EasyJet 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The increase in navigation costs per seat is driven by continued regulated

cost increases from Eurocontrol and the 2.1% increase in average sector

length in the year. Average cost increases across the major European

countries covered by easyJet routes was approximately 3.5%.

Crew costs have increased as we continue our expansion into Europe.

Per head costs including social security at our European bases are higher

than those in the UK but are a necessary part of our growth strategy. In

2009 one third of crew costs were denominated in euro or Swiss francs,

in 2010 this proportion has risen to 40% therefore this has resulted in an

increase in sterling cost as the euro and Swiss franc have strengthened

year-on-year.

Crew pay negotiations and contract changes have also added cost in

2010. Despite the expansion into Europe, the UK is still the largest

country in terms of crew heads and, along with the introduction of

German contracts, has been the biggest driver of the cost increase.

The reduction in utilisation due to disruption has also impacted cost per

seat as the xed cost element of our crew establishment is spread over

fewer seats. Crew costs remain the key cost challenge for the Company

in 2011.

Maintenance costs show an increase of £0.10 per seat but decreased

after adjusting for foreign exchange, beneting from the new SR Technics

contract completed in 2009. Maintenance costs have also beneted

fromthe reduction in the number of leased aircraft compared to 2009.

During the year nine Boeing 737s and three ex-GB Airways A320s were

returned to lessors.

Aircraft wet leasing costs totalled £13.7 million or £0.24 per seat as the

Company complemented its eet with additional wet leased Boeing 757s

during the summer period to deal with short-term operational crew

shortages and to improve operational resilience.

Other costs show a signicant £0.91 per seat increase year-on-year.

Thisline includes the operational costs and compensation relating to the

winter snow and other ATC and strike related disruption and is also

impacted by the reduction in utilisation. In addition 2009 cost per seat

was attered by the Boeing spares sale.

After excluding foreign exchange, the costs of network mix and

disruption, the underlying cost per seat was broadly at, demonstrating

the strong underlying cost control now evident across the business.

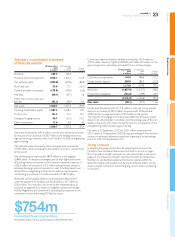

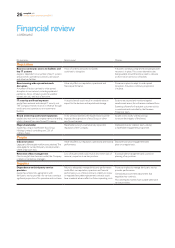

Ownership costs 2010 2009

Underlying

costs * £ million £ per

seat Pence

per ASK £ million £ per

seat Pence

per ASK

Depreciation 72.5 1.29 0.12 55.4 1.05 0.10

Amortisation

of intangible

assets 6.2 0.11 0.01 4.4 0.08 0.01

Aircraft dry

leasing 102.0 1.82 0.16 116 . 2 2.20 0.20

Interest

receivable and

other

nancing

income (7.1) (0.13) (0.01) (22.5) (0.43) (0.04)

Interest

payable and

other

nancing

charges 26.7 0.49 0.04 27.9 0.53 0.04

Net

ownership

costs 200.3 3.58 0.32 181.4 3.43 0.31

* Underlying measures exclude £27.3 million of cost relating to the volcanic ash

cloud and £7.0 million loss on disposal of A321 aircraft in 2010 and £11.0 million

profit on disposal of A321 aircraft in 2009.

Ownership costs increased by £0.15 per seat, however after adjusting for

foreign exchange, ownership costs were down £0.25 per seat reecting

the change in the owned/leased mix of aircraft. Average owned aircraftin

2010 was 123.7 compared to 98.1 in 2009 an increase of 26%. An additional

23 owned aircraft were added in the year.

The average number of leased aircraft decreased from 76.0 in 2009

to64.2 in 2010 as the Boeing 737 and ex-GB Airways A320 return

programmes continued. Return of the higher cost Boeings and

reductions in variable rates also contributed to a positive price

variancecompared to 2010.

The net of interest receivable and interest payable shows a £0.26 per

seat increase year-on-year. However, excluding foreign exchange, the net

of the two lines is constant year-on-year on a per seat basis as interest

rates have fallen. All current debt is oating rate and re-xes on either

athree month orsix month basis. Interest payable includes the effects

ofrealised and unrealised foreign exchange adjustments on the nancing

element of USdollar balance sheet hedging, the impact of which was

signicant year-on-year. Ownership costs were also impacted by

spreading costs over a smaller number of seats as capacity was

reducedand utilisation impacted as a result of disruption.

Ownership costs

We achieved a 25p per seat reduction in ownership

costs in the year at constant currency.

-25p per seat

Overview Business review Governance Accounts Other information

21

easyJet plc

Annual report and accounts 2010