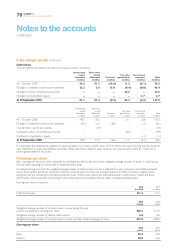

EasyJet 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Business review Governance Accounts Other information

easyJet plc

Annual report and accounts 2010

69

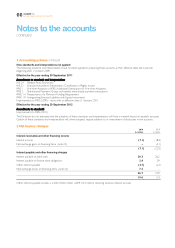

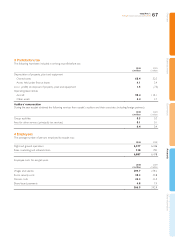

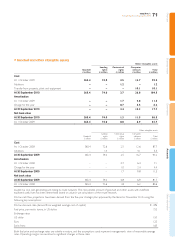

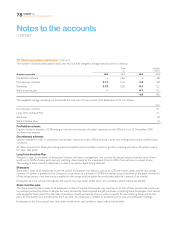

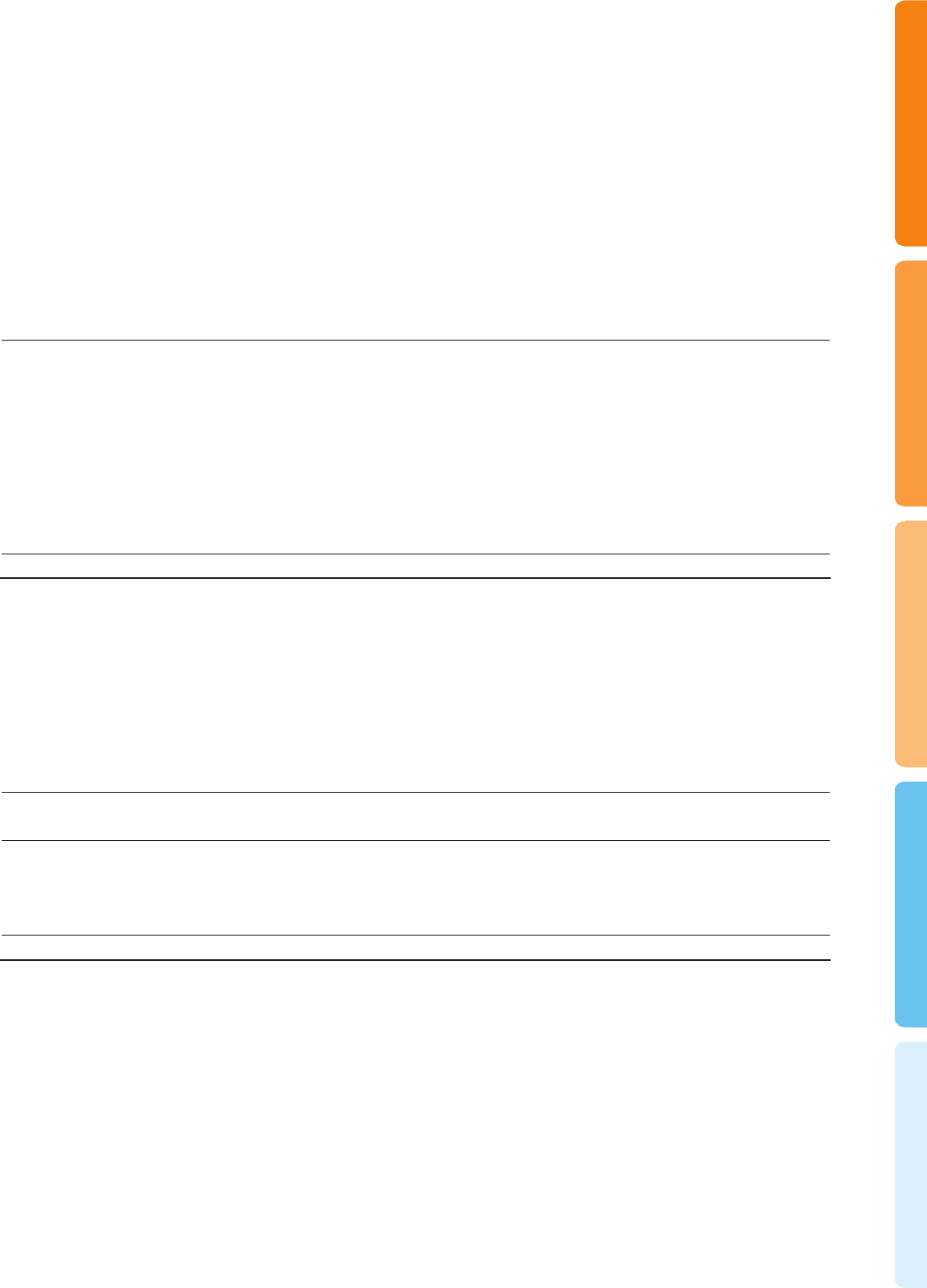

Reconciliation of the total tax charge / (credit)

The tax for the year is lower than the standard rate of corporation tax in the UK as set out below:

2010

£ million

2009

£ million

Profit on ordinary activities before tax 154.0 54.7

Tax charge at 28% 43.1 15.3

Attributable to rates other than standard UK rate (1.7) (1.3)

Income not chargeable for tax purposes (6.0) (2.5)

Expenses not deductible for tax purposes 2.1 2.5

Share-based payments 0.8 1.2

Adjustments in respect of prior years – current tax (18.4) (27.4)

Adjustments in respect of prior years – deferred tax 15.2 (4.3)

Change in tax rate (2.4) –

32.7 (16.5)

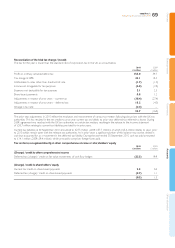

The prior year adjustments in 2010 reflect the resolution and reassessment of various tax matters following discussions with the UK tax

authorities. This has resulted in the net credits to prior year current tax and debits to prior year deferred tax referred to above. During

2009, agreement was reached with the UK tax authorities on certain tax matters, resulting in the release to the income statement

of £30.7 million relating to current tax liabilities provided for in prior years.

Current tax liabilities at 30 September 2010 amounted to £27.5 million (2009: £57.7 million), of which £25.6 million relates to years prior

to 2010 which remain open with the relevant tax authorities. As in prior years a significant portion of this balance may not be settled in

cash but accounted for as a movement in the deferred tax liability. During the year ended 30 September 2010, cash tax paid amounted

to £14.1 million (2009: £9.4 million), which principally comprises foreign taxes paid.

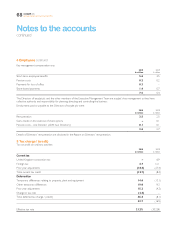

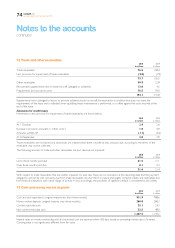

Tax on items recognised directly in other comprehensive income or shareholders’ equity

2010

£ million

2009

£ million

(Charge) / credit to other comprehensive income

Deferred tax (charge) / credit on fair value movements of cash flow hedges (22.5) 19.9

(Charge) / credit to shareholders’ equity

Current tax credit on share-based payments 2.2 0.4

Deferred tax (charge) / credit on share-based payments (2.7) 1.1

(0.5) 1.5