EasyJet 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet plc

Annual report and accounts 2010

Notes to the accounts

continued

80

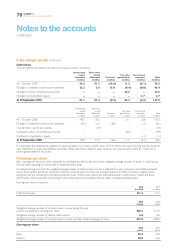

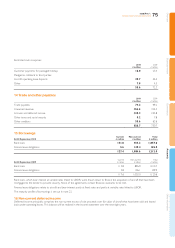

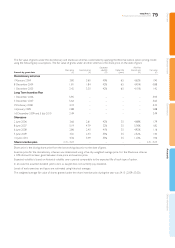

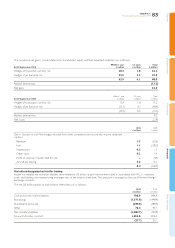

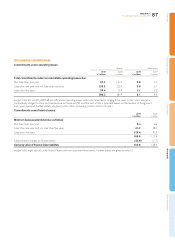

20 Reconciliation of operating profit to cash generated from operations

2010

£ million

2009

£ million

Operating profit 173.6 60.1

Adjustments for non-cash items:

Depreciation 72.5 55.4

Loss / (profit) on disposal of property, plant and equipment 1.5 (7.5)

Loss / (profit) on disposal of assets held for sale 7.0 (11.0)

Amortisation of intangible assets 6.2 4.4

Share-based payments 4.8 7.4

Derivative financial instruments – time value – 0.3

Unrealised foreign exchange differences (3.1) (6.2)

Changes in working capital and other items of an operating nature

Decrease in trade and other receivables 43.4 3.2

Increase in trade and other payables 44.9 104.9

Decrease in provisions (1.2) (27.8)

Decrease / (increase) in other non-current assets 9.2 (1.6)

Decrease / (increase) in derivative financial instruments 2.0 (0.9)

Increase / (decrease) in non-current deferred income 4.0 (16.2)

364.8 164.5

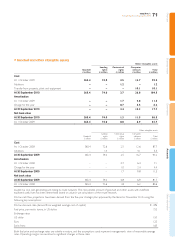

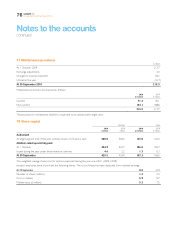

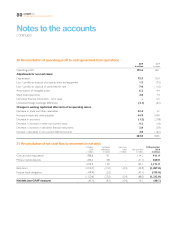

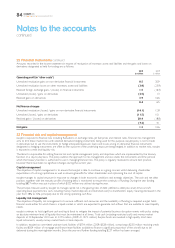

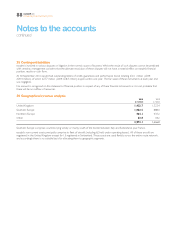

21 Reconciliation of net cash flow to movement in net debt

1 October

2009

£ million

Exchange

differences

£ million

Loan issue

costs

£ million

Net cash flow

£ million

30 September

2010

£ million

Cash and cash equivalents 788.6 9.1 – 114.2 911.9

Money market deposits 286.3 4.8 – (31.1) 260.0

1,074.9 13.9 – 83.1 1,171.9

Bank loans (1,010.7) (21.0) (0.4) (24.9) (1,057.0)

Finance lease obligations (109.9) (2.0) – (43.1) (155.0)

(1,120.6) (23.0) (0.4) (68.0) (1,212.0)

Net debt (non-GAAP measure) (45.7) (9.1) (0.4) 15.1 (40.1)