EasyJet 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review

continued

Build up of underlying pre-tax profit per seat

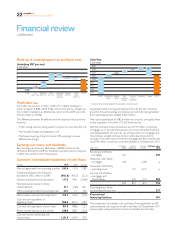

Profit after tax

Prot after tax was £121.3 million (2009: £71.2 million) resulting in a

return on equity of 8.6% (2009: 5.5%). The current year tax charge was

£32.7 million resulting in an effective tax rate of 21.2% (2009: tax credit

of£16.5 million or 30.2%).

The difference between the effective and the statutory rate is primarily

driven by:

– Prots arising overseas being subject to lower tax rates than the UK;

– Non-taxable foreign exchange gains; and

– The future lowering of the UK rate to 27% resulting in a lower

deferred tax charge.

Earnings per share and dividends

Basic earnings per share was 28.4 pence, a 68.0% increase on the

16.9 pence achieved in 2009. No dividends have been paid or proposed

in either the current or prior nancial year.

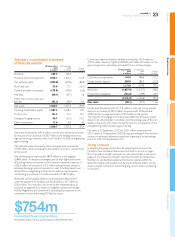

Summary consolidated statement of cash flows

easyJet generated a strong operating cash ow for the year; driven by

growth in forward bookings and revenue per seat. Net cash generated

from operating activities totalled £363.4 million.

Net capital expenditure of £482.6 million was incurred, principally driven

by the acquisition of a further 27 A320 family aircraft.

Net loan and lease nance drawdown was £177.3 million, comprising

mortgages on 13 aircraft, nance leases on two aircraft and the sale and

operating leaseback of six aircraft, net of repayments on mortgages and

nance leases. easyJet continues to be an attractive proposition to

providers of aircraft nance in both the mortgage and lease markets and

had $754 million of undrawn committed facilities at 30 September 2010.

US$ million 1 October

2009 Facilities

negotiated Facilities

utilised 30 September

2010

Revolving credit facility

–mortgages 250 – – 250

December 2007 facility

–mortgages 278 –(278) –

November 2009 facility

–operating leases –222 (222) –

Summer 2010 facilities

– mortgages and

nanceleases –615 (111) 504

528 837 (611) 754

Operating leases facility

secured after the year end 237

Committed

nancingfacilities 991

The combination of available cash, committed nancing facilities and 38

unencumbered cash acquired aircraft in the eet at 30 September 2010

leaves easyJet well positioned to nance committed aircraft orders.

6

4

2009

0.83

0.26

1.68

2.19 1.25

0.23 0.12

3.36

FX

(excl. fuel)

Revenue

(excl. fx)

Fuel

(inc. fx)

Disruption

and wet

leasing

Interest

income

Other

price

and mix

2010

3

5

2

1

Underlying PBT per seat

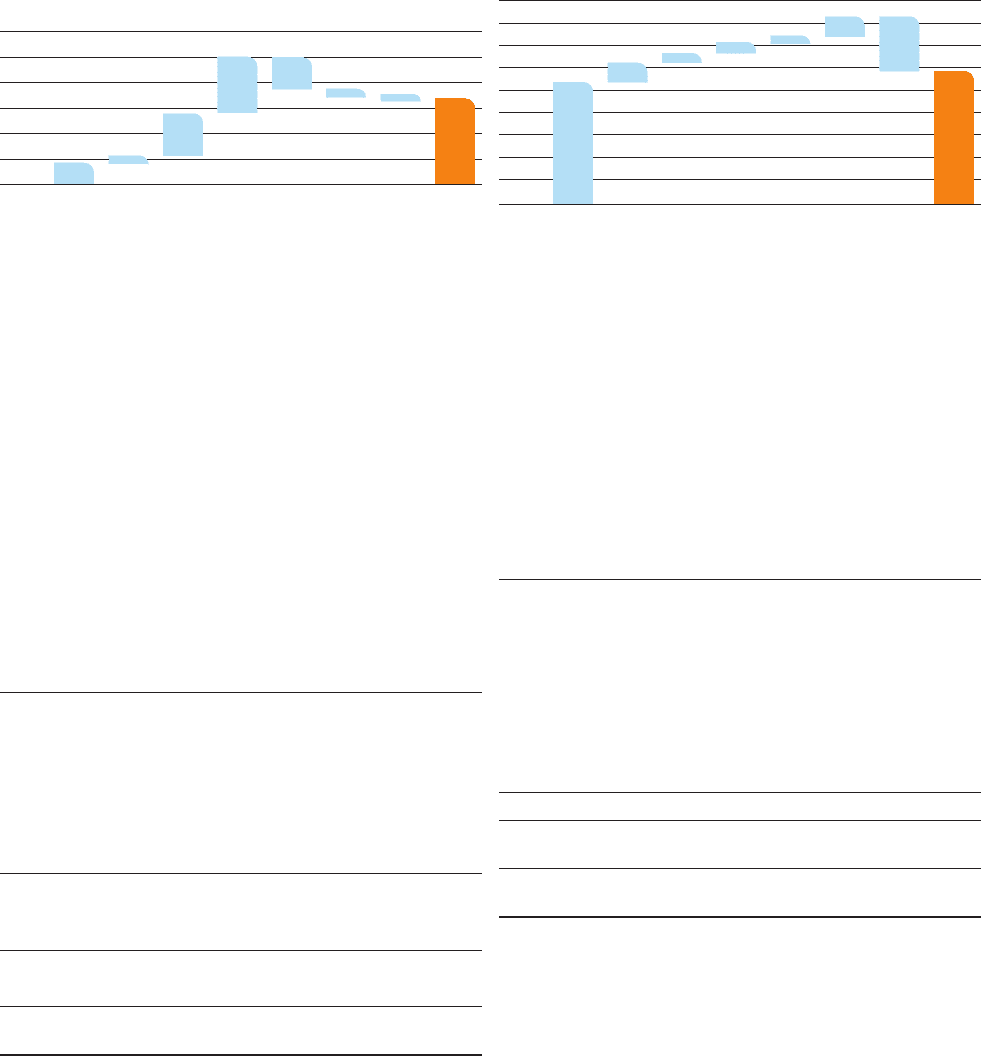

£ per seat 1,800

1,200

2009*

*Includes money market deposits but excludes restricted cash.

1,075

17479 102

48 177483

1,172

Operating

profit

Depn &

amort

Net

working

capital

Tax, net

int, fx

and other

Financing Capex 2010*

1,000

1,600

1,400

800

600

400

200

Cash flow

£ per seat

£ million 2010 2009 Change

Net cash generated from operating activities 363.4 134. 5 228.9

Capital expenditure (net of disposal

proceeds of £90.2 million in 2009) (482.6) (430.3) (52.3)

Net loan and lease nance drawdown 177.3 470.1 (292.8)

Net decrease/(increase) in money

marketdeposits 31.1 (29.0) 60.1

Other including the effect of exchange rates 34.1 11.1 23.0

Net increase in cash and cash equivalents 123.3 156.4 (33.1)

Cash and cash equivalents at

beginningofyear 788.6 632.2 156.4

Cash and cash equivalents at end of year 911.9 788.6 123.3

Money market deposits at end of year 260.0 286.3 (26.3)

Cash and money market deposits

at end ofyear 1,171.9 1,074.9 97.0

22 easyJet plc

Annual report and accounts 2010