Frontier Airlines 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

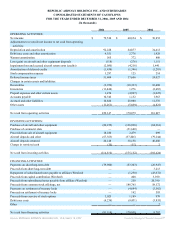

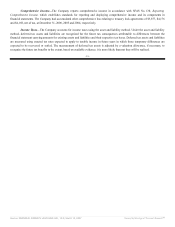

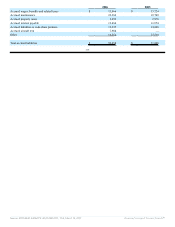

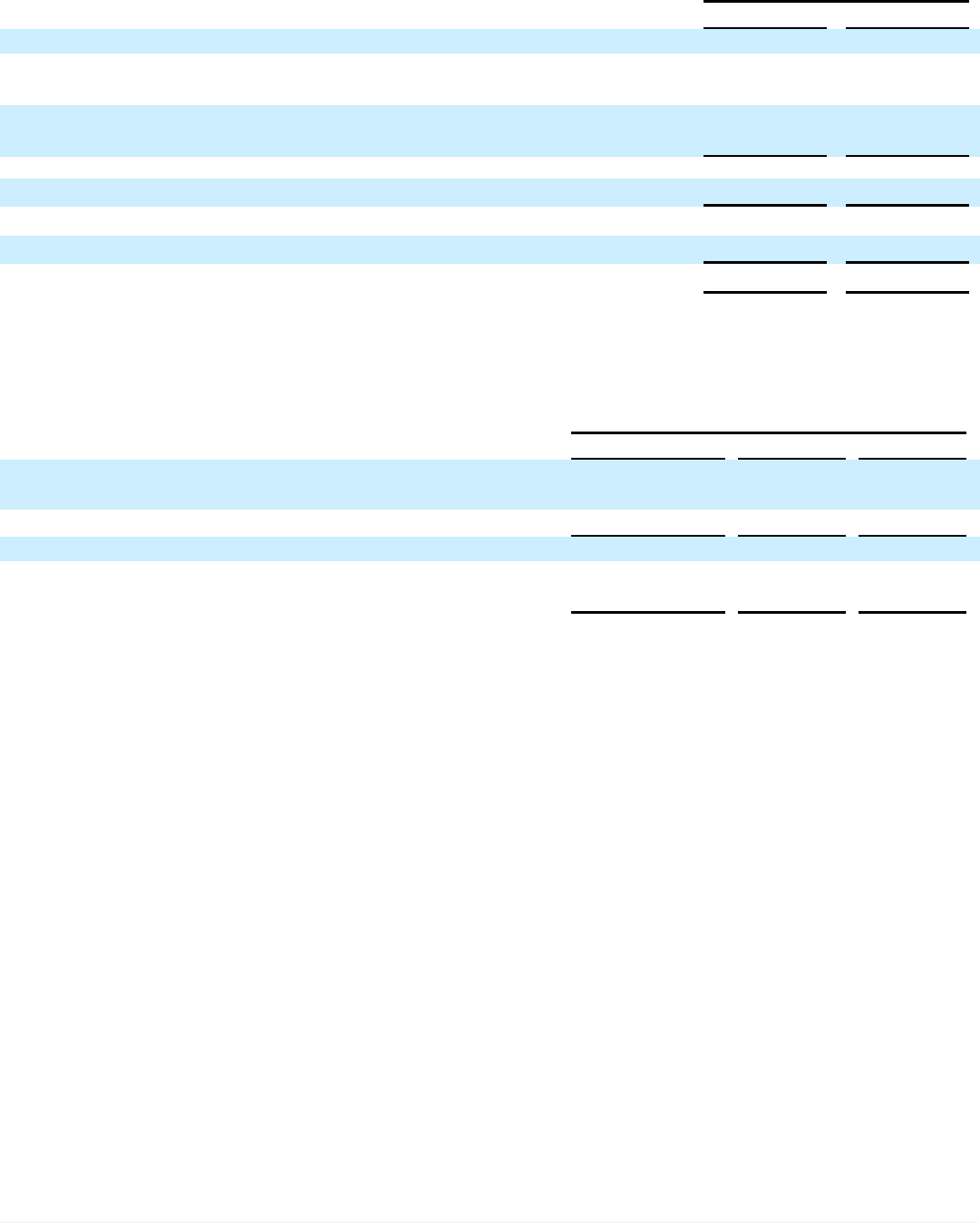

The following table illustrates the effect on net income and earnings per share if the Company had applied the fair value

recognition provisions of SFAS 123(R) to stock-based employee compensation for the years ended December 2005 and 2004.

For the years ended December 31,

2005 2004

Net income, as reported $ 60,654 $ 38,852

Add: Stock-based employee compensation expense determined under the intrinsic value

based method, net of tax of $50 and $85, respectively 75 129

Deduct: Stock-based employee compensation expense determined under the fair value

based method, net of tax of $997 and $218, respectively (1,496) (327)

Pro forma net income $ 59,233 $ 38,654

Pro forma net income per share:

Basic $ 1.65 $ 1.66

Diluted $ 1.62 $ 1.62

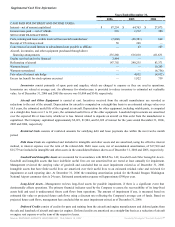

Net Income per Common Share is based on the weighted average number of shares outstanding during the period.

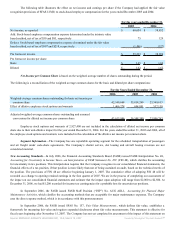

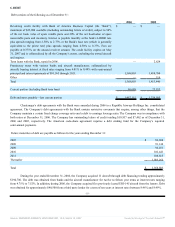

The following is a reconciliation of the weighted average common shares for the basic and diluted per share computations:

For the Years Ended December 31,

2006 2005 2004

Weighted-average common shares outstanding for basic net income per

common share 42,149,668 35,854,249 23,349,613

Effect of dilutive employee stock options and warrants 1,466,278 694,091 557,150

Adjusted weighted-average common shares outstanding and assumed

conversions for diluted net income per common share 43,615,946 36,548,340 23,906,763

Employee stock options and warrants of 2,927,400 are not included in the calculation of diluted net income per common

share due to their anti-dilutive impact for the year ended December 31, 2004. For the years ended December 31, 2005 and 2006, all of

the employee stock options and warrants were included in the calculation of the dilutive net income per common share.

Segment Information—The Company has one reportable operating segment for the scheduled transportation of passengers

and air freight under code-share agreements. The Company’s charter service, slot leasing and aircraft leasing revenues are not

considered material.

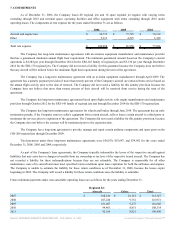

New Accounting Standards—In July 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48,

Accounting for Uncertainty in Income Taxes—an Interpretation of FASB Statement No. 109 (FIN 48), which clarifies the accounting

for uncertainty in tax positions. This Interpretation requires that the Company recognize in our consolidated financial statements, the

financial effects of a tax position, if that position is more likely than not of being sustained on audit, based on the technical merits of

the position. The provisions of FIN 48 are effective beginning January 1, 2007. The cumulative effect of adopting FIN 48 will be

recorded as a change to opening retained earnings in the first quarter of 2007. We are in the process of completing our assessment of

the impact on our consolidated financial statements and estimate that the impact upon adoption will range from $2,000 to $2,500. At

December 31, 2006, we had $1,200 recorded for income tax contingencies for a probable loss for uncertain tax positions.

In September 2006, the FASB issued FASB Staff Position (“FSP”) No. AUG AIR-1, Accounting for Planned Major

Maintenance Activities, which clarifies the accounting methods that are acceptable for major maintenance expenses. The Company

uses the direct expense method, which is in accordance with this pronouncement.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements , which defines fair value, establishes a

framework for measuring fair value and requires expanded disclosures about fair value measurements. This statement is effective for

fiscal years beginning after November 15, 2007. The Company has not yet completed its assessment of the impact of this statement on

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, March 15, 2007 Powered by Morningstar® Document Research℠