Frontier Airlines 2006 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2006 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Committee may require that any or all such certificates be held in custody by the Company until the applicable restriction have lapsed.

6. Lapse of Restrictions. If, as and when Shares become vested, and subject to the satisfaction of applicable withholding and

other legal requirements, the vested Shares will no longer be subject to the transfer restrictions contained in this Agreement and the

Company’s books will be updated accordingly. All the legends shall be removed from the stock certificates of the shares of Common

Stock covered by the Shares at the time of delivery except as otherwise required by applicable law.

7. Adjustments Upon Changes in Capitalization. Upon a Change in Capitalization (as defined in the Plan), an equitable

substitution or adjustment may be made in the kind and/or number of Shares subject to the restricted stock award as may be

determined by the Committee, in its sole discretion. Any fractional share resulting from such adjustment shall be disregarded, and

such Shares shall cover only the number of full shares resulting from the adjustment.

8. Tax Withholding. By executing this Agreement, the Executive authorizes the Company to deduct from any compensation

or any other payment of any kind (including withholding the issuance of Shares) due to the Executive the amount of any federal, state,

local or foreign taxes required by law to be withheld as a result of the grant or vesting of the Shares in whole or in part; provided,

however, that the value of the Shares and/or cash withheld may not exceed the statutory minimum withholding amount required by

law. In lieu of such deduction, the Company may condition the issuance of a certificate or other evidence of ownership for vested

Shares upon the Executive’s payment of cash to the Company or making other arrangements satisfactory to the Committee for the

payment of such withholding obligation.

9. No Employment or other Service Rights. Nothing contained in this Agreement shall confer upon the Executive any right

with respect to the continuation of the Executive’s employment or other service with the Company Group, or interfere in any way with

the right of the Company Group to terminate such employment or other service or to increase or decrease, or otherwise adjust, the

other terms and conditions of the Executive’s employment or other service with the Company Group.

10. Provisions of the Plan Control. This Agreement is subject to all the terms, conditions and provisions of the Plan and to

such rules, regulations and interpretations as may be established or made by the Committee acting within the scope of its authority and

responsibility under the Plan. The Executive acknowledges receipt of a copy of the Plan prior to execution of this Agreement. The

applicable provisions of the Plan shall govern in any situation where this Agreement is silent or where the applicable provisions of this

Agreement are contrary to or not reconcilable with such Plan provisions.

11. Compliance with Law. The issuance and delivery of Shares under the Plan shall comply with all relevant provisions of

law, including, without limitation, the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the

requirements of any stock exchange or market upon which the Common Stock may then be listed, and shall be further subject to the

approval of counsel for the Company with respect to such compliance. The Committee may require each person acquiring shares of

Common Stock to represent to and agree with the Company in writing that such person is acquiring the shares without a view to

distribution thereof. All certificates for shares of Common Stock delivered hereunder shall be subject to such stop-transfer orders and

other restrictions as the Committee may deem advisable under the rules, regulations, and other requirements of the Securities and

Exchange Commission, any stock exchange or market upon which the Common Stock may then be listed, and any applicable federal

or state securities law. The Committee may cause a legend or legends to be placed on any such certificates to make appropriate

reference to such restrictions.

12. Miscellaneous. This Agreement shall be governed by and construed in accordance with the laws of the State of

Delaware, without regard to its principles of conflict of laws. This Agreement constitutes the entire agreement between the parties

with respect to the subject matter hereof and may not be amended, except as provided in the Plan, other than by a written instrument

executed by the parties hereto.

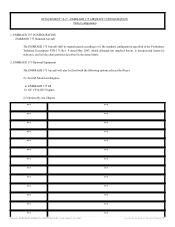

IN WITNESS WHEREOF, this Agreement has been executed as of the date first above written.

REPUBLIC AIRWAYS HOLDINGS INC.

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, March 15, 2007 Powered by Morningstar® Document Research℠