into interest rate swap agreements. Under the terms

of these agreements, we made semi-annual, floating rate interest payments based on six month LIBOR and

received a fixed rate on the notional amount. The underlying variable rate on these swaps was set either in

advance or in arrears.

The notional amounts of fixed-rate indebtedness hedged as of December 31, 2007 and 2006 were $400.0

million and $550.0 million, respectively. Such contracts required us to pay variable rates of interest (estimated

average pay rates of approximately 8.54% as of December 31, 2007, and approximately 9.02% as of

December 31, 2006) and receive fixed rates of interest (average receive rate of 8.50% as of December 31, 2007,

and 8.26% as of December 31, 2006). All swaps are accounted for under SFAS No. 133 (as amended) as fair

value hedges. For the years ended December 31, 2007 and 2006, the interest expense resulting from these interest

rate swaps totaled approximately $2.4 million and $4.2 million, respectively. For the year ended December 31,

2005, our interest expense was reduced by $2.5 million, as a result of our swaps.

On January 15, 2008, we terminated all of our interest rate swap agreements representing $400.0 million

notional amount of indebtedness associated with our Senior Notes due in 2011 and 2013. Cash proceeds on the

swap terminations of approximately $15.5 million were received in January 2008. The related gain will be

deferred on the balance sheet, and amortized into income over the term of the associated debt.

Credit Facility

As of December 31, 2007, we had available lines of credit with financial institutions in the aggregate

amount of $250.0 million and there were no outstanding standby letters of credit issued under the facility.

Associated facility fees vary, depending on our debt leverage ratio, and were 0.225% per annum as of

December 31, 2007. The expiration date for this $250.0 million five year revolving credit agreement is May 18,

2012. During the term of the credit facility we may borrow, repay and reborrow funds. The credit facility is

available for general corporate purposes but may not be used to fund dividend payments.

24