EasyJet 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

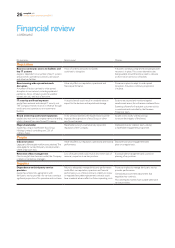

Summary consolidated statement

of financial position 30 September

2010

£ million

30 September

2009

£ million Change

£ million

Goodwill 365.4 365.4 –

Property, plant and equipment 1,928.1 1,612.2 315.9

Net working capital (589.8) (503.9) (85.9)

Restricted cash 55.6 72.3 (16.7)

Current and deferred taxation (175.4) (134.0) (41.4)

Net debt (40.1) (45.7) 5.6

Other non-current assets and

liabilities (43.1) (59.0) 15.9

Net assets 1,500.7 1,307.3 193.4

Opening shareholders’ equity 1,307.3 1,278.2 29.1

Prot in year 121.3 71.2 50.1

Change in hedging reserve 58.7 (51.5) 110. 2

Other movements 13.4 9.4 4.0

1,500.7 1,307.3 193.4

Net assets increased by £193.4 million over the year, driven by the prot

for the year and an increase of £58.7 million in the hedging reserve as

high cost jet swaps matured, offset in part by the US dollar strengthening

against sterling.

The net book value of property, plant and equipment increased by

£315.9 million, driven principally by the addition of a net 21 owned A320

family aircraft.

Net working capital improved by £85.9 million to a net negative

£589.8million. As easyJet’s passengers pay for their ights at the time

ofbooking, the key component of this balance is unearned revenue of

£356.5 million; an increase of £32.2 million during the year driven by

increased bookings and improvements in yield. A further benet was

derived from renegotiating contract terms with key card acquirers,

contributing to a reduction in trade receivables of £81.9 million.

Restricted cash principally relates to operating lease deposits and

customer payments for holidays and decreased by £16.7 million to

£55.6million. This reduction was driven by the implementation of

insurance arrangements to meet our obligations under the Package

Holiday Regulations and reductions in operating lease deposits as we

continued to return the Boeing 737 eet to lessors.

Current and deferred taxation liabilities increased by £41.4 million to

£175.4 million, driven by higher protability and deferred taxation on the

gains recognised on derivatives accounted for as cash ow hedges.

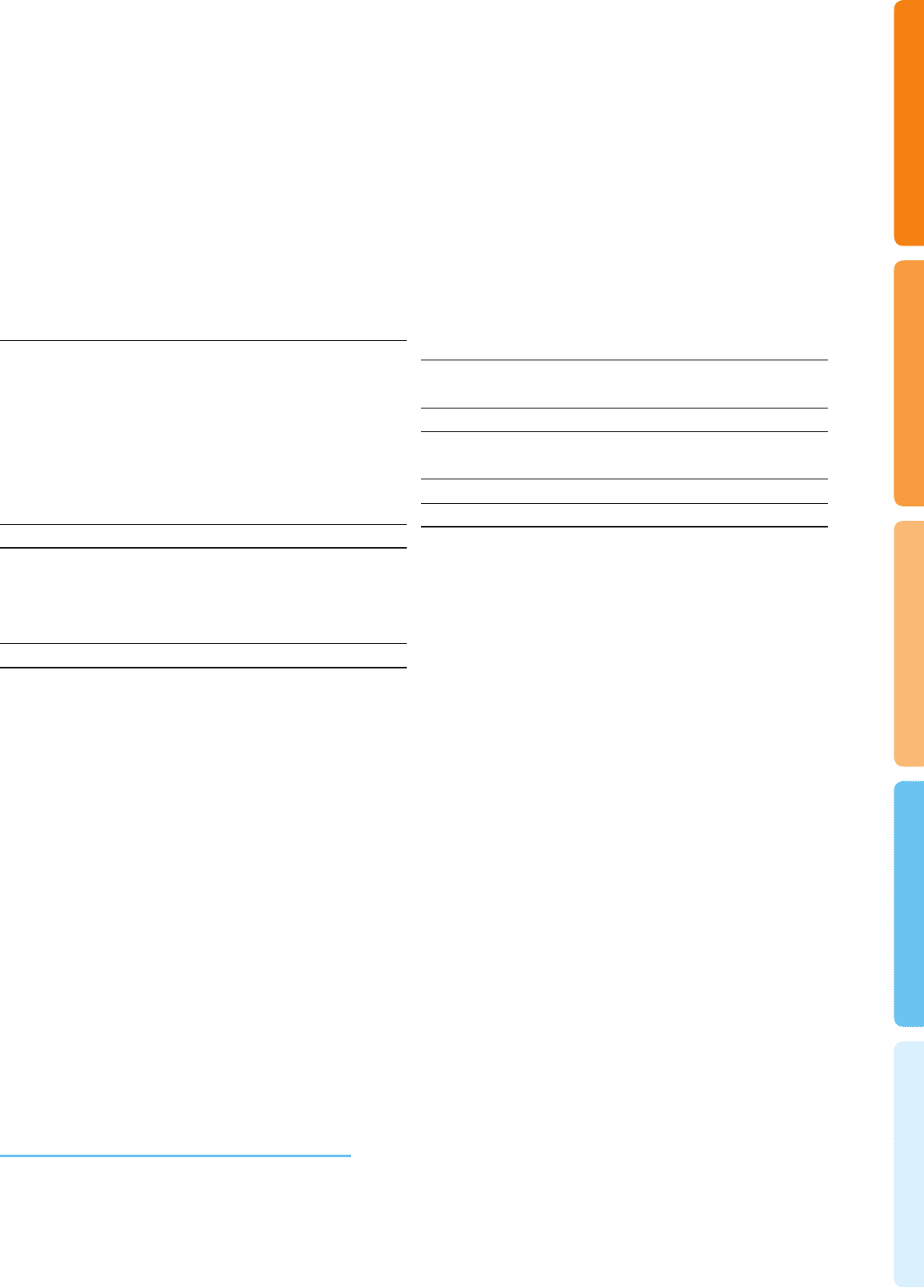

30 September

2010

£ million

30 September

2009

£ million Change

£ million

Cash and cash equivalents 911.9 788.6 123.3

Money market deposits 260.0 286.3 (26.3)

1,171.9 1,074.9 97.0

Bank loans (1,057.0) (1,010.7) (46.3)

Finance lease obligations (155.0) (109.9) (45.1)

(1,212.0) (1,120.6) (91.4)

Net debt (40.1) (45.7) 5.6

easyJet ends the period with £1,171.9 million in cash and money market

deposits; an increase of £97.0 million compared with 30 September

2009. Net borrowings increased by £91.4 million in the period.

Themajority of mortgage and nance lease debt and all money market

deposits are denominated in US dollars and the sterling value of this net

liability increased by £9.1 million during the year as a consequence of the

strengthening of the US dollar against sterling.

Net debt at 30 September 2010 was £40.1 million compared with

£45.7million at 30 September 2009. Strong operating cash ow and the

increase in net assets delivered a reduction in gearing of six percentage

points to 32% at 30 September 2010.

Going concern

In adopting the going concern basis for preparing the accounts, the

Directors have considered the business activities as set out on pages

8to13 as well as easyJet’s principal risks and uncertainties as set out on

pages 25 to 27. Based on easyJet’s cash ow forecasts and projections,

theBoard is satised that easyJet will be able to operate within the

levelof its facilities and available cash for the foreseeable future. For this

reason, easyJet continues to adopt the going concern basis in preparing

its accounts.

Committed financing facilities

We had $754 million of financing committed as at 30September 2010.

$754m

Overview Business review Governance Accounts Other information

23

easyJet plc

Annual report and accounts 2010