EasyJet 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

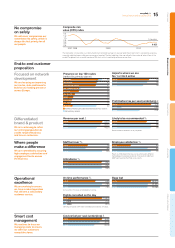

Smart cost

management

No compromise

on safety

We will never compromise our

commitment to safety, which is

always the first priority for all

our people.

End-to-end customer

proposition

Focused on network

development

We are focusing on improving

our routes, slots and bases to

build on our leading presence

across Europe.

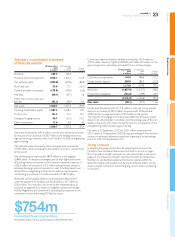

The Composite risk value index is an internal benchmark to monitor average risk value per sector own over time. It is calculated by assigning a

numerical weighting to every safety occurrence report received. The total weighting is then normalised by the number of sectors own in the

period. Management sets a nominal boundary of 0.8 which assists in monitoring performance over time.

Composite risk

value (CRV) index

2007 2008 2009 2010

0.625

0.8 boundary

1.2

1.4

1.0

0.8

0.6

0.4

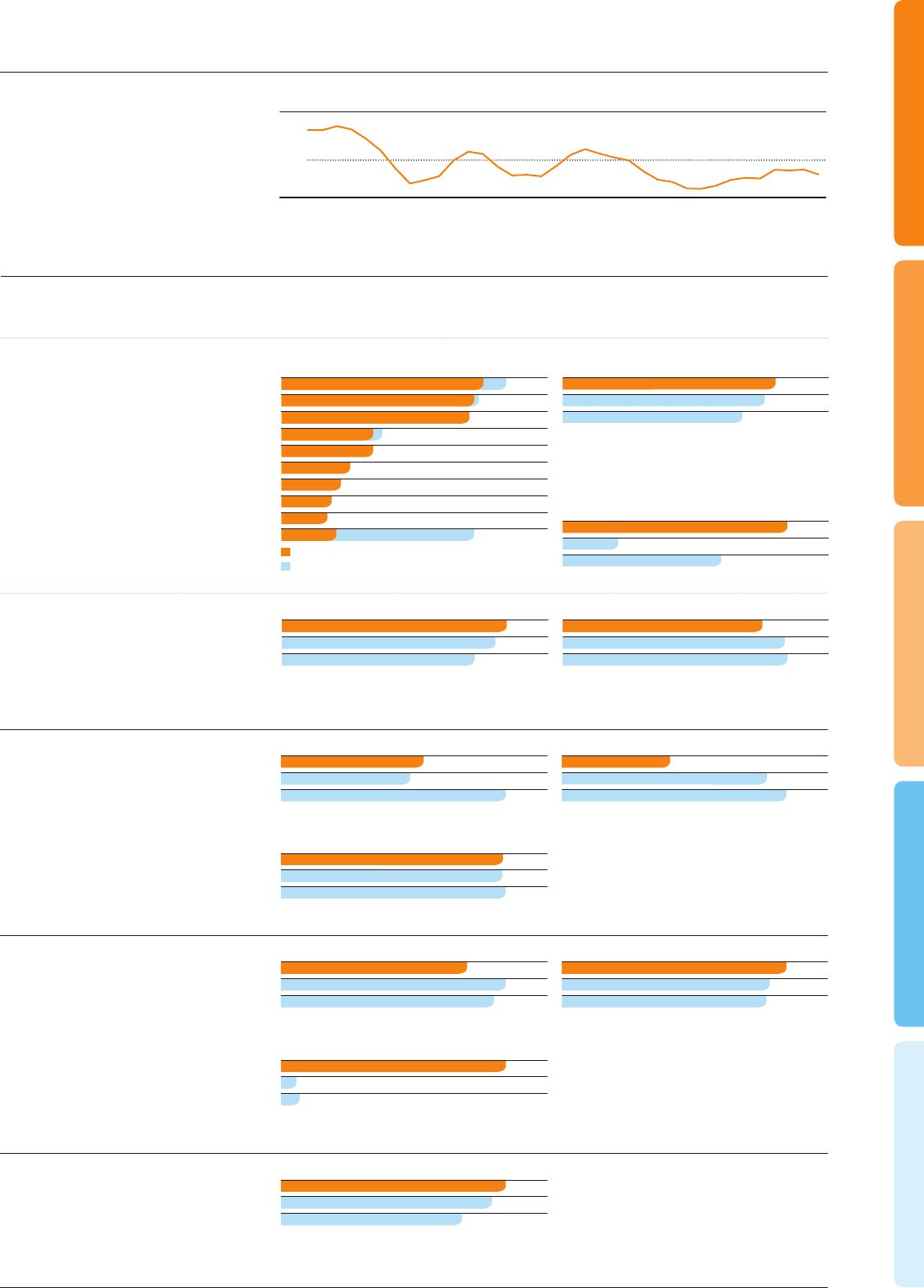

41

22

43

49

20

Presence on top 100 routes

(ranked by primary airport)

Lufthansa-Swiss

Air France-KLM

BA/Iberia

Alitalia

15

13

Air Berlin

SAS

10

11

Vueling

Norwegian

42

Ryanair

easyJet

Number of market pairs operated between primary airports

Non-primary airports

19

18

16

Airports where we are

No.1 or No.2 airline

2010

2009

2008

3.36

0.83

2.37

Profit before tax per seat (underlying) £

2010

2009

2008

We continue to focus on

managing coststo ensure

we offer our customers

competitive fares.

36.62

34.36

29.49

Cost ex fuel per seat (underlying) £

2010

2009

2008

Where people

make a difference

We are committed to ensuring

high employee satisfaction and

engagement levels across

the business.

Results in 2010 relate to the uSay survey, which used a different

methodology to calculate satisfaction. The results for 2008 and

2009 were based on the Pulse survey results.

Results based on customer survey responses.

35

66

72

Employee satisfaction %

2010

2009

2008

7.6

6.9

12.0

Staff turnover %

2010

2009

2008

95.3

95.2

96.5

Attendance %

2010

2009

2008

Operational

excellence

We are working to ensure

we have arobust operation

that delivers a satisfactory

customer service.

Arrival within 15 minutes of scheduled arrival time.

65.8

79.5

75.4

On time performance %

2010

2009

2008

99,419

91,930

90,388

Bags lost

2010

2009

2008

2010 gure includes 7,314 ights cancelled due to volcanic ash cloud.

15,976

1,102

1,315

Flights cancelled on the day

2010

2009

2008

Differentiated

brand & product

We are continuing to refine

our winning proposition to

a wide range of business

and leisure customers.

50.47

53.07

45.51

Revenue per seat £

2010

2009

2008

80

89

90

Likely to be recommended %

2010

2009

2008

Overview Business review Governance Accounts Other information

15

easyJet plc

Annual report and accounts 2010