Frontier Airlines 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

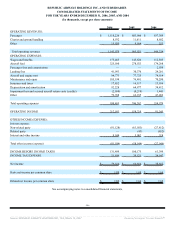

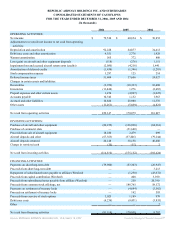

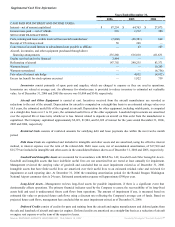

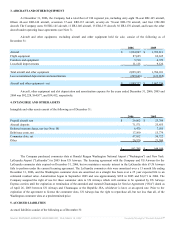

The following sets forth code-share partners’ passenger revenue and accounts receivable as a percentage of total passenger

revenue and net receivables:

Passenger revenues for the years ended: Delta United

US

Airways American

December 31, 2006 35% 30% 24% 11%

December 31, 2005 34 32 21 13

December 31, 2004 36 10 38 16

Receivables as of:

December 31, 2006 4 19 31 16

December 31, 2005 9 32 13 17

For the years ended December 31, 2006, 2005 and 2004, substantially all of the Company's revenue is derived from

agreements with its code-share partners. Termination of any of these code-share agreements could have a material adverse effect on

the Company's financial position, results of operations and cash flows.

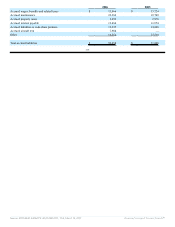

On September 12, 2004, US Airways filed a petition for Chapter 11 bankruptcy protection. Unpaid amounts related to

pre-petition claims were approximately $3,200, which were written off as of September 30, 2005. We have been paid for all amounts

due post-petition in accordance with our code-share agreement. In October 2005, US Airways emerged from bankruptcy, and we

received 13,272 shares of US Airways common stock for our pre-petition claims during 2005 and 2006. During 2006, we sold 12,338

shares for a gain of $588. The value of the remaining 934 shares at December 31, 2006 was $50.

Delta is attempting to reorganize its respective businesses under Chapter 11 of the bankruptcy code. Delta has begun to

utilize our smaller aircraft at less than historical levels, and contingency plans are being developed to address potential outcomes of

the Delta bankruptcy proceedings. On March 13, 2007, we and Delta amended out code-share agreements. The amendments, if

approved, provide for early removal of all 15 ERJ-135 aircraft between September 2008 and April 2009 at a rate of 2 aircraft per

month, and an approximate 3% reduction in the reimbursement rates on the Company's ERJ-145/170 aircraft for the remaining term of

the agreements. In return for these amended terms, Delta has agreed that we will have a negotiated pre-petition claim in the amount of

$91 million, and Delta, will surrender all of its warrants on approximately 3.4 million shares of the Company's common stock.

In July 2006, the Company entered into a code-share agreement with Continental Airlines, Inc. (‘Continental”). The

Company began flying for Continental in January 2007. (See Note 7.)

On January 11, 2007, we entered into an air services agreement with Frontier. Under the agreement, we will provide and

operate seventeen 76-seat Embraer 170 regional jets for Frontier beginning in March 2007.

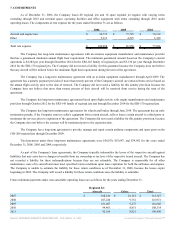

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Consolidation—The consolidated financial statements include the accounts of the Company and its wholly-owned

subsidiaries, Chautauqua, Shuttle America and Republic Airline. All significant intercompany accounts and transactions are

eliminated in consolidation.

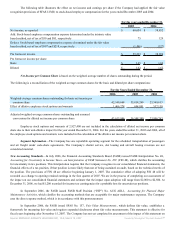

Risk Management—The Company accounts for derivatives in accordance with Statement of Financial Accounting Standard

(SFAS) No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended and interpreted.

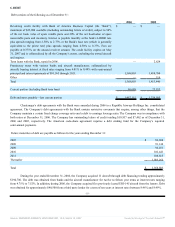

Beginning in April 2004, in anticipation of financing the purchase of regional jet aircraft on firm order with the manufacturer,

the Company entered into fourteen treasury lock agreements with notional amounts totaling $373,500 and a weighted average interest

rate of 4.47% with expiration dates through June 2005. Management designated the treasury lock agreements as cash flow hedges of

forecasted transactions. The treasury lock agreements were settled at each respective settlement date, which were the purchase dates of

the respective aircraft. The Company settled all of the agreements during 2004 and 2005 and the net amount paid was $7,472, and was

recorded in accumulated other comprehensive loss, net of tax. Amounts paid or received on the settlement date are reclassified to

interest expense over the term of the respective aircraft debt. During 2004, 2005 and 2006, the Company reclassified $21, $286 and

$299 to interest expense, respectively. The Company expects to reclassify $867 to interest expense for the year ending December 31,

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, March 15, 2007 Powered by Morningstar® Document Research℠