Frontier Communications 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Critical Accounting Policies and Estimates

We review all significant estimates affecting our consolidated financial statements on a recurring basis and

record the effect of any necessary adjustment prior to their publication. Uncertainties with respect to such

estimates and assumptions are inherent in the preparation of financial statements; accordingly, it is possible that

actual results could differ from those estimates and changes to estimates could occur in the near term. The

preparation of our financial statements requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of the contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenue and expenses during the reporting period. Estimates

and judgments are used when accounting for allowance for doubtful accounts, impairment of long-lived assets,

intangible assets, depreciation and amortization, pension and other postretirement benefits, income taxes,

contingencies and purchase price allocations among others.

Management has discussed the development and selection of these critical accounting estimates with the

Audit Committee of our Board of Directors and our Audit Committee has reviewed our disclosures relating to

them.

Telecommunications Bankruptcies

Our estimate of anticipated losses related to telecommunications bankruptcies is a “critical accounting

estimate.” We have significant ongoing normal course business relationships with many telecom providers, some

of which (in prior years) have filed for bankruptcy. We generally reserve approximately 95% of the net

outstanding pre-bankruptcy balances owed to us and believe that our estimate of the net realizable value of the

amounts owed to us by bankrupt entities is appropriate. In 2007 and 2006, we had no “critical estimates” related

to telecommunications bankruptcies.

Asset Impairment

In 2007 and 2006, we had no “critical estimates” related to asset impairments.

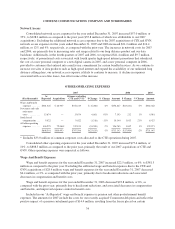

Depreciation and Amortization

The calculation of depreciation and amortization expense is based on the estimated economic useful lives of

the underlying property, plant and equipment and identifiable intangible assets. An independent study updating

the estimated remaining useful lives of our plant assets is performed annually. We adopted the lives proposed in

the study effective October 1, 2007. Our “composite depreciation rate” increased from 5.25% to 5.45% as a result

of the study. We anticipate depreciation expense of approximately $350.0 million to $370.0 million for 2008.

Intangibles

Our indefinite lived intangibles consist of goodwill and trade name, which resulted from the purchase of

ILEC properties. We test for impairment of these assets annually, or more frequently, as circumstances warrant.

All of our ILEC properties share similar economic characteristics and as a result, we aggregate our reporting

units into one ILEC segment. In determining fair value of goodwill during 2007 we compared the net book value

of the reporting units to current trading multiples of ILEC properties as well as trading values of our publicly

traded common stock. Additionally, we utilized a range of prices to gauge sensitivity. Our test determined that

fair value exceeded book value of goodwill.

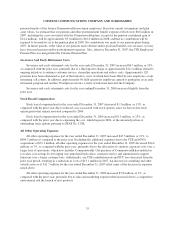

Pension and Other Postretirement Benefits

Our estimates of pension expense, other post retirement benefits including retiree medical benefits and

related liabilities are “critical accounting estimates.” We sponsor noncontributory defined benefit pension plans

covering a significant number of current and former employees and other post retirement benefit plans that

27