Frontier Airlines 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Delta, which represented 35% of our passenger revenues for the year ended December 31, 2006, is attempting to reorganize

its respective businesses under Chapter 11 of the bankruptcy code. In 2006, Delta utilized our smaller aircraft at less than historical

levels. On March 13, 2007, we and Delta amended out code-share agreements. The amendments, if approved, provide for early

removal of all 15 ERJ-135 aircraft between September 2008 and April 2009 at a rate of 2 aircraft per month, and an approximate 3%

reduction in the reimbursement rates on the Company's ERJ-145/170 aircraft for the remaining term of the agreements. In return for

these amended terms, Delta has agreed that we will have a negotiated pre-petition claim in the amount of $91 million, and Delta will

surrender all of its warrants on approximately 3.4 million shares of the Company's common stock.

We currently anticipate that our available cash resources, cash generated from operations and anticipated third party funding

arrangements will be sufficient to meet our anticipated working capital and capital expenditure requirements for at least the next 12

months.

Aircraft Leases and Other Off-Balance Sheet Arrangements

We have significant obligations for aircraft and engines that are classified as operating leases and, therefore, are not reflected

as liabilities on our balance sheet. Aircraft leases expire between 2009 and 2022. As of December 31, 2006, our total mandatory

payments under operating leases for aircraft aggregated approximately $1.1 billion and total minimum annual aircraft rental payments

for the next 12 months under all non-cancelable operating leases is approximately $108.2 million. Other non-cancelable operating

leases consist of engines, terminal space, operating facilities, office space and office equipment. The leases expire through 2016. As of

December 31, 2006, our total mandatory payments under other non-cancelable operating leases aggregated approximately

$104.3 million. Total minimum annual other rental payments for the next 12 months are approximately $10.1 million.

Purchase Commitments

The Company has reached an agreement with US Airways to acquire and operate thirty 86 seat ERJ-175 regional jets. As of

December 31, 2006, the Company had firm orders to purchase 38 ERJ-170/175 regional jets. The current total list price of the 38

regional jets is $1.1 billion. During the year ended December 31, 2006, the Company made aircraft deposits in accordance with the

aircraft commitments of $67.6 million. The Company also has a commitment to acquire seven spare aircraft engines with a current list

price of approximately $30.5 million. These commitments are subject to customary closing conditions.

In July 2006, the Company announced that it had reached an agreement to operate forty-four 50-seat regional jets for

Continental. Twenty of the aircraft are ERJ-145 regional jets that will transition from the Company’s US Airways operations. The

Company has firm commitments to lease 24 CRJ-200 regional jets with lease terms from 24 to 36 months. As of December 31, 2006,

the Company had taken delivery of 4 CRJ-200 regional jets. All 44 of the aircraft are expected to be placed into service for

Continental between January and August 2007 and will be operated for terms that vary from two years to five years. Under certain

conditions Continental may extend the term on the aircraft up to five additional years.

In January 2007, the Company and Frontier entered into an agreement, whereby, Republic will operate for Frontier

seventeen, 76-seat Embraer 170 regional jets. Four of the seventeen aircraft are currently in the Republic fleet but not allocated to a

code-share partner and the remaining 13 aircraft will be funded by delivery positions available from Embraer.

We expect to fund future capital commitments through internally generated funds, third-party aircraft financings, and debt

and other financings.

We currently anticipate that our available cash resources, cash generated from operations and anticipated third-party

financing arrangements will be sufficient to meet our anticipated working capital and capital expenditure requirements for at least the

next 12 months. We may need to raise additional funds, however, to fund more rapid expansion, principally the acquisition of

additional aircraft, or meet unanticipated working capital requirements. It is possible that future funding may not be available to us on

favorable terms, or at all.

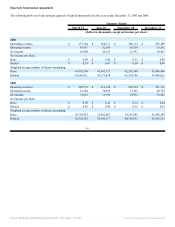

Our contractual obligations and commitments at December 31, 2006, include the following (in thousands):

Payments Due By Period

Less than 1-3 years 4-5 years Over Total

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, March 15, 2007 Powered by Morningstar® Document Research℠