Frontier Airlines 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

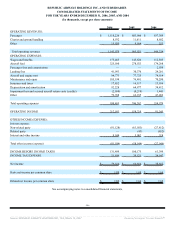

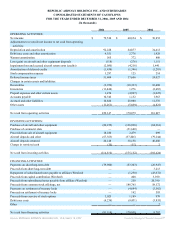

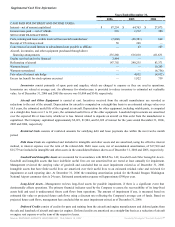

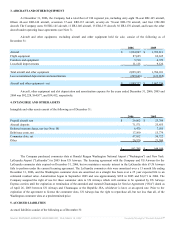

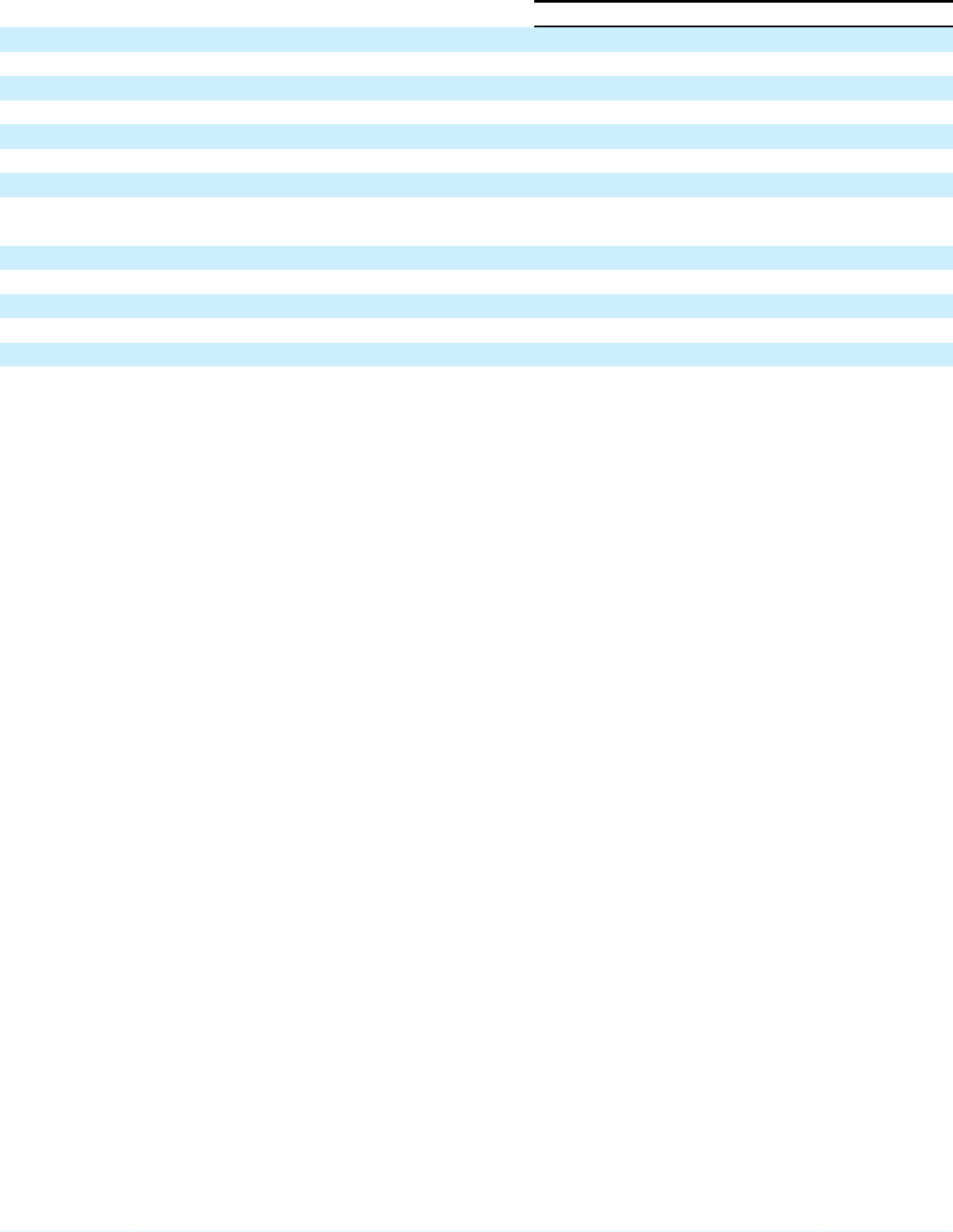

Supplemental Cash Flow Information:

Years Ended December 31,

2006 2005 2004

CASH PAID FOR INTEREST AND INCOME TAXES:

Interest—net of amount capitalized $ 87,254 $ 64,763 $ 27,073

Income taxes paid — net of refunds 518 1,212 380

NON-CASH TRANSACTIONS:

Parts, training and lease credits received from aircraft manufacturer (7,860) (26,381) 662

Receipt of US Airways stock 50 248 —

Conversion of accrued interest to subordinated note payable to affiliate — 43 107

Aircraft, inventories, and other equipment purchased through direct

financing arrangements 235,260 616,010 411,631

Engine received and to be financed 3,464 — —

Refinancing of aircraft 147,792 240,235 83,371

Warrants issued — — 10,263

Warrants surrendered — — (6,756)

Fair value of interest rate hedge — 4,012 (4,012)

Excess tax benefit for stock options exercised — 1,922 739

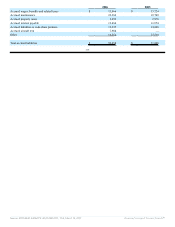

Inventories consist primarily of spare parts and supplies, which are charged to expense as they are used in operations.

Inventories are valued at average cost. An allowance for obsolescence is provided to reduce inventory to estimated net realizable

value. As of December 31, 2006 and 2005 this reserve was $1,004 and $340, respectively.

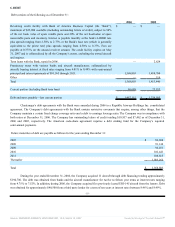

Aircraft and Other Equipment is carried at cost. Incentives received from the aircraft manufacturer are recorded as

reductions to the cost of the aircraft. Depreciation for aircraft is computed on a straight-line basis to an estimated salvage value over

16.5 years, the estimated useful life of the regional jet aircraft. Depreciation for other equipment, including rotable parts, is computed

on a straight-line basis over 3 to 10 years, the estimated useful lives of the other equipment. Leasehold improvements are amortized

over the expected life or lease term, whichever is less. Interest related to deposits on aircraft on firm order from the manufacturer is

capitalized. The Company capitalized approximately $2,021, $1,904, and $1,692 of interest for the years ended December 31, 2006,

2005 and 2004, respectively.

Restricted Cash consists of restricted amounts for satisfying debt and lease payments due within the next twelve month

period.

Debt Issue Costs are capitalized and included in intangible and other assets and are amortized, using the effective interest

method, to interest expense over the term of the related debt. Debt issue costs, net of accumulated amortization, of $17,560 and

$15,779 are included in intangible and other assets in the consolidated balance sheets as of December 31, 2006 and 2005, respectively.

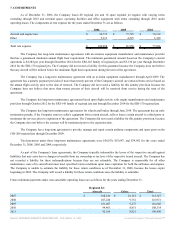

Goodwill and Intangible Assets are accounted for in accordance with SFAS No. 142, Goodwill and Other Intangible Assets.

Goodwill and intangible assets that have indefinite useful lives are not amortized but are tested at least annually for impairment.

Management reviewed the carrying value of goodwill and concluded that no asset impairment existed as of December 31, 2006.

Intangible assets that have finite useful lives are amortized over their useful lives to an estimated residual value and reviewed for

impairment at each reporting date. At December 31, 2006 the remaining amortization period for the Ronald Reagan Washington

National Airport commuter slots is 24 years. Estimated amortization expense will approximate $390 per year.

Long-Lived Assets—Management reviews long-lived assets for possible impairment, if there is a significant event that

detrimentally affects operations. The primary financial indicator used by the Company to assess the recoverability of its long-lived

assets held and used is undiscounted future cash flows from operations. The amount of impairment if any, is measured based on

estimated fair value or projected future cash flows using a discount rate reflecting the Company's average cost of funds. Based on

projected future cash flows, management has concluded that no asset impairment existed as of December 31, 2006.

Deferred Credits consist of credits for parts and training from the aircraft and engine manufacturers and deferred gains from

the sale and leaseback of aircraft and spare jet engines. Deferred credits are amortized on a straight-line basis as a reduction of aircraft

or engine rent expense over the term of the respective leases.

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, March 15, 2007 Powered by Morningstar® Document Research℠