Frontier Communications 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

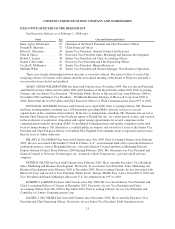

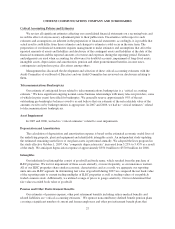

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

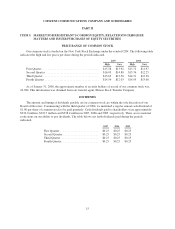

ITEM 6. SELECTED FINANCIAL DATA

The following tables present selected historical consolidated financial information of Citizens for the

periods indicated. The selected historical consolidated financial information of Citizens as of and for each of the

five fiscal years in the period ended December 31, 2007 has been derived from Citizens’ historical consolidated

financial statements. The selected historical consolidated financial information as of December 31, 2007 and

2006 and for the three years ended December 31, 2007 is derived from the audited historical consolidated

financial statements of Citizens included elsewhere in this Form 10-K. The selected historical consolidated

financial information as of December 31, 2004 and for the years ended December 31, 2004 and 2003 is derived

from the audited historical consolidated financial statements of Citizens not included in this Form 10-K. The

selected historical consolidated financial information as of December 31, 2003 is derived from the unaudited

historical consolidated financial statements of Citizens not included in this Form 10-K and has been recast to be

comparable to the audited historical consolidated financial statements.

($ in thousands, except per share amounts)

Year Ended December 31,

2007 2006 2005 2004 2003

Revenue (1) ........................... $2,288,015 $2,025,367 $2,017,041 $2,022,378 $2,268,561

Income from continuing operations before

cumulative effect of change in accounting

principle (2) ......................... $ 214,654 $ 254,008 $ 187,942 $ 57,064 $ 71,879

Net income .......................... $ 214,654 $ 344,555 $ 202,375 $ 72,150 $ 187,852

Basic income per share of common stock

from continuing operations before

cumulative effect of change in accounting

principle (2) ......................... $ 0.65 $ 0.79 $ 0.56 $ 0.19 $ 0.26

Earnings available for common shareholders

per basic share ...................... $ 0.65 $ 1.07 $ 0.60 $ 0.24 $ 0.67

Earnings available for common shareholders

per diluted share .................... $ 0.65 $ 1.06 $ 0.60 $ 0.23 $ 0.64

Cash dividends declared (and paid) per

common share ...................... $ 1.00 $ 1.00 $ 1.00 $ 2.50 $ —

As of December 31,

2007 2006 2005 2004 2003

Total assets .......................... $7,256,069 $6,797,536 $6,427,567 $6,679,899 $7,457,939

Long-term debt ....................... $4,736,897 $4,467,086 $3,995,130 $4,262,658 $4,179,590

Equity units (3) ........................ $ — $ — $ — $ — $ 460,000

Company Obligated Mandatorily

Redeemable

Convertible Preferred Securities (4) ........ $ — $ — $ — $ — $ 201,250

Shareholders’ equity ................... $ 997,899 $1,058,032 $1,041,809 $1,362,240 $1,415,183

(1) Operating results include activities from our Vermont Electric segment for three months of 2004 and the

year ended 2003, and for Commonwealth from the date of its acquisition on March 8, 2007 and for GVN

from the date of its acquisition on October 31, 2007.

(2) The cumulative effect of change in accounting principles represents the $65.8 million after tax non-cash

gain resulting from the adoption of Statement of Financial Accounting Standards No. 143 in 2003.

(3) On August 17, 2004, we issued common stock to equity unit holders in settlement of the equity purchase

contract.

(4) The consolidation of this item changed effective January 1, 2004, as a result of the adoption of FIN

No. 46R, “Consolidation of Variable Interest Entities.”

18