EasyJet 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chief Executive’s statement

continued

Leverage scale and the recession to deliver

procurement efciencies

The renegotiation of our maintenance contract with SR Technics will

drive savings of around £17 million per annum. We have also maintained

our approach of leveraging our scale and buying power to challenge

airports on the charges they levy.

Efcient eet management

easyJet continues to make good progress towards its goal of operating

a common aircraft eet. Eliminating the Boeing and ex-GB Airways

sub-eets will take cost out of the business and simplify our operations.

The intention is to exit all aircraft in the two sub-eets by 2012 to

complete the realisation of ownership cost savings of around £30 million

per annum. Nine Boeing 737s and three ex-GB Airways A320s were

returned to lessors in the year. The remaining four ex-GB Airways

A321s exited the eet in November 2010.

We have benchmarked easyJet cost categories against other low

cost carriers and identied further efciencies. We have named this

programme easyJet Lean and the £190 million cost savings programme

will be folded up into this initiative. One of our cost saving plans we have

already stepped up is to build a greater proportion of A320s into our

eet plan. There are currently 25 easyJet 180 seat A320s in the eet and

our review of their introduction has shown a reduction in cost per seat

which has led to a signicant increase in contribution, although as you

might expect there is a slight yield decrease. This is a perfect example

of how we aim to balance yield and cost to improve margins.

Regulated costs

A signicant proportion of easyJet’s cost base is determined by

governments and regulators and we continue to constructively engage

with them on a number of issues that will impact easyJet’s cost base in

the future. The closure of European airspace because of volcanic ash

and the wide scale air trafc control disruption across Europe have

highlighted some of the weaknesses of the current policy framework.

We are supporting efforts to put in place a European framework to

deal with future crises. The volcanic ash disruption also exposed the

weaknesses in EU2004/261, which effectively requires airlines to act

as insurer of last resort.

We will work with the EU on consumer rules to ensure that they

strike the right balance between the benets that regulation brings

to consumers over its costs to the industry. The strike disruption

to air trafc control is due to the wider economic pressures facing

Europe and union concerns about the forthcoming Single European

Sky programme. We expect disruption to continue in 2011; we will

press for measures to be put in place that alleviate the impact of

these strikes and push for faster reform.

Our increasing focus on primary airports increases the importance

of regulated airport charges to the business. We continue to work

with airports and regulators to ensure that charges are as low as

possible and also that charging structures do not discriminate against

easyJet. In the UK, we are active participants in the CAA’s work on

airport regulation methodologies and competition; we are also

involved in regulation in theNetherlands, France and Belgium.

We are now at the initial stages of aviation’s entry into the EU Emissions

Trading System (ETS); 2010 is a monitoring year ahead of the

requirement in 2012 to have permits to cover emissions. We support

moves towards a global framework for addressing aviation’s impact on

climate change. However, this must not come at the expense of schemes

such as ETS. These schemes are the right way to address aviation’s

environmental obligations. We also remain concerned about the

imposition of passenger taxes across Europe, with Germany introducing

a €8 passenger tax for European ights. We can see no rationale for

these taxes and where they remain we will continue to argue for their

reform of any passenger taxes into environmentally efcient plane taxes,

which tax ights rather than passengers.

Fleet plan

In the period, easyJet took delivery of eight A320 aircraft and nineteen

A319 aircraft under the terms of the easyJet Airbus agreement.

Congured with 180 seats, the A320 is enabling us to increase our

capacity at peak times at slot constrained airports. The aircraft also

operates with a cost per seat that is around 6% lower than the A319.

The total eet at 30 September 2010 comprised 196 aircraft. A further

45 easyJet specication aircraft deliveries are currently planned for arrival

over the next three years. The eet is expected to comprise 220 aircraft

by 30 September 2013.

easyJet has exibility in its eet planning arrangements and thus is able

to manage the total number of aircraft in the eet through a combination

of deferrals and lease extensions.

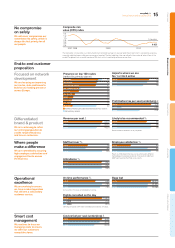

25 A320 aircraft within our fleet

We have 25 A320 aircraft within our fleet at 30 September, after taking

delivery of 8 new A320 aircraft in the year. This aircraft operates with a

cost per seat that is around 6% lower than the A319.

25 A320s

Annual maintenance savings

easyJet expects to make around £17 million of savings per annum

following the renegotiation of the SR Technics contract.

£17m

A flexible approach to fleet planning

27 new aircraft have been delivered in the year and we are

able to manage our future fleet size through deferrals and

lease extensions.

196 aircraft

12 easyJet plc

Annual report and accounts 2010