EasyJet 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Business review Governance Accounts Other information

easyJet plc

Annual report and accounts 2010

83

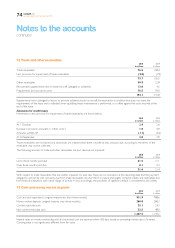

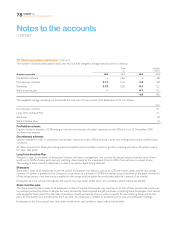

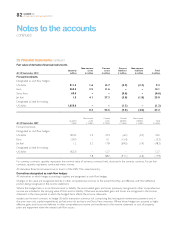

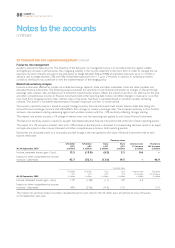

The cumulative net gains / (losses) deferred in shareholders’ equity and their expected maturities are as follows:

At 30 September 2010

Within 1 year

£ million

1–2 years

£ million

Total

£ million

Hedges of transaction currency risk 20.4 1.8 22.2

Hedges of jet fuel price risk 23.5 2.3 25.8

43.9 4.1 48.0

Related deferred tax (13.2)

Net gains 34.8

At 30 September 2009

Within 1 year

£ million

1–2 years

£ million

Total

£ million

Hedges of transaction currency risk 13.4 1.8 15.2

Hedges of jet fuel price risk (53.1) 4.7 (48.4)

(39.7) 6.5 (33.2)

Related deferred tax 9.3

Net losses (23.9)

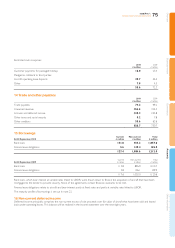

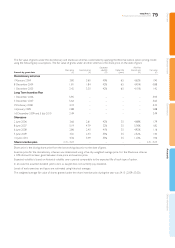

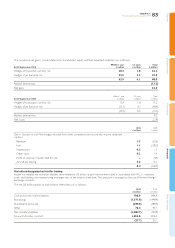

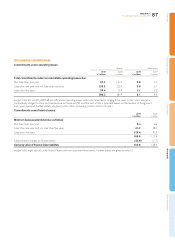

2010

£ million

2009

£ million

Gains / (losses) on cash flow hedges recycled from other comprehensive income into income statement

captions:

Revenue 1.3 (30.5)

Fuel 1.1 (209.3)

Maintenance 0.5 1.3

Other costs 0.3 1.4

Profit on disposal of assets held for sale – (4.4)

Aircraft dry leasing 5.2 13.2

8.4 (228.3)

Derivatives designated as held for trading

easyJet has material net monetary liabilities denominated in US dollars at each balance sheet date. In accordance with IAS 21, monetary

assets and liabilities are revalued using exchange rates at the balance sheet date. This exposure is managed by the use of forward foreign

exchange contracts.

The net US dollar position at each balance sheet date was as follows:

2010

$ million

2009

$ million

Cash and money market deposits 708.9 896.4

Borrowings (1,571.0) (1,498.9)

Maintenance provisions (299.0) (289.5)

Other 78.4 97.1

Net monetary liabilities (1,082.7) (794.9)

Forward US dollar contracts 1,055.0 825.0

(27.7) 30.1