EasyJet 2010 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

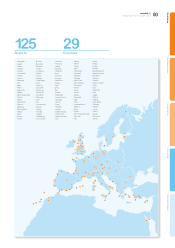

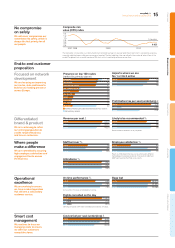

Mainland Europe

Growing our footprint through increased based

capacity in Switzerland, France and Italy

In Switzerland three new aircraft were introduced and seats own

grew by 12%. Frequencies were increased on routes such as Geneva to

London Gatwick, Paris Orly and Barcelona. An A320 was introduced at

Geneva to enable ights to longer range destinations such as Sharm El

Sheikh. easyJet also took advantage of Ryanair’s retreat from Basel to

addadditional capacity into the market.

France is a compelling investment opportunity for easyJet. Low cost

carrier penetration is half the European average and easyJet is uniquely

positioned to grow in France due to its decision to put its crew onto local

terms and conditions. easyJet grew capacity by 22% in France in the year,

against market growth of just 1%. At Paris Orly, easyJet has added a

seventh aircraft and now has ten aircraft deployed at Paris Charles

DeGaulle. At Lyon, a third aircraft has been added as we have taken

advantage of Air France’s reduced capacity on routes such as Madrid

andBarcelona; a fourth aircraft will be added over the winter.

Capacity in Italy increased by 25%, with 16 aircraft now based at Milan

Malpensa where easyJet launched eight new routes and increased

frequencies on business routes such as Rome, Madrid, Barcelona

andAmsterdam.

Growing our footprint through increased inbound

flying in Germany and Spain

In Germany, easyJet continued to refocus its offering. We have increased

capacity on key business routes out of Berlin such as Brussels,

Copenhagen and London Gatwick. easyJet has also increased its

presence in Scandinavia and we now have thirteen routes operating

out of the region.

In Madrid, capacity grew by 20% in the period, with eight aircraft now

deployed there. The Spanish market continues to be competitive

however both city and beach in-bound routes continue to perform well.

Portugal is an important market for easyJet and we are already its

secondlargest airline. In October, we announced that we are opening

abase at Lisbon in winter 2011. This will enable us to further develop

ourbusiness there.

Ancillary revenues

Ancillary revenues grew in the year by 43 pence per seat to £10.20

despite regulatory changes to the sales process for insurance products

which led to a reduction in insurance income of £8 million in the year

andchanges in VAT legislation which negatively impacted in-ight income

by £2 million. There were improved performances in fees and charges

and bag revenue.

However, hotel and car hire revenues were down versus the prior year.

This performance is disappointing and we are reviewing this area to

ensure that we have the correct product offerings to underpin our

growth plans going forward.

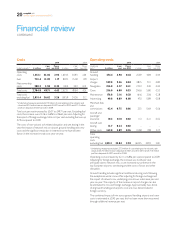

Smart cost management

It is vital that easyJet effectively manages its cost base so that it can

continue to offer competitive fares protably. However, it is important

that cost management is sensibly executed and does not lead to

sub-optimal decisions such as those made around crewing this year.

Total cost per seat excluding fuel, rose by 5.2% at constant currency to

£36.15 in the period, principally due to disruption and wet leasing costs.

Excluding the effect of additional disruption, cost per seat rose by 2.2%

at constant currency to £35.14 as improvements in aircraft ownership

and maintenance costs partially offset increased airport and navigation

charges. We are making good progress to be on track to deliver against

our £190million savings programme.

Systems implementation to drive reduced fuel consumption

and improvements in crew efciency

easyJet has maintained the level of fuel burn in the period. Whilst crew

productivity savings were delivered in the year, the way in which these

savings were achieved drove substantially more cost in the business as

we suffered disruption due to crew shortages in part of the network.

Consequently, we have decided to stabilise the operation during 2011

and have built more resilience into our crew planning. These additional

costs will be offset by reduced disruption and wet leasing costs.

20%

Capacity growth in Madrid

In Madrid, we have 8 aircraft and increased

capacity by 20% in the year.

easyJet grows French capacity

We increased capacity in the year by 22%

against a total market growth of only 1%.

22%

Overview Business review Governance Accounts Other information

11

easyJet plc

Annual report and accounts 2010