Frontier Communications 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

For purposes of determining compensation expense, the fair value of each option grant is estimated on the

date of grant using the Black-Scholes option-pricing model which requires the use of various assumptions

including expected life of the option, expected dividend rate, expected volatility, and risk-free interest rate. The

expected life (estimated period of time outstanding) of stock options granted was estimated using the historical

exercise behavior of employees. The risk free interest rate is based on the U.S. Treasury yield curve in effect at

the time of the grant. Expected volatility is based on historical volatility for a period equal to the stock option’s

expected life, calculated on a monthly basis.

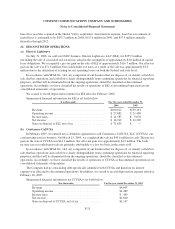

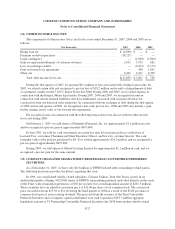

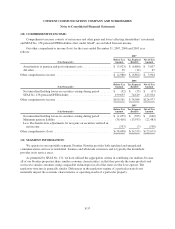

The following table presents the weighted average assumptions used for stock option grants in 2006 and

2005. No stock option grants were issued in 2007.

2006 2005

Dividend yield ............................................. 7.55% 7.72%

Expected volatility .......................................... 44% 46%

Risk-free interest rate ........................................ 4.89% 4.16%

Expected life ............................................... 5years 6 years

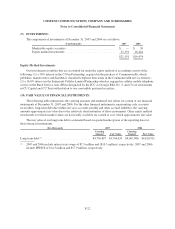

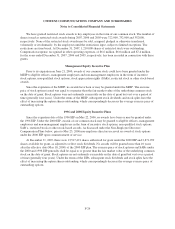

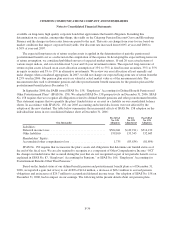

The following summary presents information regarding unvested restricted stock and changes with regard to

restricted stock under the MEIP and the EIPs:

Number of

Shares

Weighted

Average

Grant Date

Fair Value Aggregate

Fair Value

Balance at January 1, 2005 ..................................... 1,686,000 $12.29 $23,253,000

Restricted stock granted .................................... 352,000 $13.11 $ 4,305,000

Restricted stock vested .................................... (491,000) $12.27 $ 6,000,000

Restricted stock forfeited ................................... (91,000) $12.58

Balance at December 31, 2005 .................................. 1,456,000 $12.47 $17,808,000

Restricted stock granted .................................... 732,000 $12.87 $10,494,000

Restricted stock vested .................................... (642,000) $12.08 $ 9,226,000

Restricted stock forfeited ................................... (372,000) $12.60

Balance at December 31, 2006 .................................. 1,174,000 $12.89 $16,864,000

Restricted stock granted .................................... 722,000 $15.04 $ 9,187,000

Restricted stock vested .................................... (587,000) $12.94 $ 7,465,000

Restricted stock forfeited ................................... (100,000) $13.95

Balance at December 31, 2007 .................................. 1,209,000 $14.06 $15,390,000

For purposes of determining compensation expense, the fair value of each restricted stock grant is estimated

based on the average of the high and low market price of a share of our common stock on the date of grant. Total

remaining unrecognized compensation cost associated with unvested restricted stock awards at December 31,

2007 was $12.7 million and the weighted average period over which this cost is expected to be recognized is

approximately two to three years.

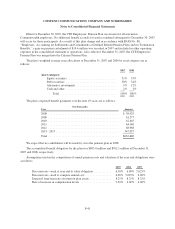

Non-Employee Directors’ Compensation Plans

Upon commencement of his or her service on the Board of Directors, each non-employee director receives a

grant of 10,000 stock options. These options are currently awarded under the Directors’ Equity Plan. Prior to

effectiveness of the Directors’ Equity Plan on May 25, 2006, these options were awarded under the 2000 EIP.

The exercise price of these options, which become exercisable six months after the grant date, is the fair market

F-31