EasyJet 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Business review Governance Accounts Other information

easyJet plc

Annual report and accounts 2010

51

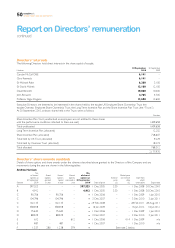

Carolyn McCall OBE

Scheme

No.

of shares/

options at

30 September

20091

Share/

options

granted

in year

Shares/

options

lapsed

in year

Shares/

options

exercised

in year

No.

of shares/

options at

30 September

20101Date of grant

Exercise

price

(£)

Market price

on exercise

date

(£)

Date from

which

exercisable Expiry date

C – 335,096 – – 335,096 5 July 2010 – – 5 July 2013 5 Jan 2014

Chris Kennedy

Scheme

No.

of shares/

options at

30 September

20091

Share/

options

granted in

year

Shares/

options

lapsed

in year

Shares/

options

exercised

in year

No.

of shares

/options at

30 September

20101Date of grant

Exercise

price

(£)

Market price

on exercise

date

(£)

Date from

which

exercisable Expiry date

C – 201,562 – – 201,562 5 July 2010 – – 5 July 2013 5 Jan 2014

No Non Executive Director has been granted any share options or awards.

The closing share price of the Company’s ordinary shares at 30 September 2010 was £3.70 and the range during the year ended

30 September 2010 was £3.40 to £5.00.

Notes

A Non-Approved Discretionary Share Option Scheme

B Approved Discretionary Share Option Scheme

C Long Term Incentive Plan – Performance Shares

D Long Term Incentive Plan – Matching Shares

E Share Incentive Plan – Free Shares

F Share Incentive Plan – Matching Shares

Note 1: The number of shares are calculated according to the scheme rules of individual plans based on the middle-market closing share price of the day prior to grant (except

for the June 2005 ESOS award which was based on the previous practice of the average middle-market price of the five days prior to grant). As is usual market practice, the

option price for SAYE awards is determined by the Committee in advance of the award, by reference to the share price following announcements of results.

Note 2: Participants purchase shares monthly under the plan and the Company provides one matching share for each share purchased. These are first available for vesting three

years after purchase.

The potential vesting of outstanding awards if the performance were based on that for the year under review is nil as shown at the end of

this section.

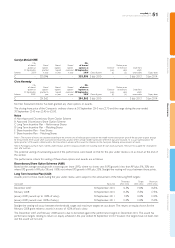

The performance criteria for vesting of these share options and awards are as follows:

Discretionary Share Option Schemes (A&B)

Based on the average annual growth in earnings per share (EPS), where no shares vest if EPS growth is less than RPI plus 5%, 30% vest

where EPS growth is RPI plus 5% and 100% vest where EPS growth is RPI plus 20%. Straight-line vesting will occur between these points.

Long Term Incentive Plan (C&D)

Awards prior to those made during the year under review were subject to the achievement of the following ROE targets:

Grant date Basis year

Threshold

(25% vests)

Target

(50% vests)

Maximum

(100% vests)

December 2007 30 September 2010 12.5% 14.0% 16.5%

February 2008 30 September 2010 13.5% 15.5% 17.5%

January 2009 (awards up to 100% of salary) 30 September 2011 7.0% 10.0% 13.0%

January 2009 (awards over 100% of salary) 30 September 2011 11.0% 13.0% 15.0%

Straight-line vesting will occur between the threshold, target and maximum targets set out above. The returns on equity shown for the

February 2008 grant relate to awards in excess of 100% of basic salary.

The December 2007 and February 2008 award is due to be tested against the performance targets in December 2010. The award has

performance targets relating to return on equity achieved in the year ended 30 September 2010. However, the targets have not been met

and the award will not vest.