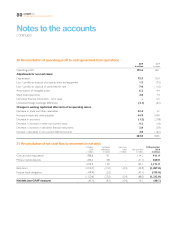

EasyJet 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Business review Governance Accounts Other information

easyJet plc

Annual report and accounts 2010

73

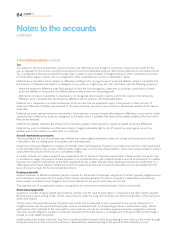

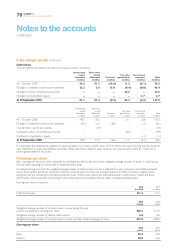

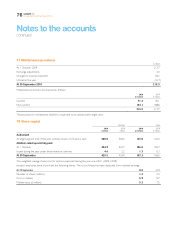

During the year ended 30 September 2010, six aircraft were sold and leased back under operating leases. Two of these aircraft were

acquired during the year ended 30 September 2009. The amounts shown above under the caption “aircraft sold and leased back”

relate to these two aircraft and deposits paid on the other four aircraft before 1 October 2009.

During the year ended 30 September 2009, five A319 aircraft were transferred back to property, plant and equipment from assets

held for sale.

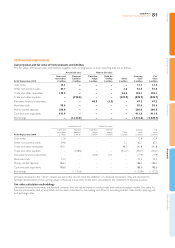

The net book value of aircraft includes £153.2 million (2009: £148.5 million) relating to advance and option payments for future deliveries

of aircraft. This amount is not depreciated.

Aircraft with a net book value of £1,107.6 million (2009: £984.5 million) are mortgaged to lenders as loan security.

Aircraft with a net book value of £105.4 million (2009: £71.1 million) are held under finance leases.

easyJet is contractually committed to the acquisition of 47 (2009: 74) Airbus A320 family aircraft with a total list price of US$2.2 billion

(2009: US$3.4 billion) before escalations and discounts, for delivery in the period to May 2013.

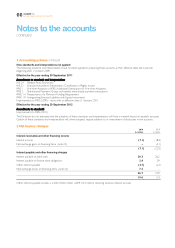

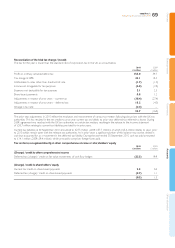

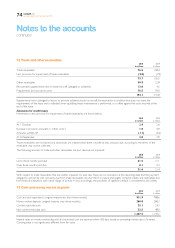

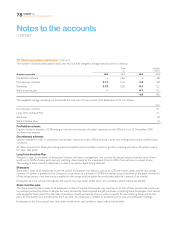

9 Loan notes

In 2001, easyJet in consortium with six other UK airlines formed The Airline Group Limited in order to acquire a non-controlling interest

in NATS, the company that owns the UK air traffic control system. easyJet’s investment is principally in the form of unsecured loan notes

bearing interest at a fixed rate of 8%. Interest receivable is settled by the issue of additional loan notes. Redemption is governed by a

priority agreement among the consortium members.

2010

£ million

2009

£ million

At 1 October 12.6 12.0

Interest receivable converted to loan notes 1.1 0.9

Redemption of loan notes (0.6) (0.3)

At 30 September 13.1 12.6

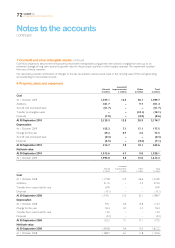

10 Other non-current assets

2010

£ million

2009

£ million

Recoverable supplemental rent on leased aircraft (pledged as collateral) 48.6 57.3

Deposits held by aircraft lessors 1.1 2.3

Other 3.8 3.1

53.5 62.7

Supplemental rent is pledged to lessors to provide collateral should an aircraft be returned in a condition that does not meet the

requirements of the lease and is refunded when qualifying heavy maintenance is performed, or is offset against the costs incurred at the

end of the lease.

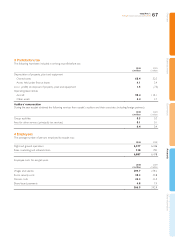

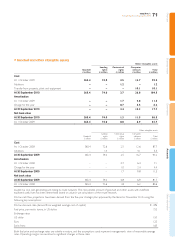

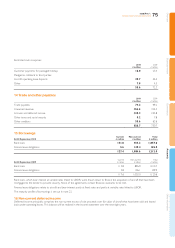

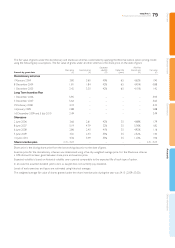

11 Assets held for sale

Following the acquisition of GB Airways in the year ended 30 September 2008, seven A321 aircraft were classified as assets held for sale.

During the year ended 30 September 2009 three of these aircraft were sold realising a net profit of £11.0 million. At 30 September 2009,

easyJet continued to market the remaining four A321 aircraft and although the period over which the assets were classified as held for sale

exceeded one year, the Directors considered that this classification remained appropriate.

easyJet has entered into an arrangement to dispose of the remaining four aircraft. Subsequent to the year end, in November 2010,

the legal title to these four aircraft was transferred. The total cash consideration to be received is £75.2 million. easyJet has incurred certain

costs in connection with the disposal and the aggregate net loss on the disposal of £7.0 million has been charged to the income statement

in the year ended 30 September 2010.