EasyJet 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet plc

Annual report and accounts 2010

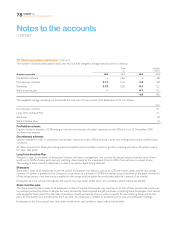

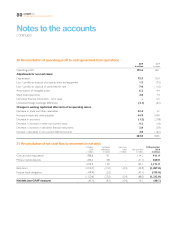

Notes to the accounts

continued

82

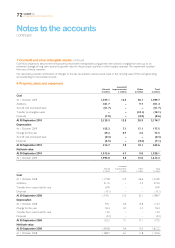

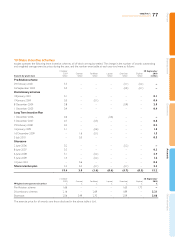

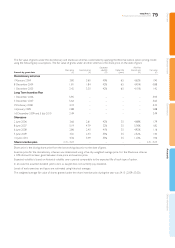

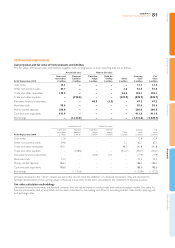

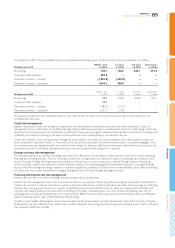

22 Financial instruments continued

Fair value of derivative financial instruments

At 30 September 2010

Quantity

million

Non-current

assets

£ million

Current

assets

£ million

Current

liabilities

£ million

Non-current

liabilities

£ million

Total

£ million

Forward contracts

Designated as cash flow hedges:

US dollar 911.3 1.6 13.7 (3.9) (2.2) 9.2

Euro 263.3 2.5 11.6 – – 14.1

Swiss franc 69.0 – – (0.6) – (0.6)

Jet fuel 1.5 4.1 27.3 (3.8) (1.8) 25.8

Designated as held for trading:

US dollar 1,055.0 – – (1.3) – (1.3)

8.2 52.6 (9.6) (4.0) 47.2

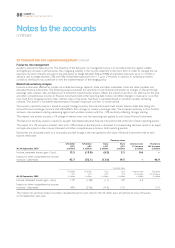

At 30 September 2009

Quantity

million

Non-current

assets

£ million

Current

assets

£ million

Current

liabilities

£ million

Non-current

liabilities

£ million

Total

£ million

Forward contracts

Designated as cash flow hedges:

US dollar 874.2 2.5 37.4 (6.2) (0.7) 33.0

Euro 200.0 – 0.1 (15.4) – (15.3)

Jet fuel 1.2 5.3 17.8 (69.5) (1.9) (48.3)

Designated as held for trading:

US dollar 825.0 – 12.7 – – 12.7

7.8 68.0 (91.1) (2.6) (17.9)

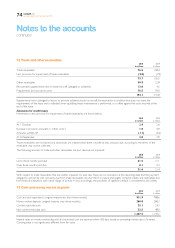

For currency contracts, quantity represents the nominal value of currency contracts held, disclosed in the contract currency. For jet fuel

contracts, quantity represents contracted metric tonnes.

All derivative financial instruments are in level 2 of the IFRS 7 fair value hierarchy.

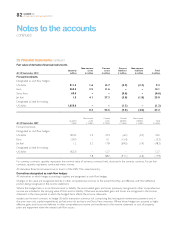

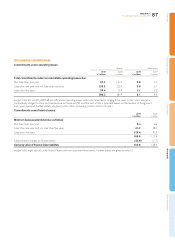

Derivatives designated as cash flow hedges

All derivatives to which hedge accounting is applied are designated as cash flow hedges.

Changes in fair value are recognised directly in other comprehensive income, to the extent that they are effective, with the ineffective

portion being recognised in the income statement.

Where the hedged item is a non financial asset or liability, the accumulated gains and losses previously recognised in other comprehensive

income are included in the carrying value of that asset or liability. Otherwise accumulated gains and losses are recognised in the income

statement in the same period in which the hedged items affects the income statement.

easyJet uses forward contracts to hedge US dollar transaction currency risk (comprising fuel, leasing and maintenance payments and, in

the prior year only, capital expenditure), jet fuel price risk and euro and Swiss franc revenues. Where these hedges are assessed as highly

effective, gains and losses are deferred in other comprehensive income and transferred to the income statement or cost of property,

plant and equipment when the related cash flow occurs.