Frontier Communications 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

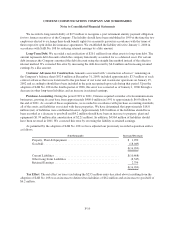

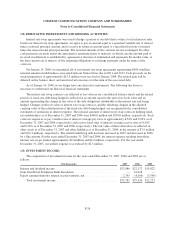

(11) LONG-TERM DEBT:

The activity in our long-term debt from December 31, 2006 to December 31, 2007 is summarized as

follows:

($ in thousands) December 31,

2006

Year Ended December 31, 2007

December 31,

2007

Interest

Rate* at

December 31,

2007Payments New

Borrowings

Assumed from

Commonwealth

Acquisition

Interest

Rate

Swap

Conversion to

Common

Stock

Rural Utilities Service

Loan Contracts $ 21,886 $ (4,331) $ — $ — $ — $ — $ 17,555 6.07%

Senior Unsecured

Debt ............ 4,435,018 (897,149) 950,000 226,779 18,198 (17,833) 4,715,013 7.96%

EPPICS (see Note

15) ............. 17,860 — — — — (3,339) 14,521 5.00%

Industrial

Development

Revenue Bonds 58,140 (44,590) — — — — 13,550 6.31%

TOTAL LONG-

TERM DEBT .... $4,532,904 $(946,070) $950,000 $226,779 $18,198 $(21,172) $4,760,639 7.94%

Less: Debt

Discount ......... (26,547) (21,294)

Less: Current

Portion .......... (39,271) (2,448)

$4,467,086 $4,736,897

* Interest rate includes amortization of debt issuance costs, debt premiums or discounts. The interest rate for Rural Utilities Service Loan

Contracts, Senior Unsecured Debt, and Industrial Development Revenue Bonds represent a weighted average of multiple issuances.

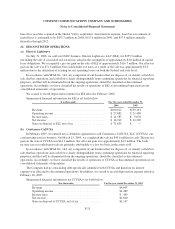

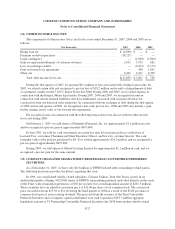

Additional information regarding our Senior Unsecured Debt at December 31:

($ in thousands)

2007 2006

Principal

Outstanding Interest

Rate Principal

Outstanding Interest

Rate

Senior Notes:

Due 8/15/2008 .......... $ — — $ 495,240 7.625%

Due 5/15/2011 .......... 1,050,000 9.250% 1,050,000 9.250%

Due 10/24/2011 ......... 200,000 6.270% 200,000 6.270%

Due 12/31/2012 ......... 148,500 6.44%(Variable) 150,000 6.75%(Variable)

Due 1/15/2013 .......... 700,000 6.250% 700,000 6.250%

Due 3/15/2015 .......... 300,000 6.625% — —

Due 3/15/2019 .......... 450,000 7.125% — —

Due 1/15/2027 .......... 400,000 7.875% 400,000 7.875%

Due 8/15/2031 .......... 945,325 9.000% 945,325 9.000%

4,193,825 3,940,565

Debentures due 2025 - 2046 . . . 468,742 7.136% 468,742 7.136%

Subsidiary Senior

Notes due 12/1/2012 ..... 36,000 8.050% 36,000 8.050%

CTE Convertible Notes due

7/23/2023 ............ 8,537 3.250% — —

Fair value of interest rate

swaps ............... 7,909 (10,289)

Total .............. $4,715,013 $4,435,018

F-23