EasyJet 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Business review Governance Accounts Other information

easyJet plc

Annual report and accounts 2010

75

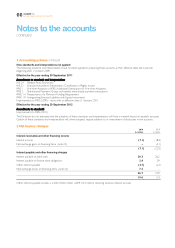

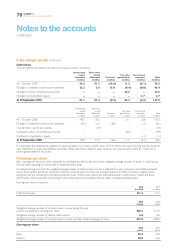

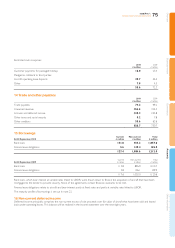

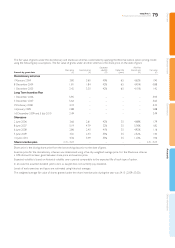

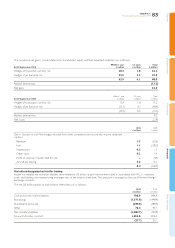

Restricted cash comprises:

2010

£ million

2009

£ million

Customer payments for packaged holidays 18.0 23.4

Pledged as collateral to third parties:

Aircraft operating lease deposits 29.7 44.4

Other 7.9 4.5

55.6 72.3

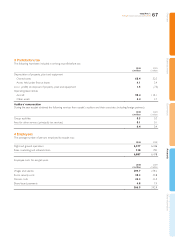

14 Trade and other payables

2010

£ million

2009

£ million

Trade payables 79.2 99.2

Unearned revenue 356.5 324.3

Accruals and deferred income 328.2 255.8

Other taxes and social security 9.2 7.8

Other creditors 55.6 63.6

828.7 750.7

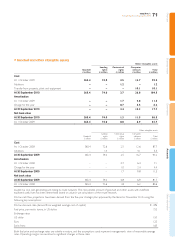

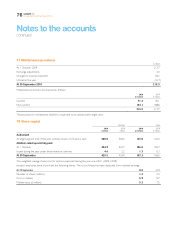

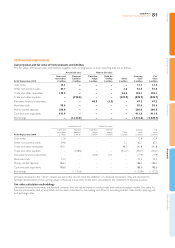

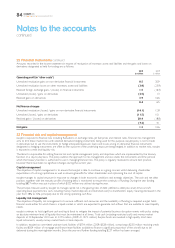

15 Borrowings

At 30 September 2010

Current

£ million

Non-current

£ million

Total

£ million

Bank loans 121.8 935.2 1,057.0

Finance lease obligations 5.6 149.4 155.0

127.4 1,084.6 1,212.0

At 30 September 2009

Current

£ million

Non-current

£ million

Total

£ million

Bank loans 113.8 896.9 1,010.7

Finance lease obligations 3.8 106.1 109.9

117.6 1,003.0 1,120.6

Bank loans, which bear interest at variable rates linked to LIBOR, were drawn down to finance the acquisition of aircraft that have been

mortgaged to the lender to provide security. None of the agreements contain financial covenants to be met.

Finance lease obligations relate to aircraft and bear interest partly at fixed rates and partly at variable rates linked to LIBOR.

The maturity profile of borrowings is set out in note 23.

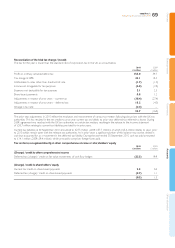

16 Non-current deferred income

Deferred income principally comprises the non-current excess of sale proceeds over fair value of aircraft that have been sold and leased

back under operating leases. This balance will be realised in the income statement over the next eight years.