EasyJet 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

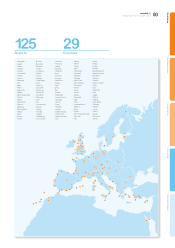

Fleet as at 30 September 2010:

Owned Operating

leases Finance

leases Total Changes in

the year

Future

committed

deliveries3

Unexercised

purchase

rights4

easyJet

A320

family 122 52 8182 27 45 88

Boeing

737-700 – 8 – 8 (9) – –

GB

Airways

A320

family 4 2 – 6 (3) 2 –

126 62 8196 15 47 88

Note 3: The 45 future easyJet deliveries and 2 ex-GB Airways deliveries are

anticipated to be delivered over the next three financial years, 25 in 2011, 18 in

2012 and 4 in 2013.

Note 4: Purchase options and rights may be taken on any A320 family aircraft and

are valid until 2015.

The total eet plan over the period to 30 September 2013 is as follows:

easyJet

A320 family Boeing

737-700 GB Airways

A320 family5Total aircraft5

At 30 September 2010 182 8 6 196

At 30 September 2011 202 2 – 204

At 30 September 2012 214 – – 214

At 30 September 2013 218 – 2 220

Note 5: Four ex-GB Airways A321 aircraft exited the fleet in November 2010.

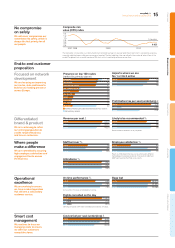

Hedging positions

easyJet operates under a clear set of treasury policies agreed by the

Board. The aim of easyJet’s hedging policy is to reduce short term

earnings volatility and therefore the Company hedges forward, on a

rolling basis, between 50% and 80% of the next 12 months anticipated

requirements and between 20% and 50% of the following 12 months

anticipated requirements. Details of our current hedging arrangements

are set out below:

Percentage of anticipated

requirement hedged Fuel

requirement US dollar

requirement

Euro

surplus

sale

Full year ending

30 September 2011 70% 66% 64%

Rate $734/MT $1.60 €1.10

Full year ending

30 September 2012 23% 40% 21%

Rate $802/MT $1.57 €1.11

Outlook

Capacity measured in seats own, adjusting for the impact of disruption

is expected to increase compared to the prior year by around 8% as

easyJet continues with its strategy of carefully targeting growth. On a

reported basis capacity is expected to be up by 12% for the full year and

14% in the rst half. The current expectation is that competitor capacity

on easyJet routes will be up by low single digits.

Over 45% of the available rst half seats now sold and forward bookings

are in line with the prior year. Total revenue per seat in the rst half is

expected to be broadly at on a reported basis (at current exchange

rates)6 versus the prior year and slightly up by at constant currency

despite a greater proportion of A320 aircraft in the eet and the impact

of increased APD in the UK and its introduction into Germany.

Total reported cost per seat excluding fuel (at current exchange rates)6

is anticipated to fall by around 4% on an underlying basis, assuming

normal levels of disruption. Improvements in maintenance and

ownership costs and a reduction in disruption related costs will offset

the impact of planned increases in crew costs as we build more resilience

in to theoperation.

The economic outlook in Europe remains uncertain and the continuing

level of ATC industrial action is causing disruption to our ying

programme and driving additional cost. However, the strength of the

easyJet network combined with its proposition of offering consumers

thebest value fares to convenient airports means that easyJet is well

positioned for future success.

Note 6: US$1.60/£, €1.18/£ and US$788 per metric tonne at noon on

15 November 2010.

Carolyn McCall OBE

Chief Executive

Hedged against fuel price increases

We have 70% of our anticipated fuel requirement

for 2011 hedged using forwards at $734/MT.

70%

Overview Business review Governance Accounts Other information

13

easyJet plc

Annual report and accounts 2010